Closing Costs Unpacked: The Critical Differences for Buyers in Portland (OR) vs. Vancouver (WA)

If you’re planning to buy a home this year, especially if you’re a first-time buyer in the Portland-Vancouver metro area, there’s one expense you can’t afford to overlook: closing costs.

Almost every buyer knows they exist, but not that many know exactly what they cover, or how different they can be based on whether you buy in Oregon or Washington. So, let’s break them down.

What Are Closing Costs?

Your closing costs are the fees and payments you make when finalizing your home purchase. They typically include things like:

-

Lender Fees: Loan origination, underwriting, appraisal, and credit reports.

-

Title/Escrow Fees: Title insurance, title search, and service fees for the closing agent.

-

Prepaids: Homeowner’s insurance and property taxes for a set number of months.

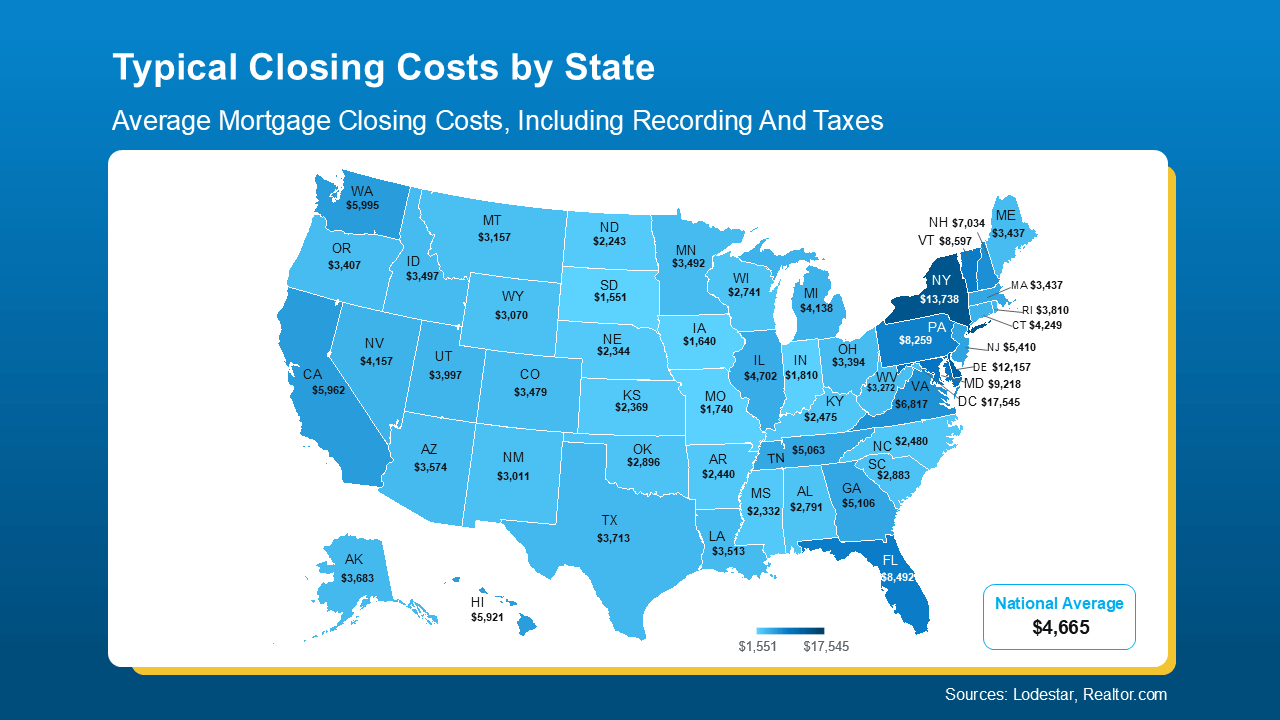

Nationally, these costs range from to of the purchase price. However, in our local bi-state market, that range can vary dramatically.

The Portland vs. Vancouver Closing Cost Divide

While the overall purchase price matters most, the specific state you buy in has a major impact on your out-of-pocket costs at closing. This is why local expertise is non-negotiable:

Strategies To Bring Your Closing Costs Down

If you're looking at those numbers and wondering if there’s any way to trim that bill, there’s good news. In today’s shifting market, buyers have more room to negotiate:

-

Negotiate with the Seller: Since our market is normalizing, many sellers are open to offering seller concessions—a credit toward your closing costs—especially if the home has been on the market for a few weeks.

-

Explore Local Assistance Programs: Oregon and Washington both offer fantastic programs. First-time buyers in Portland can look into DPAL (Down Payment Assistance Loan) funds from the Portland Housing Bureau, while Vancouver offers various state and county assistance programs. Your agent and lender can identify what you qualify for.

-

Shop Service Providers: You have the right to shop around for services like homeowner’s insurance and title work to ensure you are getting the best rate.

Knowing your numbers (and how to potentially bring them down) can go a long way and help you feel confident about your purchase.

Bottom Line

Closing costs are a key part of buying a home, but they can vary more than most people realize. Let’s look at the actual closing cost breakdown for your specific price range, loan type, and whether you are searching in Portland or Vancouver, so you can craft your ideal budget and make a strong, informed offer.

Ready to Craft Your Homebuying Budget? Book Your Complimentary Session Now!

Don't let closing costs catch you by surprise! Let's connect to get you a personalized closing cost estimate and a strategic plan to find and leverage any available down payment or closing cost assistance in the Portland-Vancouver area.

Click here to book your complimentary 60-minute appointment instantly: Book My Complimentary Homebuyer Strategy Session!

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts