What a Government Shutdown Means for the Portland & Vancouver Housing Market

There’s been a lot of talk lately about how a government shutdown impacts the housing market. If you’re buying or selling a home in the Portland Metro Area or Vancouver, WA, you might be wondering: Is this causing everything to grind to a halt?

The short answer for our local market is no.

The Portland and Vancouver housing markets don’t stop. Transactions keep moving, contracts are still signed, and closings are still happening. The key difference is that a few parts of the process—especially those involving federal agencies—may slow down, but the market continues to function.

Here's What Typically Slows Down Locally

When the government shuts down, certain federal agencies temporarily scale back operations. This can cause hiccups in real estate, particularly for specific types of financing popular with Portland and Vancouver homebuyers:

-

FHA, VA, and USDA Loans: These government-backed programs (critical for Veterans and first-time buyers in our region) may face significant processing and underwriting delays due to agency furloughs. While VA loans often continue with minimal disruption, any loan requiring manual review from HUD or the VA could be stalled.

“Applicants for FHA, VA, or USDA loans—which account for about one-quarter of all mortgage applications—may encounter significant processing delays due to agency furloughs.” – Selma Hepp, Chief Economist at Cotality

-

Income Verification: All loan types—including conventional—rely on agencies like the IRS for final income verification (e.g., tax transcripts). If these services are unavailable, even non-government loans can see delays in final underwriting.

-

Flood Insurance: Closings for homes in flood-hazard areas across the metro area may be paused if the National Flood Insurance Program (NFIP) is temporarily affected and cannot issue new policies.

The important takeaway: Even with those challenges and delays, most transactions still close. Buyers keep buying, sellers keep selling, and we keep helping people move forward.

The Portland/Vancouver Market Usually Bounces Back

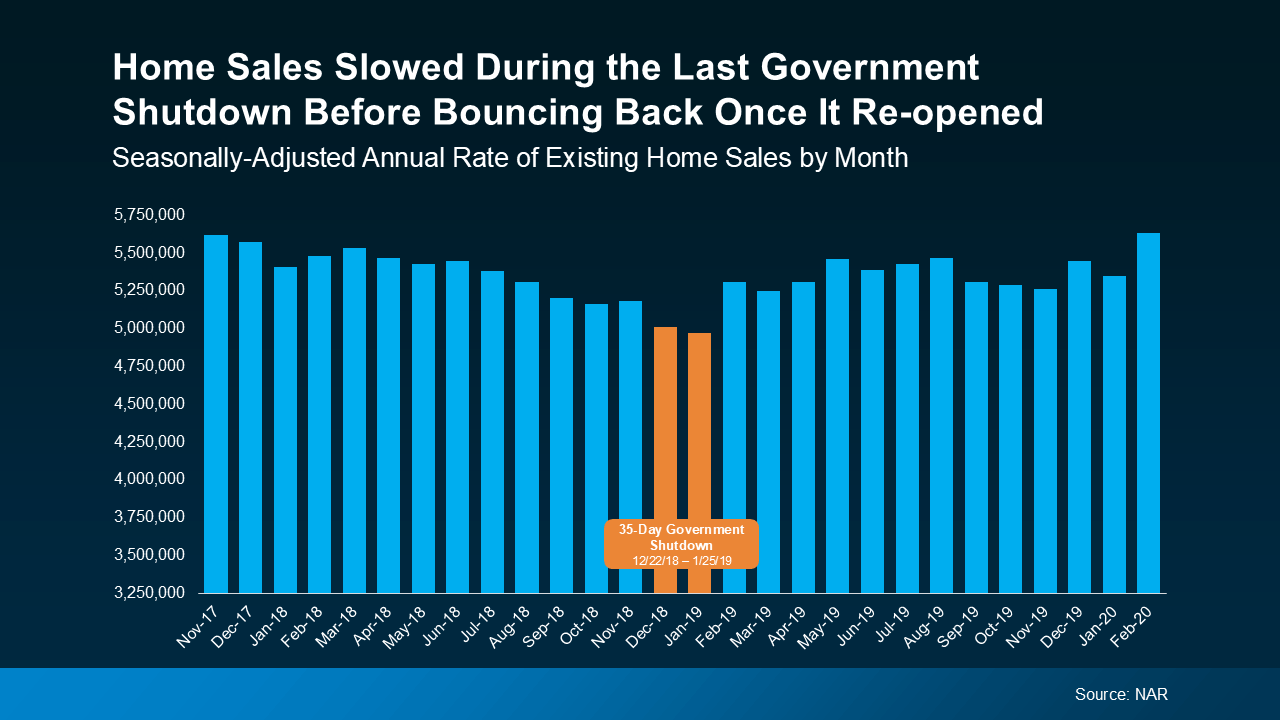

History shows that this instability creates a temporary pause, not a crash. The most recent major government shutdown saw a slight dip in national sales activity during the closure, but sales rebounded quickly once the government reopened as delayed closings worked their way through the system.

What this means is that buyer and seller activity is postponed, not eliminated. Once the issue is resolved in Washington D.C., the suppressed demand floods back into the local market.

What This Means for You Right Now

If you are currently in contract to buy a home in Portland or sell a house in Vancouver, WA, don’t panic. Most deals will still move forward, but you may need to prepare for a few extra days or a negotiated extension.

-

For Buyers: If you are using a federally-backed loan (especially FHA or USDA), talk to your lender immediately about your specific closing timeline and any contingency plans they have.

-

For Sellers: Be prepared for potential closing extensions if your buyer is using a government-backed loan. Flexibility can save your deal.

-

For Prospective Movers: This short window of uncertainty could work in your favor. When some cautious buyers/sellers pause their plans, it can lead to temporarily reduced competition, potentially opening up a unique opportunity to negotiate a great deal.

Bottom Line

A government shutdown may cause short-term delays for some buyers in the Portland and Vancouver housing markets, but it doesn't derail the market. The last time this happened, sales picked back up as soon as the government re-opened.

If you’re unsure how this might affect your plans, especially if you're using a VA or FHA loan, let’s connect today to review your strategy.

#PortlandOR #VancouverWA #PDXRealEstate #GovernmentShutdown #MortgageUpdate #FHALoan #VALoan #PortlandBuyers #VancouverWASellers #RealEstateNews

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts