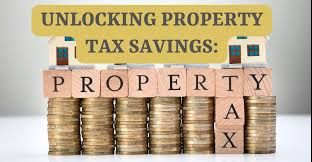

Unlock Major Tax Savings: How Buying a Home Can Benefit Your Taxes

Unlock Major Tax Savings: How Buying a Home Can Benefit Your Taxes

Discover Hidden Tax Benefits with Homeownership

Are you aware that buying a home can lead to significant tax savings? This blog reveals the incredible tax advantages of homeownership that you may not know about. Dive in to learn how your new home can save you money on your taxes!

Mortgage Interest Deduction

One of the most substantial tax benefits for homeowners is the mortgage interest deduction. You can deduct the interest paid on your mortgage, which is particularly beneficial in the early years of the loan when interest payments are at their highest.

Property Tax Deduction

Homeowners can also deduct the property taxes they pay on their home. This deduction can significantly lower your taxable income, though it is subject to certain limits.

Points Deduction

If you paid points to secure a mortgage, these points can often be deducted in the year they were paid. Points are essentially prepaid interest, and this deduction can further reduce your tax liability.

Home Office Deduction

For those who use part of their home exclusively for business purposes, the home office deduction can be a valuable benefit. Expenses related to the home office, including a portion of mortgage interest, property taxes, utilities, repairs, and depreciation, can be deducted.

Energy-Efficient Home Improvements

Investing in energy-efficient upgrades for your home can also yield tax benefits. Various tax credits are available for improvements such as installing solar panels, energy-efficient windows, or enhanced insulation, which can reduce your overall tax bill.

Exclusion of Capital Gains

When it comes time to sell your home, you can exclude up to $250,000 of the gain from your income ($500,000 if married filing jointly), provided you meet the ownership and use tests. This exclusion can significantly benefit those who have seen substantial appreciation in their property value.

Mortgage Insurance Deduction

If your adjusted gross income is below a certain threshold, you may be able to deduct premiums paid for mortgage insurance. This deduction can offer additional savings for homeowners with less than 20% equity in their home.

Conclusion

Homeownership offers numerous tax advantages that can help reduce your taxable income and save you money. Navigating the complexities of tax laws can be challenging, but understanding these benefits is crucial to making informed financial decisions.

Ready to Learn More?

Are you considering buying a home or want to learn more about how homeownership can benefit your taxes? Contact Susan and me for personalized advice and insights tailored to your unique situation. We’re here to help you make the most of your real estate investment and maximize your tax savings. Reach out today to get started on your journey to homeownership!

Categories

- All Blogs (430)

- For Sale By Owner (15)

- Local Events (6)

- Affordability (24)

- Agent Value (86)

- Buying Tips (178)

- Design (8)

- Downsize (3)

- Economy (19)

- Equity (21)

- Financial Planning (32)

- First-Time Home Buyer (123)

- For Sale by Owner (2)

- Forecasts (13)

- Foreclosures (3)

- Fun Tips (5)

- Home Buying (217)

- Home Prices (55)

- Home Selling (157)

- Inventory (33)

- Local (24)

- Luxury / Vacation (1)

- Market Update (35)

- Mortgage (43)

- Move-Up (1)

- New Construction (5)

- Newsletter (8)

- Open House (1)

- Real Estate Investing (7)

- Rent vs Buy (8)

- Restaurant Reviews (5)

- Seasonal (11)

- selling tips (118)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Wealth Building (12)

Recent Posts