The Portland & Vancouver Housing Market: Hitting the Gas for 2026

After several years marked by high mortgage rates and sideline hesitation, the Portland-Vancouver Metro housing market is finally shifting. Momentum is quietly building—sellers are reappearing, buyers are re-engaging, and for the first time in a while, our local market has genuine movement.

No, it's not a return to the frenzy of 2021. But it is a major shift that positions the Pacific Northwest real estate market for a much stronger, healthier year in 2026.

As a top 20% expert in this region, here are the three biggest trends that are breathing life back into the Portland and Clark County markets right now.

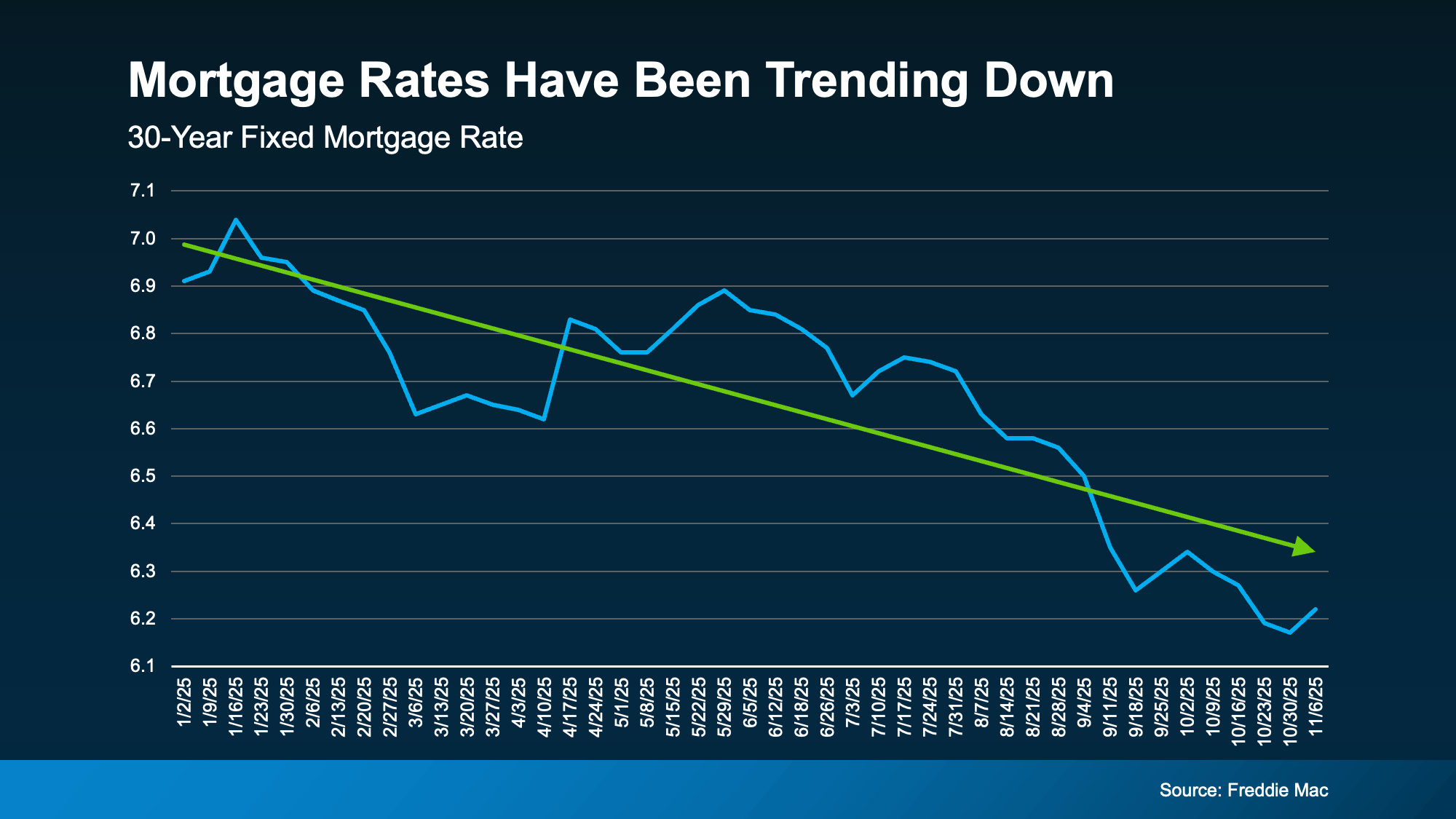

1. Mortgage Rates Are Trending Down, Driving Affordability

Mortgage rates have their expected volatility, but the overall trend for 2025 has been a gradual, downward slope. This shift is critical for local affordability.

-

Real Savings in the PNW: The drop from the 7%+ peak earlier this year to the current low 6% range is translating to hundreds of dollars in monthly savings for buyers. This is a game-changer for those who felt priced out of the Portland or Vancouver housing market.

-

Increased Buying Power: National data from Redfin shows that a buyer with a consistent monthly budget can now afford roughly $25,000 more home than they could a year ago. In a competitive, high-value area like ours—where a difference of $25K can mean the difference between a home in Tigard versus Beaverton, or Camas versus Ridgefield—this is a huge deal.

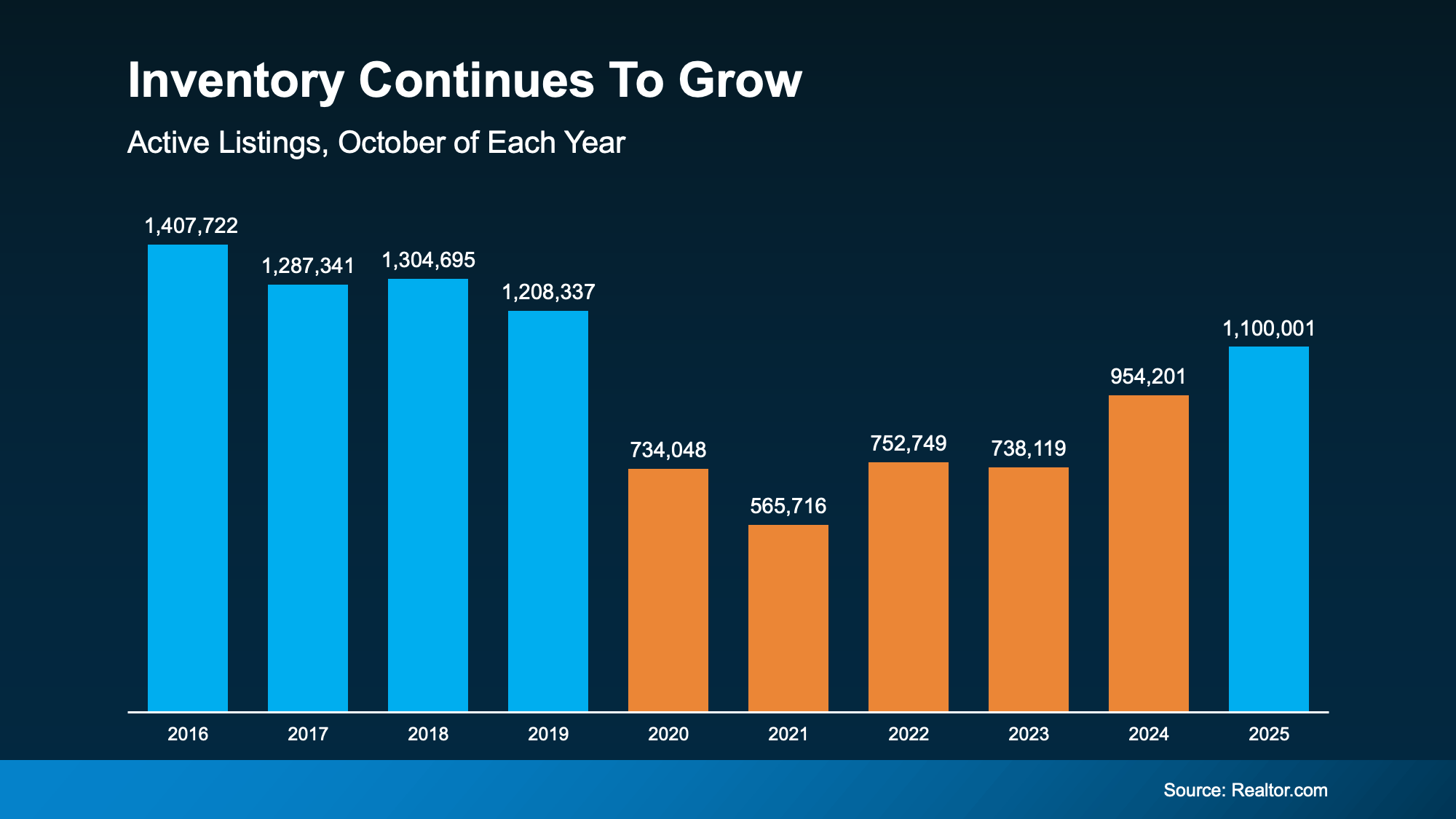

2. The Inventory "Lock-In" is Starting to Break

2. The Inventory "Lock-In" is Starting to Break

For years, the "lock-in" effect—where homeowners refused to give up their low 3% or 4% mortgage rates—kept inventory historically tight. While we are still not a balanced market (6 months of supply), that logjam is starting to ease.

What This Means Locally:

-

More Options for Buyers: Inventory levels are elevated compared to the last few years, especially in the suburbs and new construction zones of Clark County, WA. This means buyers have more negotiating leverage and less pressure to compromise.

-

Sellers Re-Engage: Life changes (new jobs, family growth, retirement) are finally outweighing the fear of giving up a low rate. As rates stabilize, more homeowners are realizing that their home equity is massive and can be leveraged for their next move. This increase in listings is a good sign for the Portland home values that thrive on healthy turnover.

Expert Take: The market is getting closer to balance. For sellers in the Portland Metro area, this means you can expect your home to sell—but you must be strategically priced and professionally presented to stand out from the rising competition.

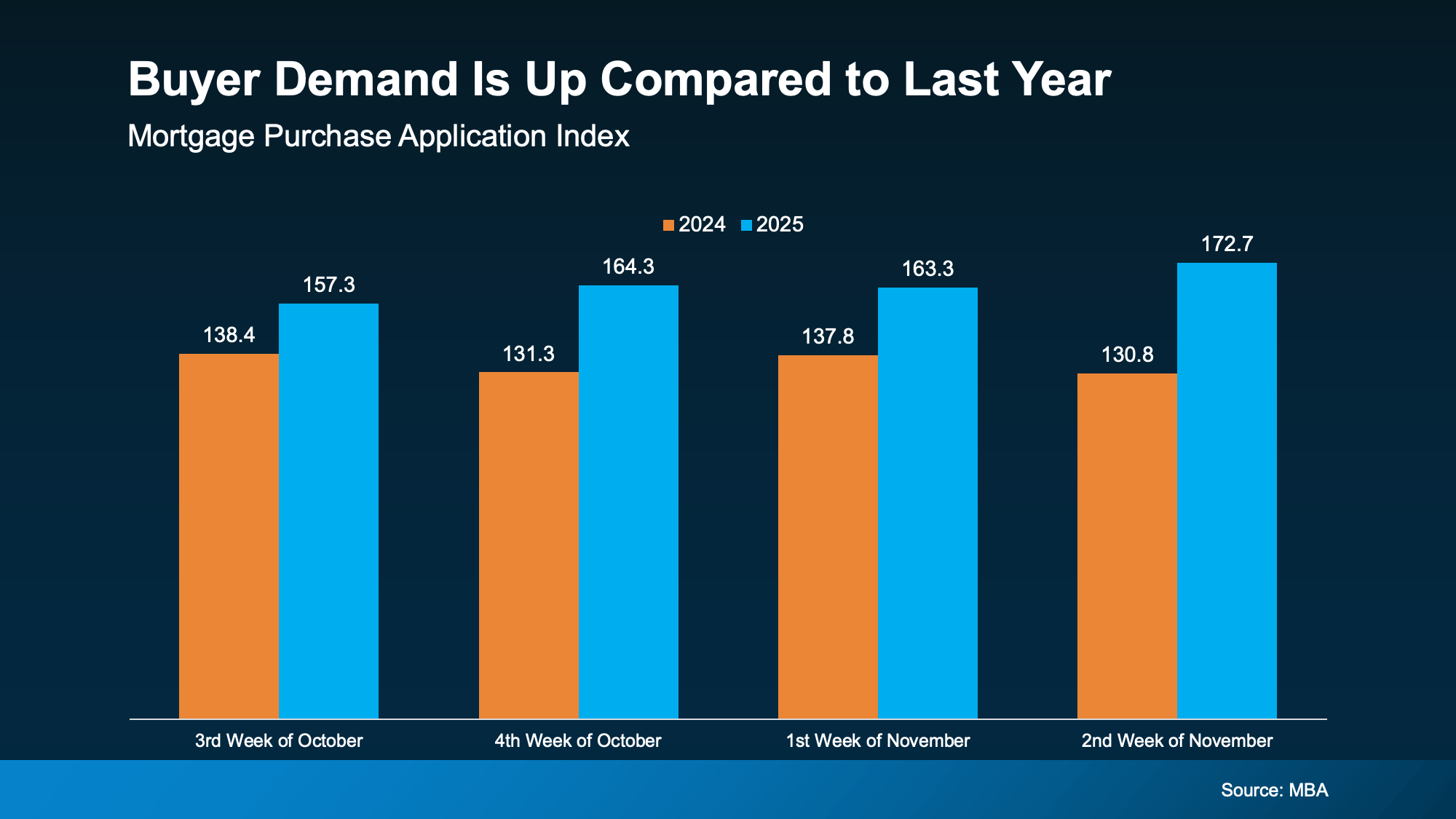

3. Buyer Demand is Poised to Surge in 2026

With improved affordability and more listings, buyers are actively getting back in the game. The Mortgage Bankers Association (MBA) reports an increase in purchase applications, a clear sign that pent-up demand is building.

This momentum is expected to accelerate into 2026. Experts from Fannie Mae and the National Association of Realtors (NAR) forecast moderate sales growth.

The Strategy for 2026:

-

For Buyers: Use this period of increasing inventory to your advantage. Get pre-approved and be ready to act before the expected surge in demand occurs when rates potentially dip below 6% next year (as some forecasters predict).

-

For Sellers: This is the ideal time to prep your home. The 2026 market will reward sellers who prioritize staging and realistic pricing. You're no longer in a hyper-frenzy, but you are heading into a strong, active market.

🏁 Bottom Line: 2026 is Your Year

After slower years, the Portland-Vancouver real estate market is finally turning a healthy corner. Declining mortgage rate trends, more listings, and growing buyer activity all point to a market gaining real, sustainable traction.

Let’s connect to create your personalized 2026 Real Estate Strategy. Whether you're moving to Vancouver, WA for the tax benefits or capitalizing on your equity in Portland, OR, I have the data to guide your next move.

#PortlandHousingMarket #VancouverWAHousing #2026HousingForecast #MortgageRates2026 #PDXMarketUpdate #Top20Percent #PNWRealEstate #BuyersMarketTips #SellersStrategy #RealEstateTrends #BuyersMarketTips #SellersStrategy #RealEstateInvestment #HomeAffordability #Top20Percent #ExpertRealtor #PDXRealtor #MarketAnalysis #HomeBuyingTips #2026HousingForecast #RealEstateTrends #MortgageRates2026 #HousingMarketShift #RealEstateOutlook #PortlandHousingMarket #VancouverWAHousing #PNWRealEstate #PDXMarketUpdate #ClarkCountyRealEstate

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts