What Vancouver & Portland Buyers Need Most (And How Our Local Market is Adjusting)

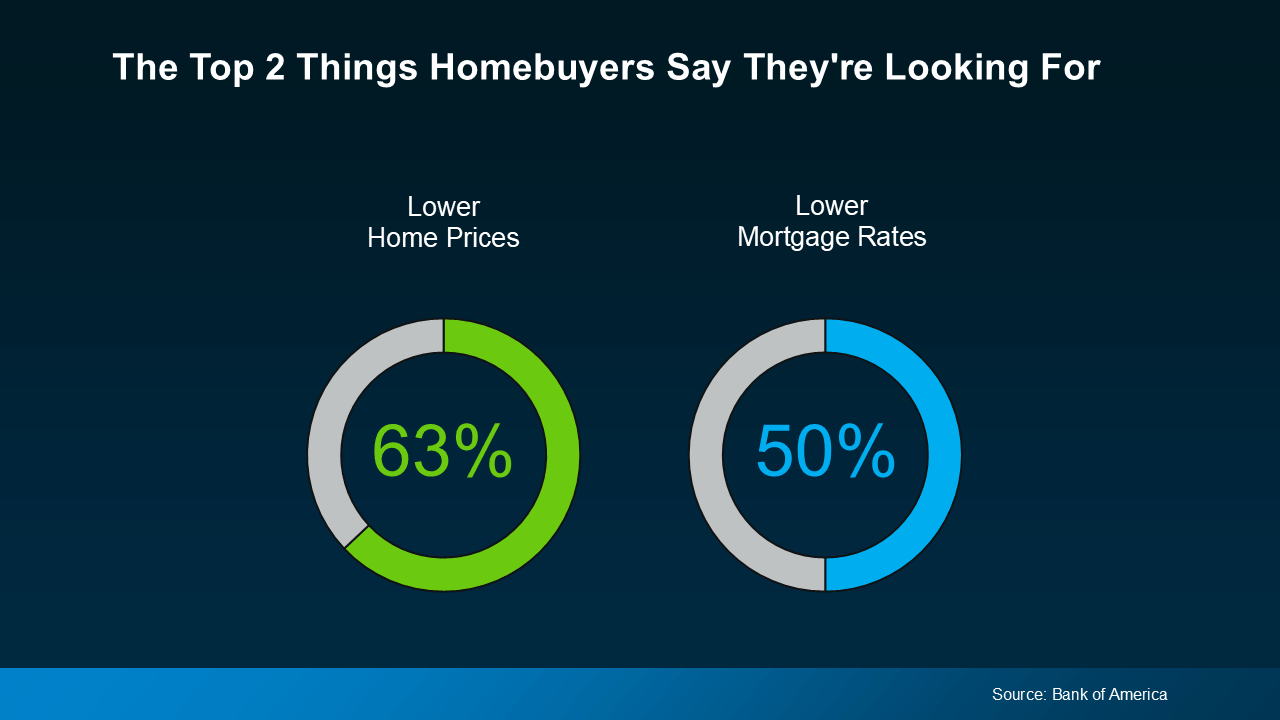

A recent survey asked would-be homebuyers what would help them feel better about making a move, and the message was loud and clear: they want affordability to improve, specifically through lower home prices and mortgage rates.

Here is the good news. While the national economy may still feel uncertain, the Vancouver WA and Portland OR housing market is showing palpable changes that favor buyers in both of those critical areas. Let's break down the local trends you need to know about.

Home Price Moderation is Real in the Portland-Vancouver Metro Area

Over the past few years, home prices in Southwest Washington and Oregon climbed at an aggressive, unsustainable pace that left many buyers feeling shut out. Today, that growth has dramatically slowed—and in some cases, even stalled.

What We’re Seeing Locally:

-

Portland, OR: After rapid increases, the median sale price is now showing year-over-year growth that is very modest or even a slight correction (one recent forecast projects a -0.8% change through early 2026).

-

Vancouver, WA: The market remains resilient, but price growth has returned to a more normal, single-digit pace (+0.5% to +2.9% year-over-year, depending on the source).

The Buyer Advantage: Prices aren't crashing, but they are clearly moderating. This slowdown is making the process of buying a home in the Vancouver/Portland area less intimidating. It's easier to plan your long-term budget when home values are moving at a much slower, more predictable pace. Crucially, increased inventory is giving buyers:

-

More time on the market (up to 36 days in Vancouver).

-

More negotiating power to ask for concessions or rate buydowns.

Mortgage Rates are Easing (And the Forecast Looks Better for 2026)

At the same time prices are moderating, mortgage rates have come down from their recent highs. This shift is the most critical factor for improving affordability. As experts note, "Slower price growth coupled with a slight drop in mortgage rates will improve affordability and create a window for some buyers to get into the market.”

The Mortgage Outlook:

While rates will still experience volatility based on economic news, the overall trend is toward easing. The current consensus from major housing authorities forecasts that 30-year fixed rates will continue to trend downward:

-

End of 2025 Forecast: Expected to land in the 6.0% to 6.5% range.

-

End of 2026 Forecast: Some forecasts now project rates may even dip below 6%, a psychological barrier that could bring many more buyers back to the market.

Even a slight drop in rates can make a difference of hundreds of dollars in your monthly mortgage payment—a huge relief for a buyer in Vancouver or Portland.

Why This Matters to You in Southwest Washington and Oregon

Affordability challenges persist, but conditions are fundamentally different than they were a year ago. The two top concerns for buyers—high prices and high rates—are both seeing market adjustments that favor those ready to make a move.

This is not a market to panic in; it’s a market to plan in. The combination of slower price appreciation and increasing inventory means you have a better opportunity to secure a home without the frantic bidding wars of the past.

Bottom Line: The Time to Act is Now

Both of the top concerns for buyers in the Vancouver WA and Portland OR metro area are seeing movement. Prices are stabilizing, and mortgage rates are easing with a better outlook for 2026. This is the affordability window many have been waiting for.

If you are considering a move in Portland, Vancouver, or Clark County, let’s connect. We will walk you through what the current data means for your budget and build a confident, winning strategy for today's market. Call or click today for a personalized affordability plan.

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts