Why Buying a Home is Better Than Renting: Unlocking Long-Term Benefits

Categories

- All Blogs (484)

- For Sale By Owner (15)

- Local Events (6)

- Affordability (33)

- Agent Value (89)

- Buying Tips (200)

- Clark County Housing (4)

- Closing Costs (1)

- Community Support (1)

- Debt-Free Living, (1)

- Design (8)

- Downsize (7)

- Economy (24)

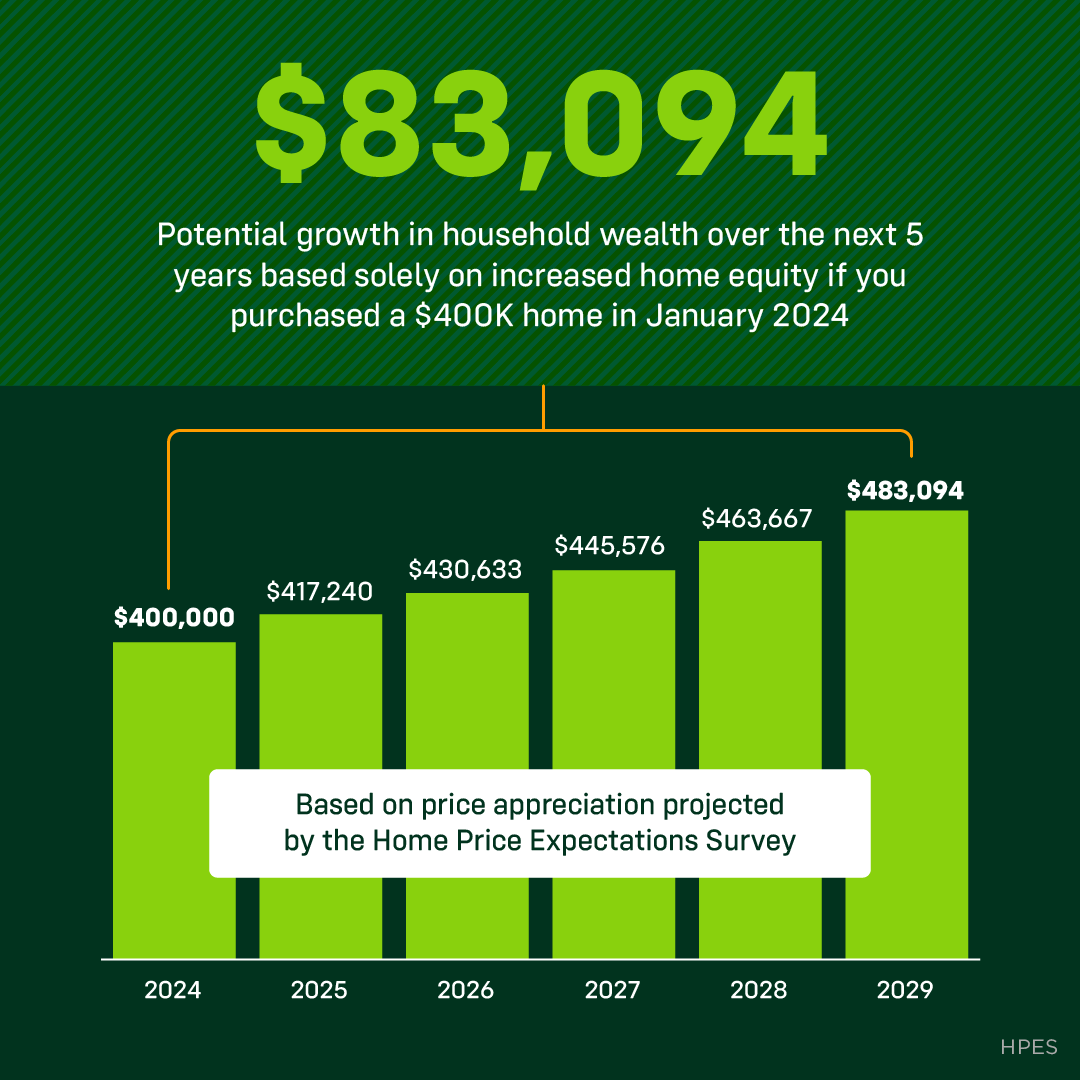

- Equity (24)

- Financial Planning (33)

- First-Time Home Buyer (144)

- For Sale by Owner (3)

- Forecasts (15)

- Foreclosures (4)

- Foster Care Resrources (1)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (249)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (181)

- Home Value (2)

- Inventory (36)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (37)

- Mortgage (54)

- Move-Up (4)

- New Construction (8)

- Newsletter (9)

- Open House (1)

- Portland OR (6)

- Portland OR Affordability (3)

- Portland OR Home Buying (3)

- Portland OR Homes (8)

- Portland OR Real Estate (20)

- Portland OR Seller Tips (2)

- Portland-Vancouver Home Value (3)

- Portland-Vancouver Inventory (3)

- Real Estate Investing (7)

- Rent vs Buy (8)

- Restaurant Reviews (5)

- Seasonal (11)

- selling tips (129)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (6)

- Vancouver WA Affordability (3)

- Vancouver WA Home Buying (5)

- Vancouver WA Real Estate (26)

- Vancouver WA Selling Tips (5)

- Wealth Building (12)

Recent Posts

The VA Home Loan Advantage: What Every Portland & Vancouver Veteran Should Know Right Now

What a Government Shutdown Means for the Portland & Vancouver Housing Market

Why Your Home Equity Still Puts You Way Ahead in the Portland & Vancouver Housing Market

Is Your Portland/Vancouver Home Sitting? Why Your Price May Be the Problem (Seller Pricing Strategy)

Staged Homes Sell 73% Faster in Portland & Vancouver! (Seller Tip)

Portland & Vancouver Sellers: The #1 Way to Stop Your Deal From Falling Apart at Inspection

Thought the Market Passed You By? The Portland & Vancouver Housing Market Just Gave You a Second Chance

Why You Don't Need to Be Afraid of Today's Mortgage Rates in Portland & Vancouver: Your Refinance-Ready Strategy

The Seller’s Secret: Why Some Vancouver/Portland Homes Sell in Days While Others Turn Stale (The Inventory Trap)

The Real Culprit Behind High Vancouver/Portland Home Prices (It’s NOT the Corporations!)