Buying a Second Home: How an Investment Property Can Boost Your Retirement Income and Build Wealth

Are you wondering if you’re on track to retire comfortably?

You’re not alone. According to Intuit, 69% of people say today’s financial environment makes it tough to plan for the future, and 68% aren’t sure they’ll ever be able to retire. That’s why more people are exploring creative ways to build stability, generate retirement income, and secure long-term wealth.

One powerful strategy? Buying a second home as an investment property.

Why Real Estate Can Strengthen Your Retirement Plan

If the numbers work for your budget, purchasing a second home could be a game-changing step toward a stronger retirement. Here’s how it can help:

-

Build wealth over time – As home values rise, your second home’s equity grows, increasing your net worth.

-

Generate rental income – Renting out the property can bring in extra cash to boost your retirement savings. (Just remember: part of the rent will go toward mortgage payments, taxes, and upkeep.)

-

Profit when you sell – Down the road, you may sell the home and use the profit to give your retirement savings a serious boost.

-

Diversify your assets – Real estate offers a tangible investment beyond stocks and savings accounts, adding stability to your financial portfolio.

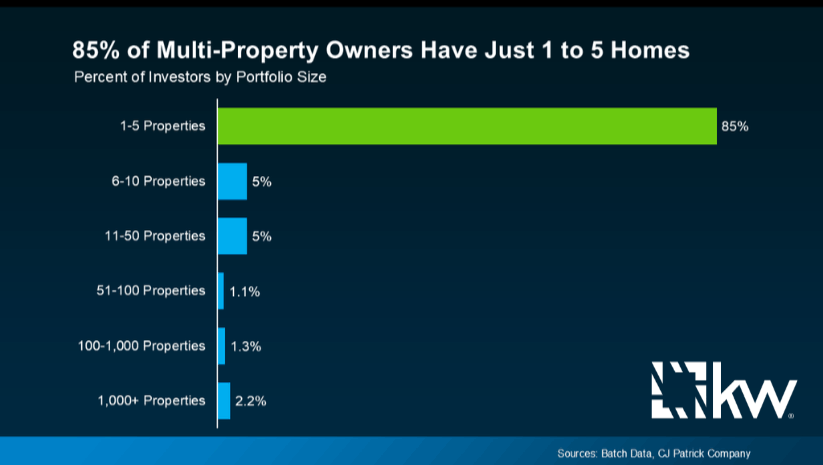

Most Second Homeowners Aren’t Large-Scale Investors

Think owning multiple homes is just for wealthy investors? Think again. Research from BatchData and CJ Patrick Company shows 85% of people who own more than one property have just 1 to 5 homes.

That means most second homeowners are everyday people—your neighbors—who purchased an additional property to rent out or hold as a long-term investment.

Why Now Might Be the Right Time to Buy a Second Home

According to Danielle Hale, Chief Economist at Realtor.com:

“. . . the balance of power in the housing market keeps shifting in favor of homebuyers. . . A confluence of factors—including more homes for sale, rising price cuts, and slower-moving inventory—is giving buyers more leverage than they've had in years . . .”

If you live in an area where home prices are projected to rise, purchasing a second home now could position you for significant financial gain later—whether you sell for a profit or rent it out for ongoing income.

How to Get Started

If you’re considering a second home purchase, start by connecting with a few trusted professionals:

-

A local real estate agent who knows your market and can identify the best investment opportunities.

-

A lender who specializes in second home and investment property financing.

The right team will help you make confident, informed decisions from the very first step.

Bottom Line

A second home can be more than just a vacation getaway—it can be a powerful tool for building wealth, creating retirement income, and diversifying your investments.

If you’d like to explore whether buying a second home could help you retire earlier or with more financial freedom, let’s talk. I’ll walk you through your options and help you find the best path forward.

📅 Schedule a 30–40 minute conversation here: Book a Meeting with Ken & Susan

#InvestmentProperty #SecondHome #RetirementPlanning #BuildWealth #pnwpropertypros #LucidoGlobal

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts