Do You Know How Much Your House is Really Worth? (Get a Free Portland-Vancouver Equity Check)

Your House is Your Biggest Financial Asset in the Pacific Northwest

Want to know something important you probably don’t have a professional check for you nearly as often as you should? Spoiler alert: it’s the value of your home in Portland or Vancouver.

Here’s the reality: Your house is likely the biggest financial asset you have. If you’ve lived in it for a few years or more, chances are it’s been quietly building wealth for you in the background—even as the market has shifted over the past few months.

You might be surprised by just how much your Vancouver WA home value or Portland OR home value has grown.

What Is Home Equity and Why Do Local Owners Have So Much?

That hidden wealth in your home is called equity. It’s the difference between what your house is worth today and what you still owe on your mortgage. Your equity grows over time as local Portland-Vancouver home prices rise and as you make your monthly payments.

The typical homeowner with a mortgage has accumulated a near-record amount of equity. Here are the two main reasons owners in the Portland and Vancouver metro area are sitting on a substantial financial cushion:

-

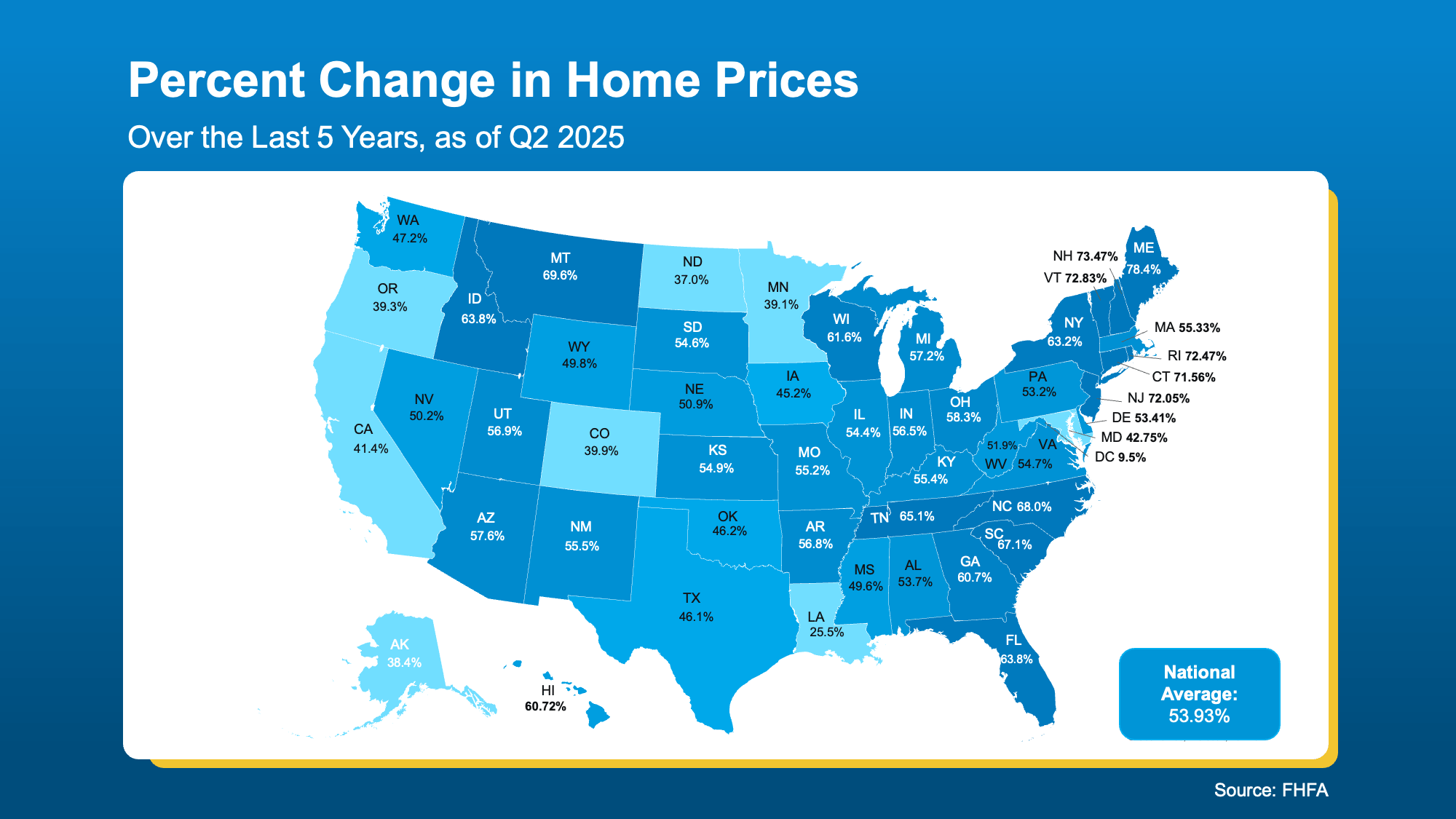

Significant Home Price Growth: Over the last five years, national home prices have jumped significantly. In the highly desirable Pacific Northwest real estate market, this appreciation has translated into massive wealth for long-term homeowners. Even if you've heard of recent market cooling, if you've been in your house for a few years (or more), you almost certainly have a substantial equity buffer.

-

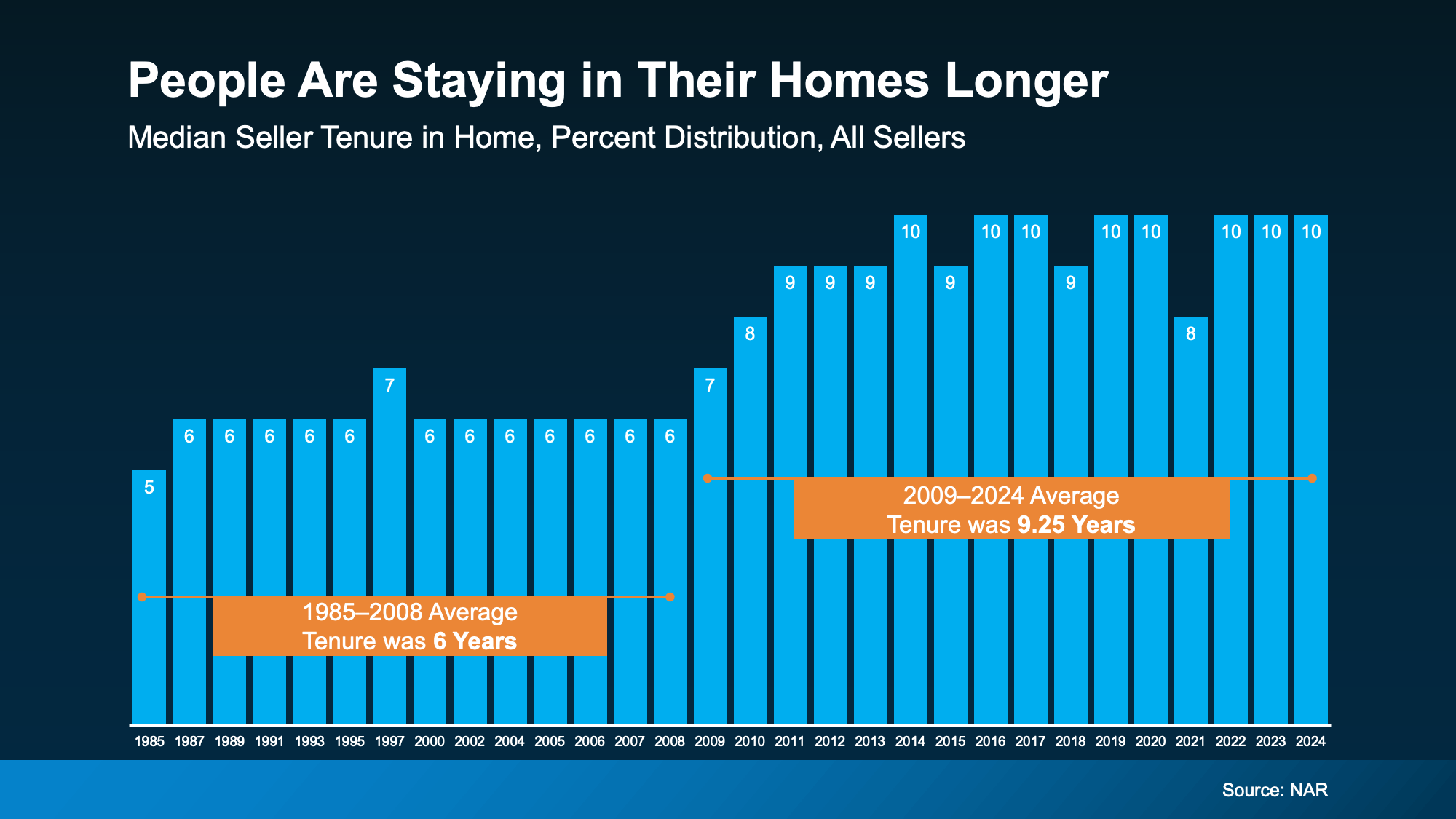

Longer Homeownership: Data shows the average homeowner stays in their home for about 10 years now. Over that decade in your Portland or Vancouver property, you’ve built equity simply by making your mortgage payments and riding the wave of rising values. According to the National Association of Realtors (NAR), the typical homeowner has accumulated over $201,600 in wealth from price appreciation alone over the past decade.

The financial side of homeownership is about playing the long game, and in the Portland-Vancouver real estate market, long-term owners are winning.

What Could You Actually Do with That Equity?

What Could You Actually Do with That Equity?

Your equity isn’t just a number on a balance sheet; it’s a powerful tool that can unlock your next big move or financial goal. As a Portland OR and Vancouver WA real estate specialist, I help homeowners explore all their options:

-

Fund Your Next Purchase: Your equity is often enough to cover the down payment on your next home. In high-equity cases, it could even allow you to buy your next house in all cash.

-

Renovate Strategically: Use a portion of your equity to finance smart renovations that dramatically increase the salability and value of your current Portland or Vancouver home before a future sale.

-

Invest or Start a Business: Your equity can be the crucial capital injection needed to start the business you’ve always dreamed of or diversify into investment properties.

Bottom Line: Get Your Free, Professional Equity Assessment

Chances are, your Portland or Vancouver house is worth significantly more than you think. Guessing is not a strategy—professional knowledge is.

If you’re curious about the true value of your home and the wealth you've built, let’s connect. We’ll run the numbers using real-time, hyper-local data to give you a professional equity assessment report, so you know exactly what you’re working with and where you can go from here.

Ready to Unlock Your Home's Hidden Wealth? Book Your Complimentary Valuation Now!

Let's discover your home's current market value and explore your options for using that equity. Click the link below to schedule your private, complimentary consultation instantly with your local Portland/Vancouver specialist.

Click here to book your complimentary 60-minute appointment instantly: Book My Complimentary Selling Strategy Session Now!

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts