Buying a Home with Friends: A Smart Move or a Risky Venture?

Buying a Home with Friends: A Smart Move or a Risky Venture?

With the rising costs of homeownership, buying a home with friends is becoming a popular option. Pooling resources can make homeownership more accessible, but it’s not without its challenges. If you’re considering this path, careful planning and open communication are essential for success.

Why Buy a Home with Friends?

For many, teaming up with friends to buy a home is a way to:

- Share Costs: Splitting the down payment, mortgage, and maintenance costs makes homeownership more affordable.

- Enter the Market Sooner: Combining resources can help you overcome financial hurdles and secure a home in today’s competitive market.

- Build Wealth Together: Real estate remains a strong long-term investment.

While the benefits are appealing, there are important steps to take before jumping in.

How to Make It Work

-

Open Communication is Key:

Start by discussing your goals, expectations, and how the property will be used. Is this a starter home? A long-term residence? A rental? Ensure everyone is on the same page before moving forward. -

Choose the Right Ownership Structure:

Decide how ownership will be legally divided. Two common options are:- Joint Tenancy: Equal ownership shares with rights of survivorship.

- Tenancy in Common: Allows unequal shares and flexibility for future changes.

Consulting with a real estate attorney can help you determine the best fit.

-

Draft a Co-Ownership Agreement:

A written agreement is essential to avoid misunderstandings. This document should include:- Each person’s financial contributions (e.g., down payment, mortgage payments, maintenance).

- A process for making decisions about repairs, selling the property, or renting it out.

- An exit strategy if one person wants to sell their share or move out.

-

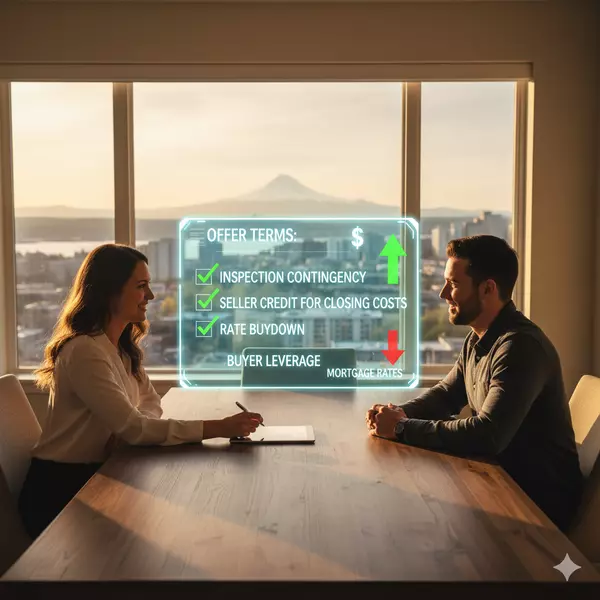

Plan Your Finances Together:

Ensure everyone involved is financially stable and preapproved for the mortgage. Having a shared understanding of budgets, responsibilities, and backup plans for unexpected expenses is crucial. -

Seek Professional Guidance:

Work with professionals to streamline the process. A real estate agent can help you find the right property, while an attorney and financial advisor ensure your agreement is solid.

Potential Pitfalls to Watch For

Buying a home with friends can be rewarding, but it comes with risks:

- Financial Disparities: Unequal contributions can lead to disputes about ownership or profits.

- Credit and Mortgage Risks: If one person misses a payment, it affects everyone’s credit score.

- Decision-Making Conflicts: Disagreements over repairs, selling, or renting can strain relationships.

- Exit Challenges: Selling a share of the property can be complicated if others can’t buy out the departing co-owner.

- Legal and Tax Issues: Co-ownership can complicate taxes and inheritance unless proper agreements are in place.

- Relationship Strain: Money matters can test even the strongest friendships.

The Bottom Line

Buying a home with friends can be a fantastic way to achieve your homeownership goals while sharing costs. However, success lies in preparation. Clear communication, solid agreements, and professional advice can help you avoid common pitfalls.

Thinking about making this move? I’d love to guide you through the process and help you find the perfect home to suit your goals. Let’s talk!

Categories

- All Blogs (462)

- For Sale By Owner (15)

- Local Events (6)

- Affordability (31)

- Agent Value (86)

- Buying Tips (192)

- Closing Costs (1)

- Community Support (1)

- Debt-Free Living, (1)

- Design (8)

- Downsize (5)

- Economy (23)

- Equity (23)

- Financial Planning (32)

- First-Time Home Buyer (137)

- For Sale by Owner (2)

- Forecasts (14)

- Foreclosures (4)

- Foster Care Resrources (1)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (237)

- Home Inspections (1)

- Home Prices (63)

- Home Selling (170)

- Inventory (34)

- Local (24)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (35)

- Mortgage (50)

- Move-Up (2)

- New Construction (7)

- Newsletter (9)

- Open House (1)

- Portland OR (1)

- Portland OR Affordability (2)

- Portland OR Homes (2)

- Portland OR Real Estate (3)

- Portland-Vancouver Home Value (1)

- Portland-Vancouver Inventory (1)

- Real Estate Investing (7)

- Rent vs Buy (8)

- Restaurant Reviews (5)

- Seasonal (11)

- selling tips (125)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (1)

- Vancouver WA Affordability (2)

- Vancouver WA Real Estate (4)

- Vancouver WA Selling Tips (1)

- Wealth Building (12)

Recent Posts