Would You Let $80 a Month Stop You From Owning a Home in Portland or Vancouver?

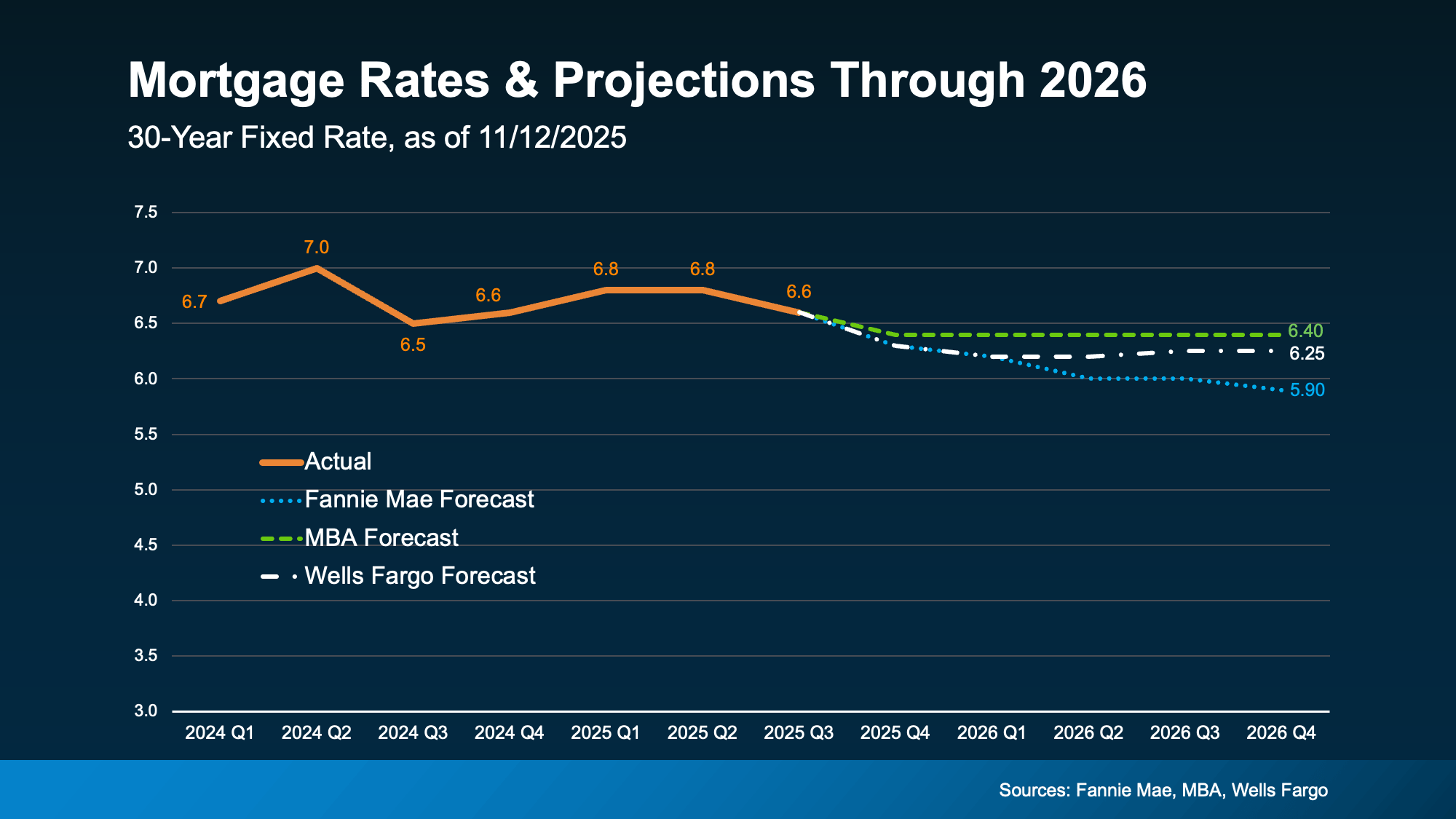

I'm seeing it daily in the Portland and Vancouver real estate market: buyers stuck in "wait and see" mode. They're watching 30-year fixed mortgage rates hover in the low 6s and thinking, "I'll jump in when rates drop back to the 5s."

As a top 20% expert serving buyers on both sides of the Columbia River, I know affordability is the biggest challenge right now. But waiting for a minor rate drop is a gamble that could cost you the bigger opportunity currently available.

Let's look at the facts and the critical math that explains why you should consider moving forward now.

📉 The Savings Are Already Significant (and Real)

The good news is that the market has already delivered substantial savings. Rates peaked for the year last spring, generally inching above 7%. Since then, we’ve seen a notable cooling trend.

While the national average is helpful, focusing on the dollar impact is key:

-

Real Savings Now: Data shows that a drop from the peak 7%+ rates earlier in the year to the current low 6% range translates to an estimated savings of hundreds of dollars per month on a typical home in our metro area.

-

The Difference is Now: If you paused your search in the spring because you thought homeownership was out of reach, you are already saving significant money by buying today. This is the real opportunity for savvy buyers.

💰 The Real Math: Is $80 Worth the Wait?

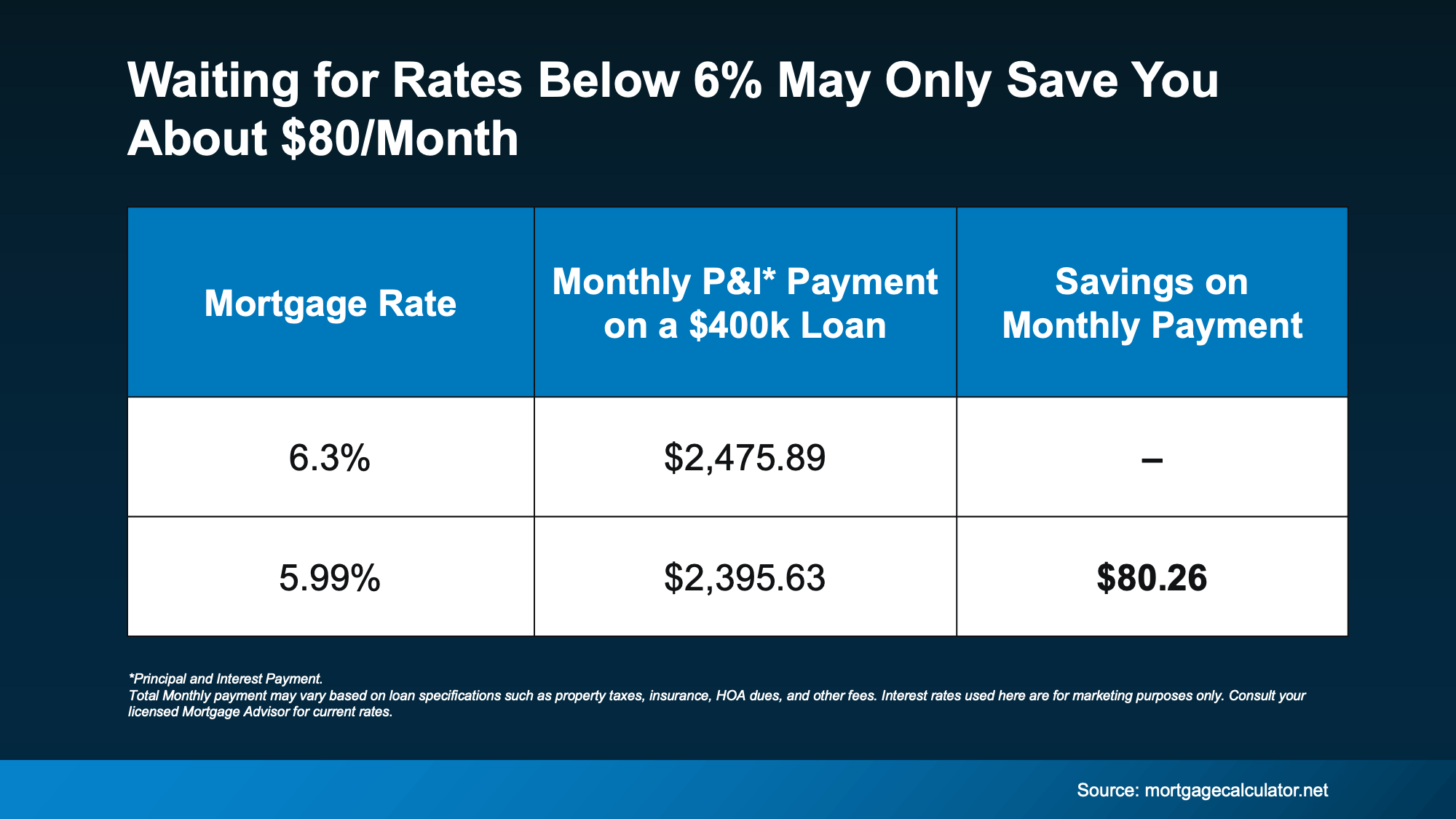

The common belief is that a drop below 6% is the magic number. But let's look at the actual payment difference on an average home loan:

Dropping from, say, 6.25% to 5.99% results in a savings of only about $60 to $90 per month on an average-priced home in the Portland-Vancouver area.

Ask yourself: Is an extra $80 a month in savings worth the risk of waiting for an uncertain future?

🛑 The Hidden Cost of Waiting in the PNW

🛑 The Hidden Cost of Waiting in the PNW

In a supply-constrained region like ours, the cost of waiting goes far beyond the mortgage payment difference.

1. The Avalanche of Competition

The moment the 30-year fixed rate consistently dips below that psychological 6% barrier, we will see a rush of buyers re-enter the market. The National Association of Realtors (NAR) estimates millions of households nationally could afford the median-priced home if rates hit 6%.

In the Portland-Vancouver metro, which already deals with low inventory, this will mean:

-

More Bidding Wars: Your chance to negotiate with sellers vanishes.

-

Higher Home Prices: Increased competition drives prices up, potentially canceling out any minor savings you gained from the lower interest rate. You could save $80 a month on the loan, but pay $15,000 to $20,000 more for the home.

2. The Power of "Buy Now, Refinance Later"

This is the smartest strategy for a determined buyer in today's market:

-

Lock in the Home: You lock in today's lower purchase price, better inventory, and stronger negotiating power with sellers.

-

Refinance When Rates Drop: If rates do fall into the 5s in the coming years, you can simply refinance into a lower payment. You've secured the asset and the lower price, giving you the best of both worlds.

🔑 Bottom Line for Portland and Vancouver Buyers

Don't let the pursuit of an extra $80 a month in savings hold you back from achieving homeownership and locking in a favorable purchase price today. The risk of waiting far outweighs the potential reward in our competitive market.

If you find a home you love in Beaverton, Gresham, Camas, or Ridgefield, let's run the personalized affordability numbers. As your local expert, I can show you how a smart "buy now, refinance later" strategy works for your financial goals.

#PortlandHousingMarket #VancouverWAHomes #MortgageRates #FirstTimeHomeBuyer #BuyNowRefiLater #RealEstateExpert #PDXAffordability #PNWRealEstate #HomeBuyingStrategy #TopAgentPDX #PortlandRealtor #VancouverRealtor #GetPreApproved #RealEstateMath #HomeLoanAdvice #RealEstateExpert #TopAgentPDX #DontWaitToBuy #MortgageTips #HomeBuyingStrategy #MortgageRates #FirstTimeHomeBuyer #BuyNowRefiLater #RealEstateForecast #HousingAffordability #PortlandHousingMarket #VancouverWAHomes #PNWRealEstate #PDXAffordability #ClarkCountyLiving

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts