Home Buyers Hibernation is OVER!

Home Buyer Hibernartion is OVER!

Let's get moving, before everyone come out! Why Renters Should Seriously Consider Buying a Home Right Now

If you’re currently renting and wondering whether now is the right time to buy a home, let’s talk facts—not fear.

Right now, renting might seem cheaper than buying, but that’s only part of the story. Yes, in today’s market, a mortgage might cost $300–$500 more per month than your rent. But what will that look like in 24 months?

📈 Rents Are Rising Fast

With projected annual rent increases of 10%, your rent could be significantly higher in two years—while your mortgage would stay the same. That means your “cheaper” rent today could actually cost you more than a fixed-rate mortgage in the near future.

🏠 Home Prices Are Climbing Too

Home values are rising—June 2025 alone saw a 4.9% increase. With that trend continuing at 4–6% annually, the average home price could be over $60,000 more in just two years. That could add hundreds of dollars to your monthly payment if you wait.

💥 When Rates Drop, the Market Will Explode

Experts project mortgage rates could drop into the 5.25%–6% range next year. When that happens, all the buyers who’ve been sitting on the sidelines for the last two years will rush into the market. That creates bidding wars, fewer repairs, and fewer seller concessions like help with closing costs.

🤔 So, Why Buy Now?

-

You avoid the future bidding wars.

-

You lock in today's prices before they rise.

-

You can negotiate repairs and get seller-paid closing costs.

-

You can use a temporary rate buydown and still land a rate in the 5.5%–6% range today.

-

You can refinance when rates drop and save tens of thousands in the long run.

🚪Don’t Wait for the Market to Heat Up Again—Beat the Rush

If you’re ready to stop renting and start building wealth through homeownership, let’s talk. A quick 30-minute conversation could save you tens of thousands of dollars.

📅 Schedule your free consultation today: https://calendly.com/kenrosengren/60min

Categories

- All Blogs (487)

- For Sale By Owner (15)

- Local Events (6)

- Affordability (34)

- Agent Value (89)

- Buying Tips (202)

- Clark County Housing (4)

- Closing Costs (1)

- Community Support (1)

- Debt-Free Living, (1)

- Design (8)

- Downsize (7)

- Economy (24)

- Equity (24)

- Financial Planning (33)

- First-Time Home Buyer (145)

- For Sale by Owner (3)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (1)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (252)

- Home Inspections (1)

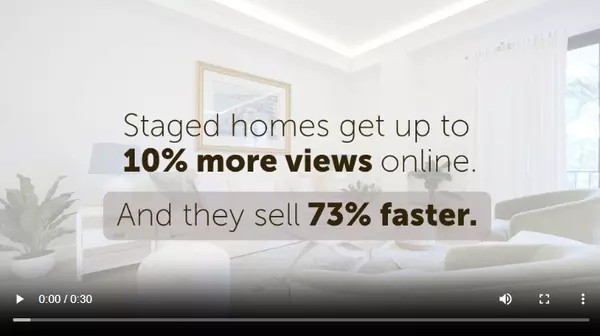

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (183)

- Home Staging PNW (1)

- Home Value (2)

- Inventory (36)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (37)

- Mortgage (55)

- Move-Up (4)

- New Construction (9)

- Newsletter (9)

- Open House (1)

- Portland OR (6)

- Portland OR Affordability (3)

- Portland OR Home Buying (4)

- Portland OR Homes (9)

- Portland OR Real Estate (21)

- Portland OR Seller Tips (2)

- Portland-Vancouver Home Value (4)

- Portland-Vancouver Inventory (3)

- Real Estate Investing (7)

- Rent vs Buy (8)

- Restaurant Reviews (5)

- Seasonal (11)

- selling tips (129)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (6)

- Vancouver WA Affordability (3)

- Vancouver WA Home Buying (6)

- Vancouver WA Real Estate (29)

- Vancouver WA Selling Tips (5)

- Wealth Building (12)

Recent Posts