Should You Move This Year? Here’s What You Need to Know About Home Prices and Mortgage Rates

Should You Move This Year? Here’s What You Need to Know About Home Prices and Mortgage Rates

Thinking about making a move this year? Two critical factors are likely on your mind: home prices and mortgage rates. You’re probably wondering what’s next and whether it’s worth moving now or waiting it out.

The best decision you can make is based on the latest information available. Here’s what experts are saying about both prices and rates:

What’s Next for Home Prices?

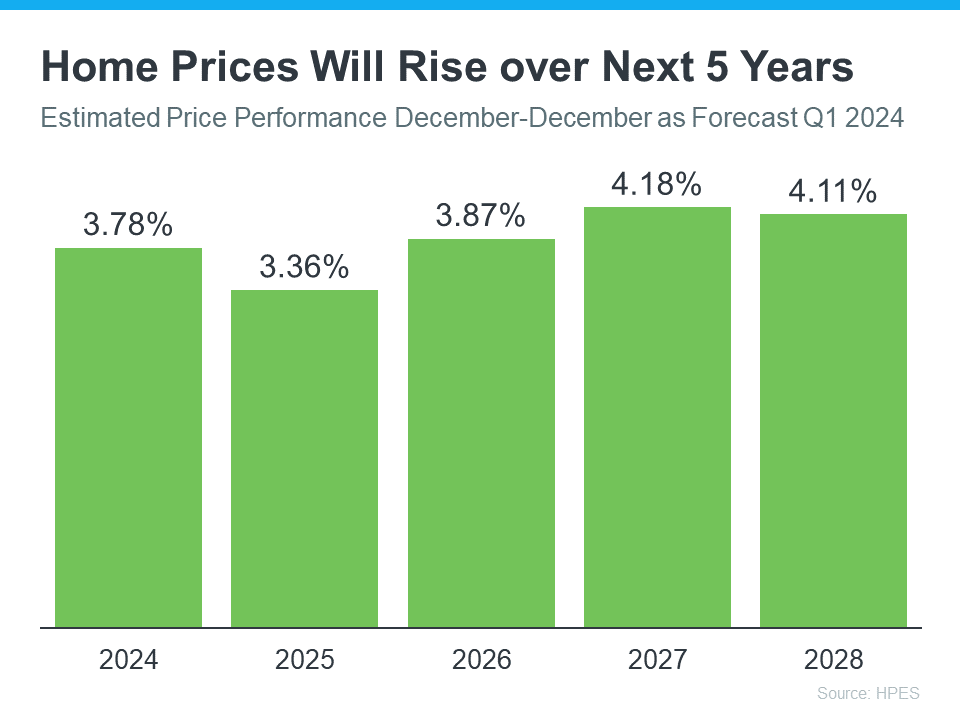

A reliable source for home price forecasts is the Home Price Expectations Survey from Fannie Mae. This survey includes insights from over one hundred economists, real estate experts, and investment strategists. According to the latest release, experts project that home prices will continue to rise at least through 2028:

While the annual appreciation rate varies, the consensus is that prices will keep climbing for at least the next five years, albeit at a more normal pace.

What does this mean for your move? If you buy now, your home’s value will likely grow, and you should gain equity in the coming years. However, if you wait and prices continue to rise, the cost of a home will be higher later on.

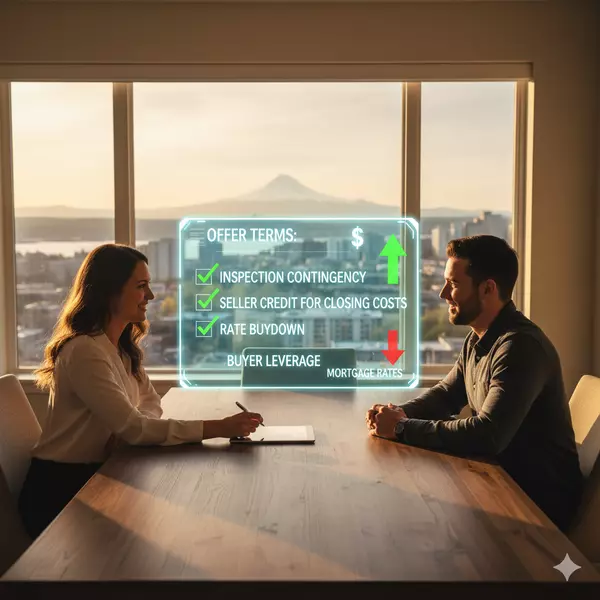

When Will Mortgage Rates Come Down?

This is the million-dollar question. The mortgage rate environment is volatile due to several contributing factors. Odeta Kushi, Deputy Chief Economist at First American, explains:

“Every month brings a new set of inflation and labor data that can influence the direction of mortgage rates. Ongoing inflation deceleration, a slowing economy, and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.”

What happens next depends on these factors. Experts are optimistic that rates will come down later this year, but acknowledge that changing economic indicators will continue to impact them. As a CNET article notes:

“Though mortgage rates could still go down later in the year, housing market predictions change regularly in response to economic data, geopolitical events, and more.”

So, if you’re ready, willing, and able to afford a home right now, partner with a trusted real estate advisor to weigh your options and decide what’s right for you.

Bottom Line

Let’s connect to ensure you have the latest information on home prices and mortgage rate expectations. Together, we’ll review what the experts are saying so you can make an informed decision about your move.

Categories

- All Blogs (462)

- For Sale By Owner (15)

- Local Events (6)

- Affordability (31)

- Agent Value (86)

- Buying Tips (192)

- Closing Costs (1)

- Community Support (1)

- Debt-Free Living, (1)

- Design (8)

- Downsize (5)

- Economy (23)

- Equity (23)

- Financial Planning (32)

- First-Time Home Buyer (137)

- For Sale by Owner (2)

- Forecasts (14)

- Foreclosures (4)

- Foster Care Resrources (1)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (237)

- Home Inspections (1)

- Home Prices (63)

- Home Selling (170)

- Inventory (34)

- Local (24)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (35)

- Mortgage (50)

- Move-Up (2)

- New Construction (7)

- Newsletter (9)

- Open House (1)

- Portland OR (1)

- Portland OR Affordability (2)

- Portland OR Homes (2)

- Portland OR Real Estate (3)

- Portland-Vancouver Home Value (1)

- Portland-Vancouver Inventory (1)

- Real Estate Investing (7)

- Rent vs Buy (8)

- Restaurant Reviews (5)

- Seasonal (11)

- selling tips (125)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (1)

- Vancouver WA Affordability (2)

- Vancouver WA Real Estate (4)

- Vancouver WA Selling Tips (1)

- Wealth Building (12)

Recent Posts