To Wait or Not to Wait? The Mortgage Rate Dilemma

To Wait or Not to Wait? The Mortgage Rate Dilemma

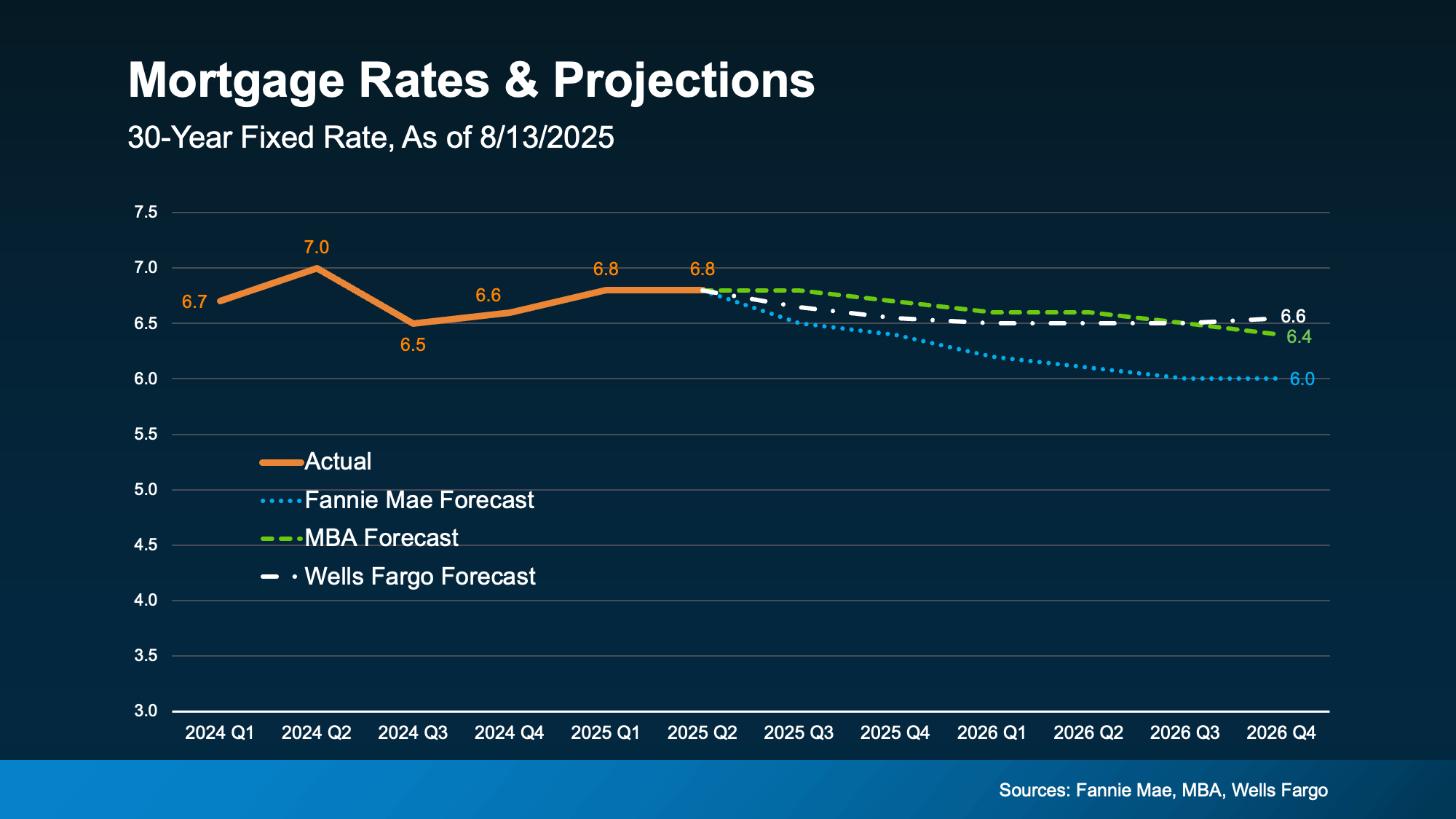

Mortgage rates are a hot topic for a reason. Recently, we've seen rates dip to their lowest point this year, sparking hope for many buyers who have been waiting on the sidelines. But what's the smart move: buy now or hold out for even lower rates? Let's break down the trade-off.

The Current Outlook

Experts and forecasts from major institutions like Fannie Mae and the National Association of Realtors (NAR) suggest that we're not likely to see a huge drop in mortgage rates anytime soon. While small fluctuations will continue, the general consensus is that rates will stay somewhere in the mid-to-low 6% range through 2026. This means the dream of a return to 3% rates is not a realistic expectation in the near future.

The Catch-22 of Waiting

A lot of buyers are waiting for rates to hit that magic 6% number. According to the NAR, if rates were to fall to 6%, millions more households would suddenly be able to afford the median-priced home, and hundreds of thousands of new buyers would enter the market.

This is where the real dilemma comes in. If you wait for rates to drop, you're not just waiting alone. You're joining a massive crowd of other motivated buyers. When that happens, you'll likely face:

-

More Competition: Bidding wars and multiple offers will become the norm again, making it much harder to get a home.

-

Fewer Choices: The best homes will get snatched up quickly, limiting your options.

-

Higher Prices: With a surge in demand, home prices will increase, potentially eating up any savings from a lower interest rate.

As the NAR wisely states, "Buyers who are holding out for lower mortgage rates may be missing a key opening in the market."

The Advantage of Buying Now

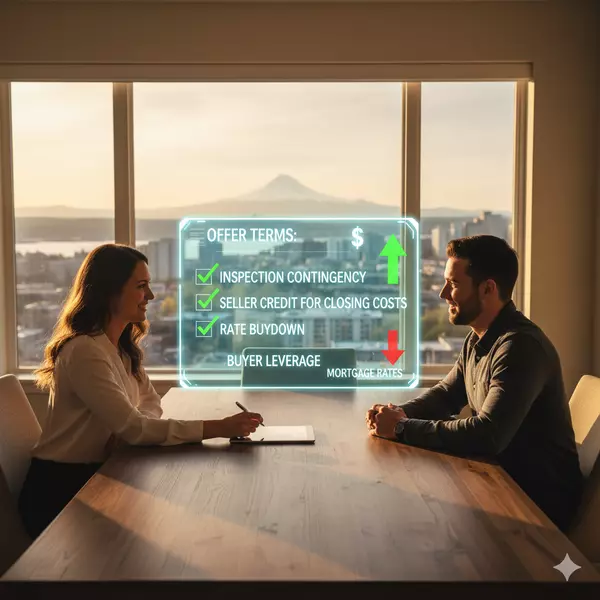

The current market offers a unique and valuable opportunity. While rates are elevated, the pressure on the market has eased. This means:

-

More Inventory: There are more homes for sale, giving you more options and time to find the right fit.

-

Slower Price Growth: Home prices have stabilized, meaning you won't be competing against runaway appreciation.

-

Negotiating Power: Sellers are more willing to negotiate on price, terms, and even offer concessions.

You can always refinance your mortgage later if rates drop, but you can't go back in time to secure a home with less competition and more leverage.

Ready to Make a Move?

The decision to buy now or wait is a personal one, but it's important to understand the full picture. The opportunity for less competition and more negotiating power is here right now, and it may not last.

Let’s connect and talk about what's happening in your local market and if now is the right time for you to make your move.

-

Ken & Susan Rosengren

-

Call or text: 602.609.0226

-

Email: KenRosengren@Lucidoglobal.com or SusanRosengren@Lucidoglobal.com

You can also book a no-obligation conversation for buyers, sellers, or investors at your convenience: Book a Conversation

Categories

- All Blogs (460)

- For Sale By Owner (15)

- Local Events (6)

- Affordability (30)

- Agent Value (86)

- Buying Tips (191)

- Closing Costs (1)

- Debt-Free Living, (1)

- Design (8)

- Downsize (5)

- Economy (23)

- Equity (23)

- Financial Planning (32)

- First-Time Home Buyer (136)

- For Sale by Owner (2)

- Forecasts (14)

- Foreclosures (4)

- Fun Tips (5)

- Home Buying (236)

- Home Inspections (1)

- Home Prices (63)

- Home Selling (170)

- Inventory (34)

- Local (24)

- Luxury / Vacation (1)

- Market Update (35)

- Mortgage (49)

- Move-Up (2)

- New Construction (7)

- Newsletter (9)

- Open House (1)

- Portland OR Affordability (2)

- Portland OR Homes (1)

- Portland OR Real Estate (3)

- Portland-Vancouver Home Value (1)

- Portland-Vancouver Inventory (1)

- Real Estate Investing (7)

- Rent vs Buy (8)

- Restaurant Reviews (5)

- Seasonal (11)

- selling tips (125)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA Affordability (2)

- Vancouver WA Real Estate (3)

- Vancouver WA Selling Tips (1)

- Wealth Building (12)

Recent Posts