8 Things a Buyer Needs to Look for When Buying a Home

8 Things a Buyer Needs to Look for When Buying a Home

When buying a home, it's essential to consider various factors to make an informed decision. Key aspects include the property's location, its condition, and market price. Buyers should also evaluate the size and layout, future potential and resale value, and conduct thorough inspection reports. Additionally, understanding legal and zoning issues and considering the rules and fees associated with Homeowners Associations (HOAs) are crucial. By paying attention to these eight factors, buyers can ensure a successful home purchase.

- Location, Location, Location: Research the neighborhood’s safety,

amenities, and proximity to essentials like schools, workplaces, hospitals, shopping centers, and public transportation.

amenities, and proximity to essentials like schools, workplaces, hospitals, shopping centers, and public transportation. - Condition of the Property: Check for structural integrity, maintenance history, and any potential issues such as dampness or roof condition.

- Price and Market Trends: Conduct a comparative market analysis and understand current market trends to ensure the asking price is fair.

- Size and Layout: Ensure the number of bedrooms and bathrooms fits your needs and that the floor plan suits your lifestyle.

- Future Potential and Resale Value: Evaluate the growth potential of the area and factors that could impact the resale value of the home.

- Inspection Reports: Always get a professional inspection to uncover any hidden issues, including pest and environmental concerns.

- Legal and Zoning Issues: Understand zoning laws and ensure the property title is clear of any disputes or liens.

- Homeowners Association (HOA) Rules and Fees: Review HOA regulations and consider the cost and coverage of HOA fees.

Considering these factors will help ensure you make a well-informed and successful home purchase. If you have any questions or need further assistance, please feel free to reach out.

Categories

- All Blogs (462)

- For Sale By Owner (15)

- Local Events (6)

- Affordability (31)

- Agent Value (86)

- Buying Tips (192)

- Closing Costs (1)

- Community Support (1)

- Debt-Free Living, (1)

- Design (8)

- Downsize (5)

- Economy (23)

- Equity (23)

- Financial Planning (32)

- First-Time Home Buyer (137)

- For Sale by Owner (2)

- Forecasts (14)

- Foreclosures (4)

- Foster Care Resrources (1)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (237)

- Home Inspections (1)

- Home Prices (63)

- Home Selling (170)

- Inventory (34)

- Local (24)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (35)

- Mortgage (50)

- Move-Up (2)

- New Construction (7)

- Newsletter (9)

- Open House (1)

- Portland OR (1)

- Portland OR Affordability (2)

- Portland OR Homes (2)

- Portland OR Real Estate (3)

- Portland-Vancouver Home Value (1)

- Portland-Vancouver Inventory (1)

- Real Estate Investing (7)

- Rent vs Buy (8)

- Restaurant Reviews (5)

- Seasonal (11)

- selling tips (125)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

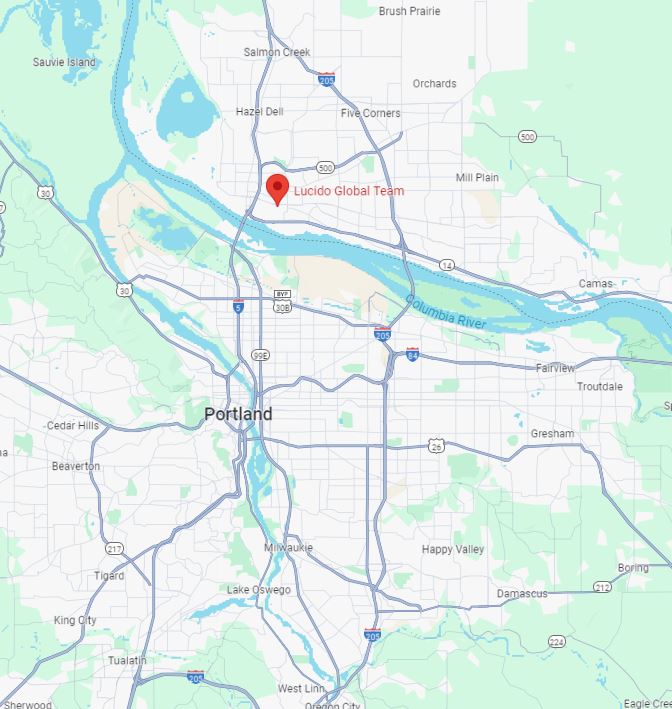

- Vancouver WA (1)

- Vancouver WA Affordability (2)

- Vancouver WA Real Estate (4)

- Vancouver WA Selling Tips (1)

- Wealth Building (12)

Recent Posts

Raising 100 Hands for Foster Care: A New Local Effort to Support SW Washington Foster Families

Mortgage Rate Forecast: Why Lower Rates Are Coming to Vancouver WA and Portland OR

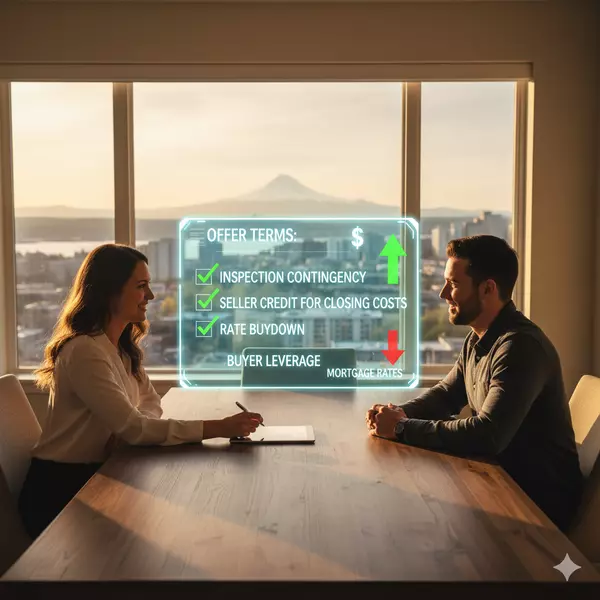

Buyer Power is Back! How to Negotiate Your Best Deal in Portland OR & Vancouver WA

The Best Time to Buy is Now: Your October Advantage in Vancouver WA & Portland OR

What Vancouver & Portland Buyers Need Most (And How Our Local Market is Adjusting)

Mortgage Rates in Portland & Vancouver: Why "Marry the House, Date the Rate" is Your 2025 Strategy

Unpacking Buyer Closing Costs in Vancouver WA & Portland OR

Closing Costs Unpacked: The Critical Differences for Buyers in Portland (OR) vs. Vancouver (WA)

Downsizing Without Debt: How Portland & Vancouver Homeowners Are Buying Their Next House in Cash

3 Reasons Affordability Is Showing Signs of Improvement for Portland & Vancouver Buyers This Fall