3 Reasons Affordability Is Showing Signs of Improvement for Portland & Vancouver Buyers This Fall

For the past couple of years, it’s been tough for many homebuyers to make the numbers work. Home prices shot up in the Portland and Vancouver, WA, real estate markets, and mortgage rates followed. Many people hit pause on their home search because it just didn’t feel possible. Maybe you were one of them.

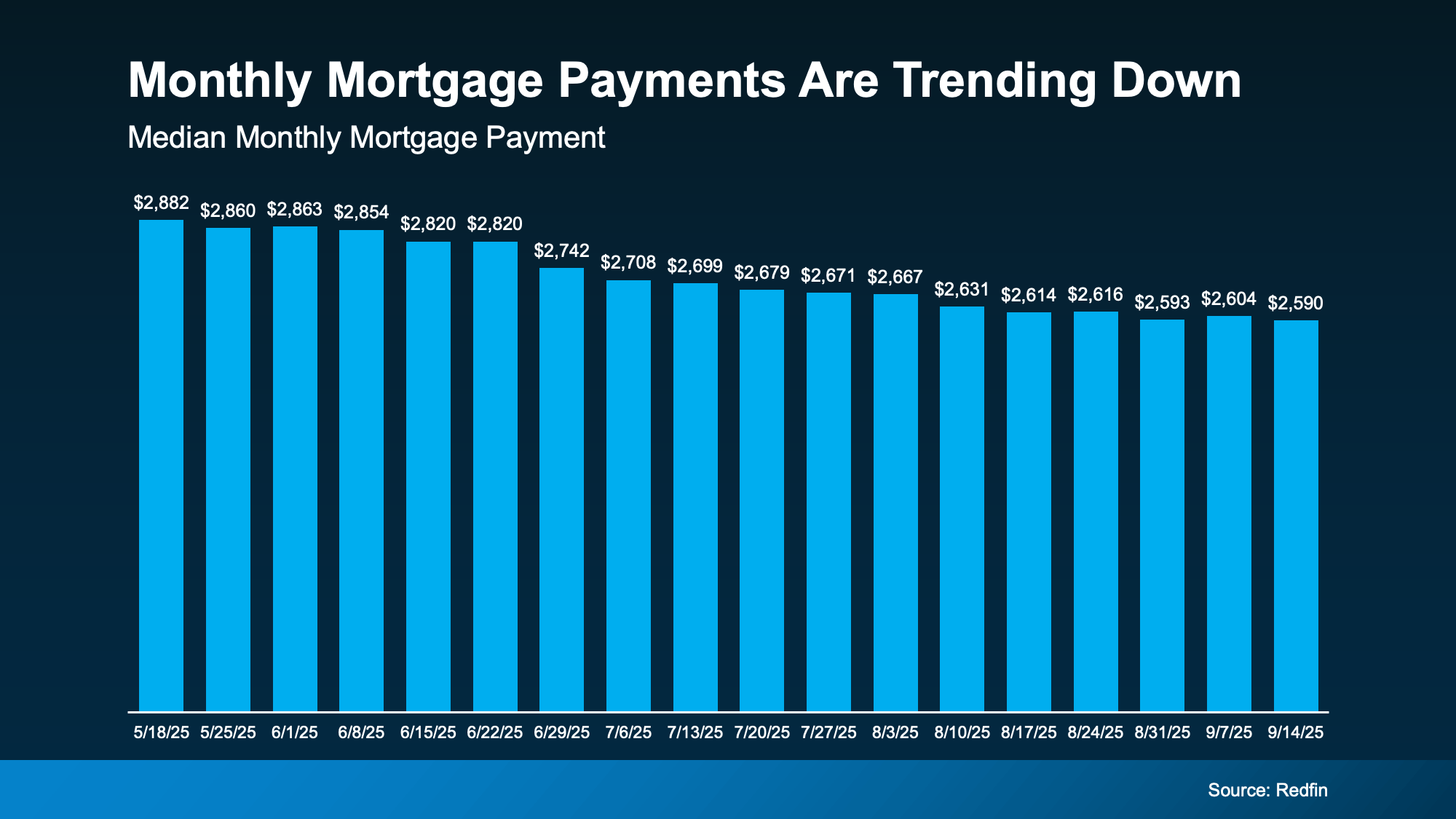

But there’s encouraging news. If you’ve been waiting for a better time to jump back in, affordability may finally be showing signs of improvement this fall. The latest national data indicates the typical monthly mortgage payment is coming down, which is a trend that is already easing the pressure on Portland-Vancouver buyers.

The cost of buying a home really comes down to three things: Mortgage Rates, Home Prices, and Your Wages. Right now, all three are finally moving in a better direction for you. While buying a home still takes strategy, it's not as challenging as it was just a few months ago.

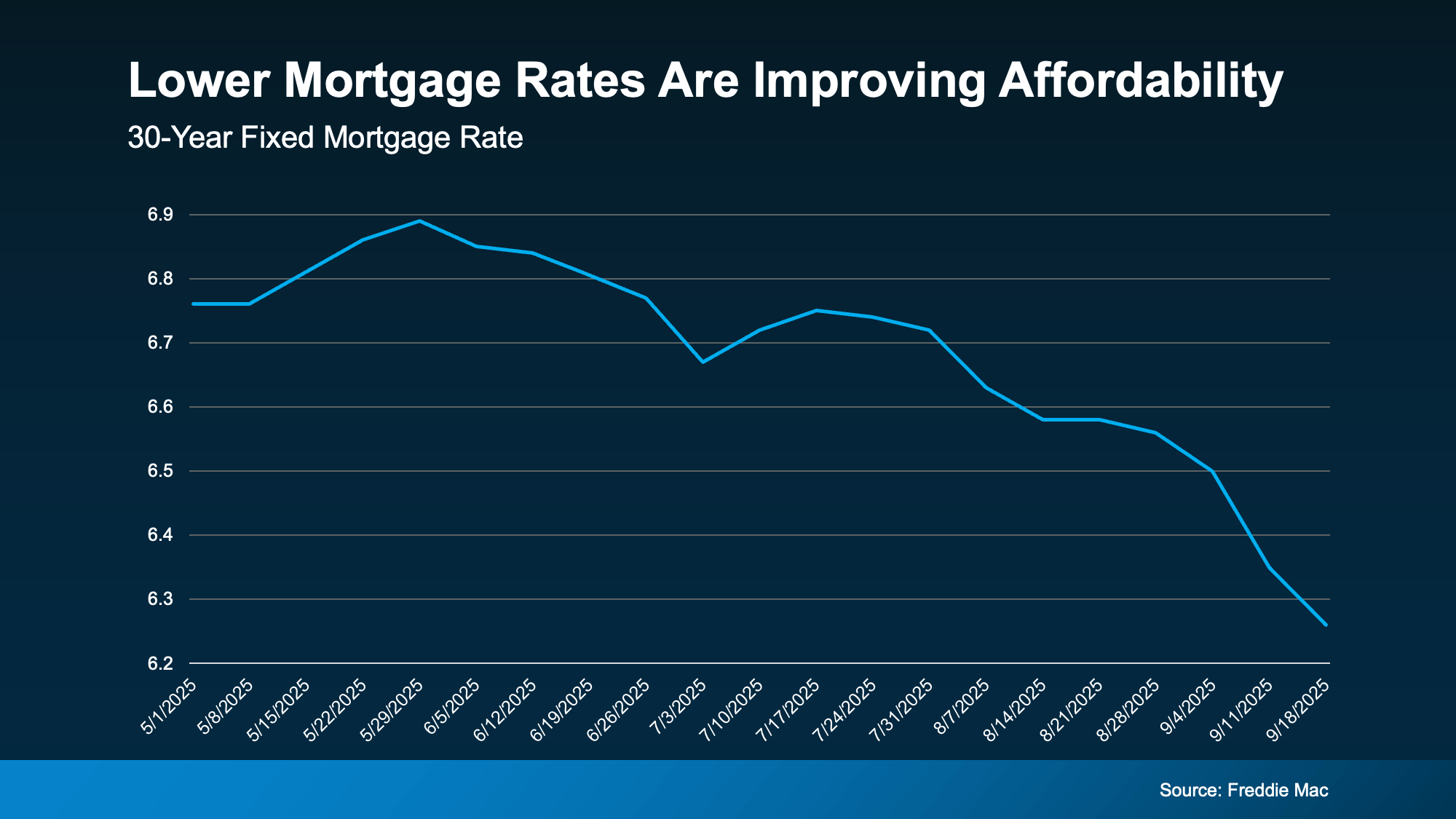

1. Mortgage Rates Are Easing in the Pacific Northwest

Mortgage rates have come down from their peak earlier this year. In May, they were roughly , and now they are closer to .

That may not sound like a huge difference, but it matters deeply for your budget. Even small changes in rates can drastically alter your future monthly payment. For example, compared to when rates were at , if you take out a typical $400K mortgage now at , it could cost about $190 less a month based on rates alone.

For many buyers in the Portland or Clark County area, that difference is enough to make buying a home possible again. As the Mortgage Bankers Association (MBA) reports, the downward rate movement has already spurred the strongest week of borrower demand since 2022.

2. Home Price Growth Has Slowed (Especially Locally)

After several years of prices rising very rapidly, price growth has finally slowed across the country. Locally, the moderation in Vancouver WA home prices and Portland OR home prices is a big relief for buyers trying to manage their budget.

As price growth settles into a more moderate, low-single-digit pace, it makes the appraisal process smoother and reduces the anxiety of overpaying. Furthermore, in some neighborhoods around the metro area, prices have even dipped slightly, which can be the difference-maker you need to find an affordable entry point.

This stabilization is a powerful argument for getting into the market now, especially before any future rate cuts bring a massive wave of new competition.

3. Wages Are Gaining Ground on Home Prices

According to the Bureau of Labor Statistics (BLS), wages are up near annually. This is a crucial factor right now, as wage growth is comfortably outpacing the rate of home price growth.

In other words, the typical paycheck is rising faster than home prices, which helps make buying a little more affordable over time. It’s not a big difference overnight, but in a tight market like ours, every bit of increased purchasing power counts. This trend provides a stable foundation for first-time home buyers in Portland or Vancouver.

What This Means for You: It's Time To Re-engage

What This Means for You: It's Time To Re-engage

Lower rates, slower price growth, and stronger wages might be enough to make the numbers finally work for you this fall.

While affordability is still a factor, it is noticeably easier on your wallet to buy now than it was just a few months ago. If you hit pause on your home search, this shift is your signal to re-engage.

Ready To Turn Window-Shopping Into Key-Turning? Book Your Complimentary Appointment Now!

Don't miss the window of improving affordability. As your local Portland/Vancouver specialist, I can run the numbers tailored to your budget, discuss local down payment assistance programs, and show you exactly what’s changed in the market.

Click here to book your complimentary 60-minute appointment instantly: Book My Complimentary Buying Strategy Session Now!

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts