Why You Don't Need to Be Afraid of Today's Mortgage Rates in Portland & Vancouver: Your Refinance-Ready Strategy

🗝️ The Magic Number (and Why Waiting for It is a Mistake)

Expert forecasters are increasingly projecting that mortgage rates will ease into the high 5% to low 6% range sometime in 2026. While a rate under 6% sounds like a great time to buy, here's what happens when that "magic number" hits the market:

-

The Floodgates Open: The psychological shift to lower rates will unleash a massive wave of pent-up buyer demand in the Portland and Vancouver housing market.

-

Competition Spikes: Fewer buyers have been actively searching in neighborhoods like SE Portland, North Vancouver, and Beaverton. Once rates drop, you can expect an immediate return to bidding wars, waived contingencies, and fewer opportunities for seller concessions.

-

Prices Soar: Increased activity and demand quickly lead to home price appreciation. You may secure a lower rate, but that saving is often instantly negated (or worse) by paying a higher price for the home.

The Math That Matters in the Portland-Vancouver Market

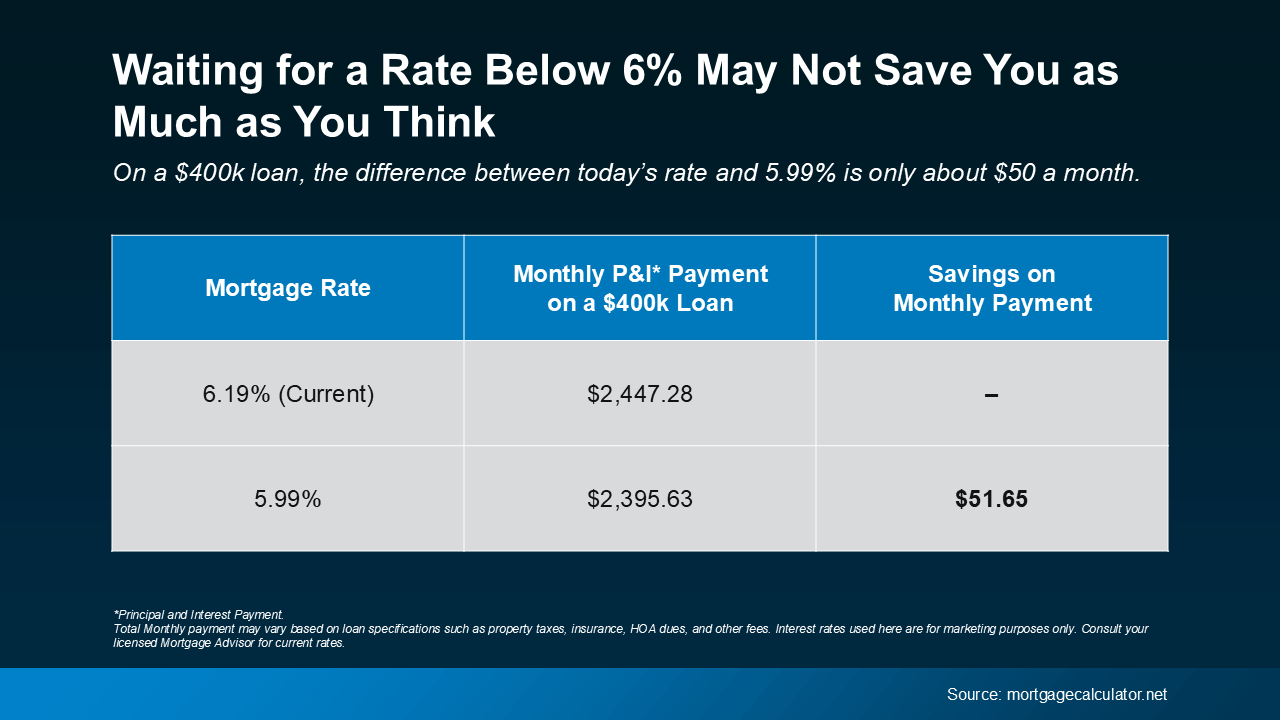

Let's look at the numbers. On a median-priced home in the Vancouver WA or Portland OR area (around a $\$400,000$ to $\$500,000$ mortgage):

-

The difference between today's average 30-year fixed rate (currently hovering around 6.2%) and the coveted $5.99\%$ is typically around $\$50-\$70$ a month.

-

In a hot market, that small monthly saving could easily be lost by a price increase of just $\$10,000$ or $\$15,000$ due to competition and a seller's market return.

The take-away: Waiting for the rate to drop might cost you more on the purchase price than you'll save on the monthly payment.

💰 Why Acting Now Makes Sense: "Marry the House, Date the Rate"

The savvy Portland and Vancouver buyer is taking advantage of today's less frantic market to secure a strategic advantage.

Jessica Lautz, Deputy Chief Economist at NAR, notes: "This has provided savvy buyers a sweet spot to reexamine the home search process with more inventory, widening their choices."

The current market environment offers opportunities you won't see when rates drop:

-

Less Competition: You have more homes to choose from in desired areas across Clark County and the Portland Metro, and less risk of an intense bidding war.

-

Negotiation Power: Sellers are more open to negotiating on price, repairs, and closing costs, which can save you thousands up front.

-

Lock in the Price: You get to "marry the house" at a price negotiated in a more favorable market.

-

Refinance Opportunity: When rates do dip into the 5s (as many expect in 2026), you can "date the rate" by refinancing into a lower monthly payment, having already secured the home at a better initial price.

As Matt Vernon, Head of Retail Lending at Bank of America, says, if the house is right, and the upfront and monthly payments are affordable, it could be the right chance to make a move.

💡 Bottom Line for Portland & Vancouver Homebuyers

If moving at today’s rate scares you, remember: waiting for a lower rate doesn't always pay off in the Pacific Northwest.

Once rates dip below 6%, more buyers will rush back in, leading to the return of higher prices and less buyer leverage. If you've been searching for homes for sale in Vancouver WA or first-time buyer homes in Portland OR, this moment—with less competition—might be your best chance to secure the right property.

Don't be afraid of today’s mortgage rates. If you're ready, this is your opportunity to secure a home before the Portland and Vancouver real estate market wakes up again.

#PortlandRealEstate #VancouverWAHomes #MortgageRates #PNWRealEstate #HomeBuyers #FirstTimeBuyers #MoveUpBuyer #ClarkCountyWA #BuyingTips #PortlandHomeSearch #RealEstateStrategy #RefiReady #OregonRealEstate #WashingtonHomes #PDXRealEstate

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts