What Do Mortgage Delinquencies Tell Us About the Future of Foreclosures?

What Do Mortgage Delinquencies Tell Us About the Future of Foreclosures?

You've probably seen the headlines about rising foreclosures and wondered if we're headed for another housing crisis. It's a valid concern, especially if you remember the crash of 2008. But here's the good news: the data tells a much more optimistic story.

During the housing crash, over nine million people went through a distressed sale from 2007 to 2011. Last year, that number was just over 300,000. So, while foreclosures have increased, we're nowhere near the levels of the past.

But what about the future? Is a wave of foreclosures on the horizon? The short answer is no, and here's why.

The Real Story Behind the Numbers

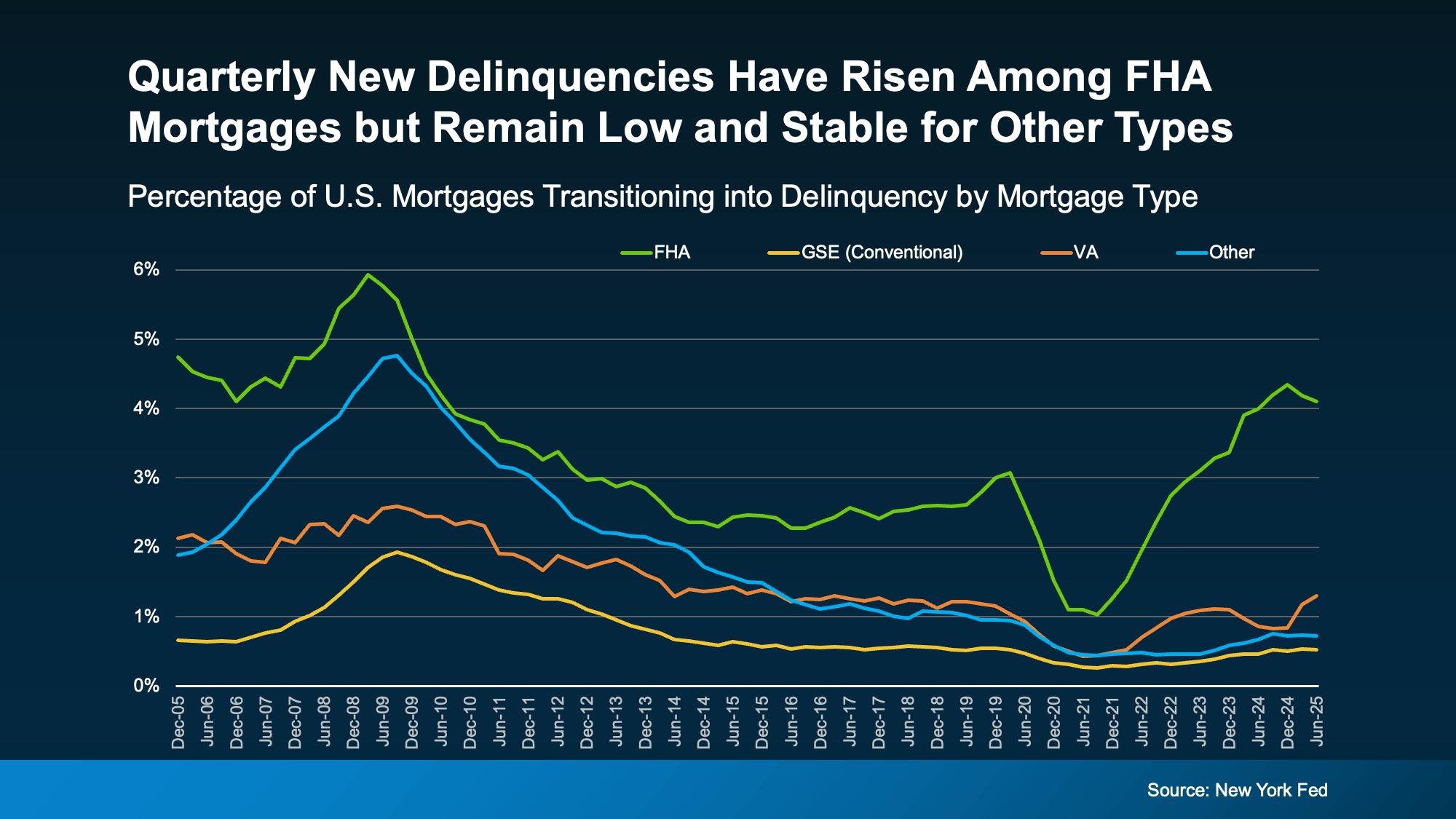

Industry experts look at mortgage delinquencies—loans that are more than 30 days past due—as an early warning sign for potential foreclosures. While overall delinquencies are consistent with last year, the composition has changed.

Borrowers with FHA mortgages currently make up the biggest share of new delinquencies. Why? These borrowers may be more sensitive to economic shifts. With inflation, recession fears, and other financial challenges, it makes sense that this segment of the market is feeling the pressure more.

But this doesn’t mean a crash is coming. Here’s why:

-

It’s Not a Widespread Issue: While FHA loans are seeing an increase in hardship, delinquency rates for other loan types, like conventional mortgages, remain low and stable. During the crash of 2008, all loan types were significantly elevated. This shows that the broader mortgage market is on much stronger footing today.

-

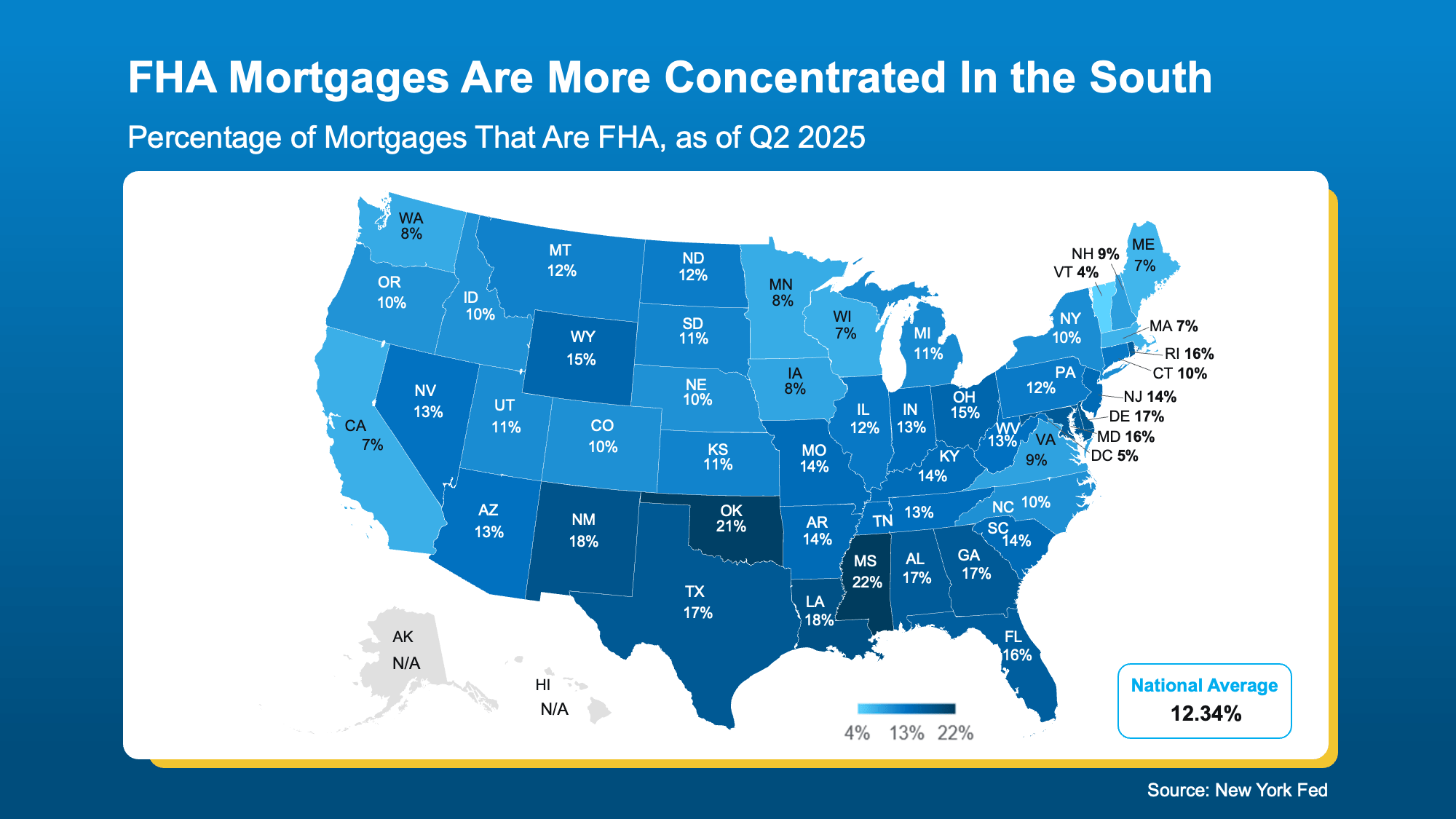

A Small Percentage: FHA loans only make up about 12% of all home loans nationwide. While there are some regions, particularly in the South, that have a higher concentration of these loans, it's not a signal of a national crisis.

If You're Facing Financial Hardship

If You're Facing Financial Hardship

No one wants to face the stress of foreclosure. If you're a homeowner struggling with payments, please know you have options.

First, contact your mortgage provider. You may be able to set up a repayment plan or explore loan modifications to help you get back on track. A powerful option many homeowners have today is the near-record amount of equity they have in their homes. Selling your house may be the best way to avoid foreclosure and protect your financial future.

We’re here to help you navigate this complex market. Let's connect so you always have the most up-to-date and accurate information. Whether you're worried about your home or simply want to stay informed, we can guide you through the process.

Ready to find out your options? Contact us today!

Ken or Susan Rosengren 360.609.0226 KenRosengren@LucidoGlobal.com

#pnwPropertpros #lucidoglobal #Vancouverwa #PortlandOR #RealEstateMarket #Foreclosure #MortgageDelinquency #HousingCrisis #RealEstateAdvice #HomeSellingTips

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts