The VA Home Loan Advantage: What Every Portland & Vancouver Veteran Should Know Right Now

If you’ve served in the military (or if your spouse has), you have access to one of the most powerful homebuying tools available in the Portland Metro Area and Vancouver, WA: the chance to buy a home without a down payment.

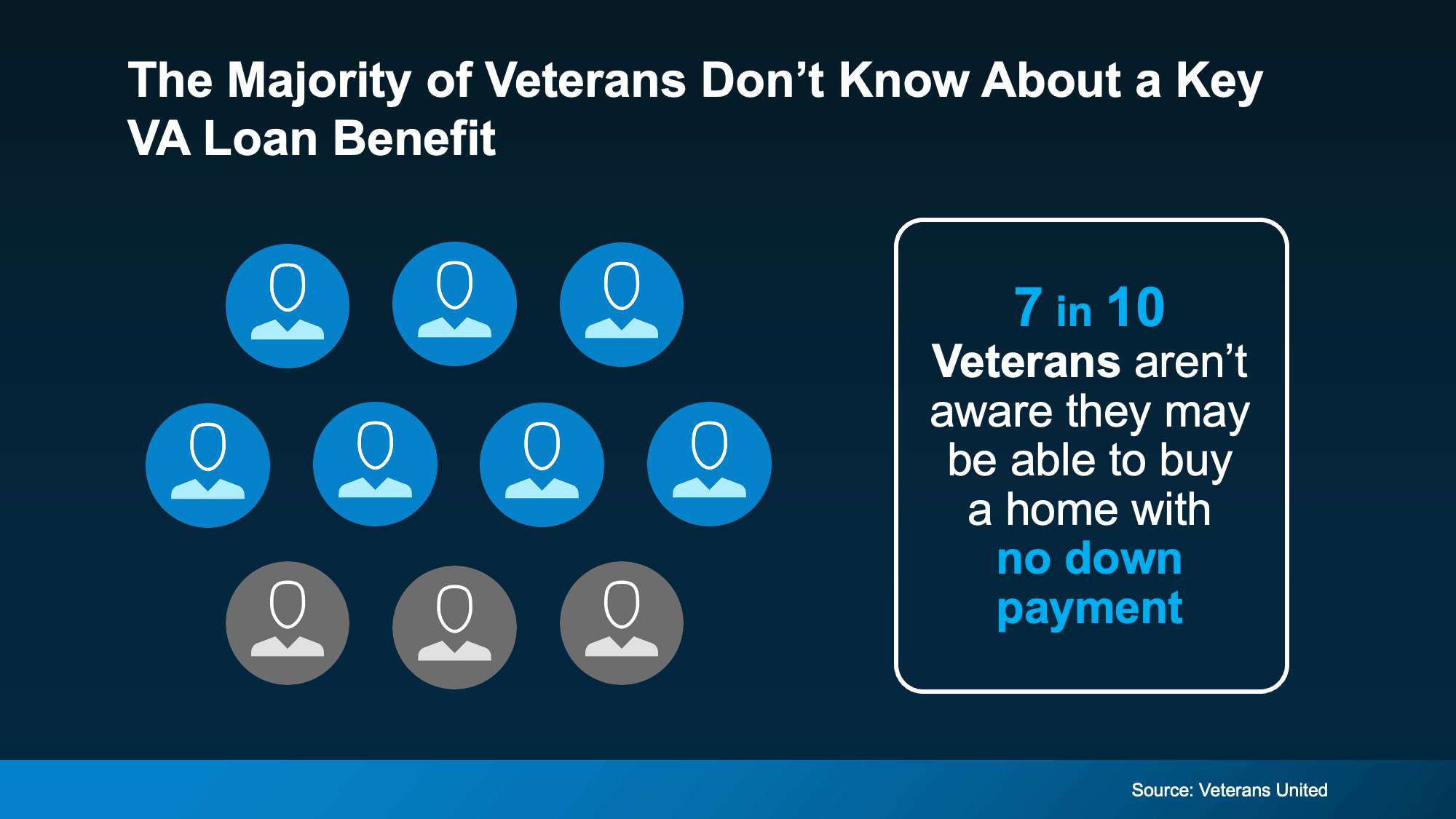

Unfortunately, 70% of Veterans don’t know about this benefit, according to Veterans United. That’s a massive missed opportunity for those who’ve earned this incredible benefit through service.

Let’s break down what you really need to know about the Veterans Affairs (VA) home loan right now, especially as you look to purchase a home in the competitive Pacific Northwest market.

Why VA Home Loans Are a Game-Changer in Portland & Vancouver

For nearly 80 years, VA loans have made homeownership possible for millions. In a region like ours, where saving a down payment can be challenging due to high prices, the VA loan is an invaluable tool for stability and wealth creation.

Here are the top perks for our local buyers:

-

Options for $0 Down Payment: For Veterans looking at homes in Vancouver, WA or Portland, OR, eliminating the 20% down payment requirement is life-changing, allowing you to enter the market years sooner.

-

No Private Mortgage Insurance (PMI): This significantly lowers your monthly housing payment compared to FHA or conventional loans where you put down less than 20%.

-

Limited Closing Costs: The VA limits which closing costs you have to pay, helping you keep more cash on hand for moving expenses or furnishing your new home.

Can You Still Get a VA Loan Despite National Headlines?

Lately, national confusion around a potential government shutdown has created uncertainty. It’s important to clarify: You can absolutely still use your VA home loan benefit.

While a shutdown may cause delays for certain federal services (like processing manual underwriting or appraisal reviews), the VA loan process continues to move forward.

“The good news is that the shutdown has minimal impacts on VA lending. Lenders are still able to order appraisals, obtain a borrower’s Certificate of Eligibility, submit the VA Funding Fee and more. In short, Veterans are still able to use their home loan benefit to buy a home or refinance an existing mortgage.” – Veterans United

For those ready to buy a house in Vancouver, WA or Portland, OR, do not let national news keep you on the sidelines. The process is ready when you are—it just requires the right local team.

Why Your Local Agent and Lender Matter Most

Using your VA home loan is significantly smoother when you have a local team—an agent and a lender—who are experienced in this specific benefit.

VA News emphasizes this point:

“Choosing a military-friendly broker or agent who understands the VA home loan application process can make all the difference... Finding the right agency or brokerage is just as important as locking in a good VA mortgage lender. Communication is key to getting to the loan closing table.”

A knowledgeable Portland or Vancouver-based agent can help you navigate the appraisal process, understand the VA's minimum property requirements, and advise on strategies to make your offer competitive with sellers who may favor conventional loans.

🔑 Bottom Line

If you’re a Veteran or active service member, the VA home loan is the most valuable financial benefit you’ve earned through your service. It offers a clear path to homeownership with no down payment in the highly-desired Portland-Vancouver metro area.

Want to learn more about how you can take full advantage of this incredible benefit right now? Let’s connect to discuss your local home-buying strategy.

#VAHomeLoan #VeteransUnited #MilitaryFamily #NoDownPayment #PortlandVA #VancouverWAVeteran #PDXRealEstate #FirstTimeHomebuyer #VeteranBenefits #BuyingTips

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts