Understanding the Fed: What a Rate Cut Means for You in Vancouver & Portland

Understanding the Fed: What a Rate Cut Means for You in Vancouver & Portland

This week, the Federal Reserve (the Fed) is meeting, and the financial world is buzzing with anticipation. Expectations are high that they will cut the Federal Funds Rate. But if you're a potential homebuyer or seller in the Vancouver, WA, and Portland, OR metro areas, you're probably asking the most important question: what does this mean for mortgage rate?

Let's clear up the confusion and get to the heart of what this could mean for our local real estate market.

The Fed's Indirect Influence on Mortgage Rates

It's a common misconception that the Fed directly sets mortgage rates. In reality, the Federal Funds Rate is a short-term rate that banks charge each other for overnight loans. While it doesn't directly control what you pay for a mortgage, the Fed's actions send a powerful signal to the broader financial markets.

It's a common misconception that the Fed directly sets mortgage rates. In reality, the Federal Funds Rate is a short-term rate that banks charge each other for overnight loans. While it doesn't directly control what you pay for a mortgage, the Fed's actions send a powerful signal to the broader financial markets.

Here's the key takeaway: mortgage rates often react to what the markets think the Fed will do, even before the official announcement. We saw this in action recently after weaker-than-expected jobs reports. As financial markets grew more confident that a rate cut was coming, mortgage rates already started to tick down.

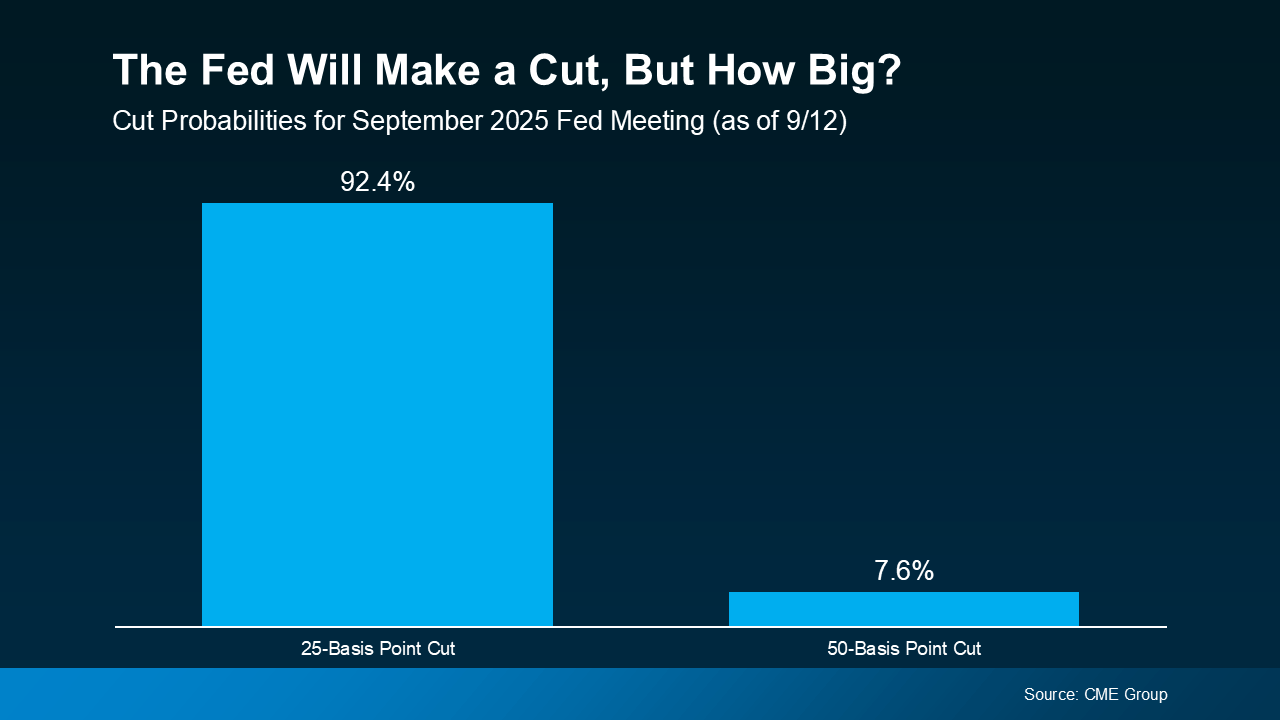

So, while a small, anticipated cut (like the 25-basis-point cut that is largely expected) might not cause a dramatic drop in mortgage rates, a larger, surprise cut could have a more significant impact.

What's Next for Mortgage Rates in Our Area?

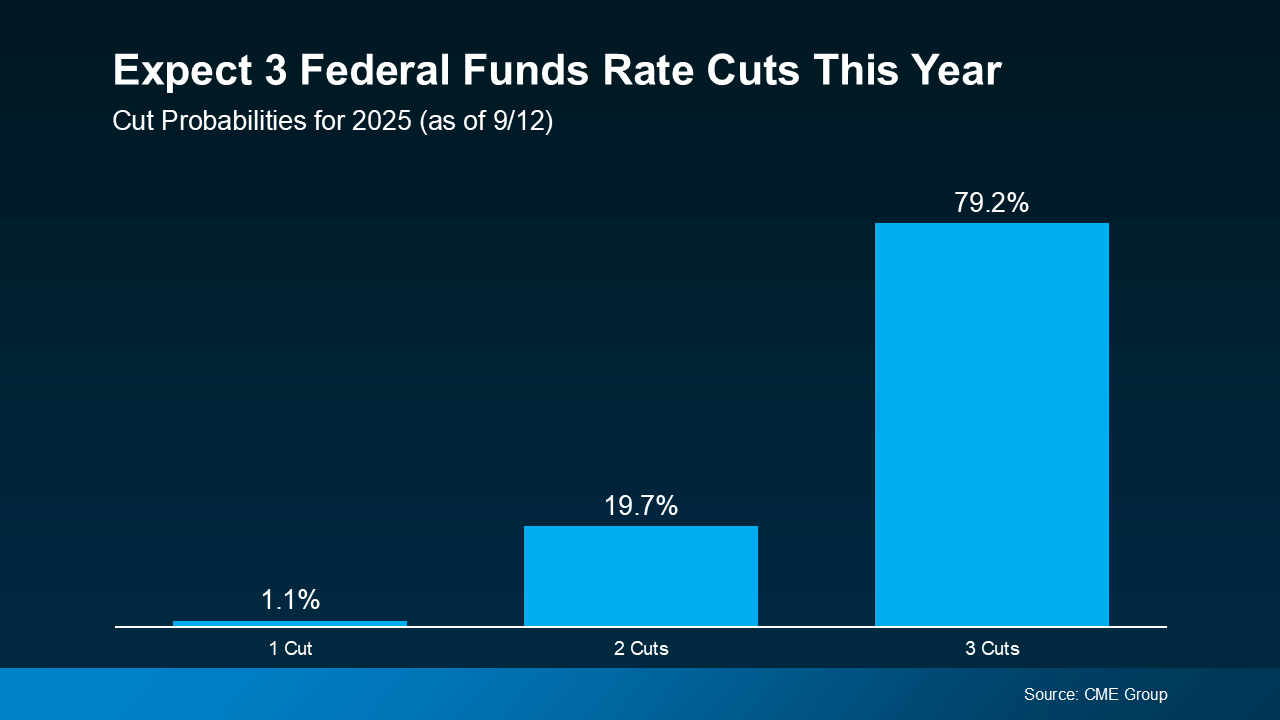

While a single rate cut might not be a game-changer, the good news is that many experts believe the Fed could make more cuts before the end of the year if the economy continues to cool.

As Sam Williamson, Senior Economist at First American, explains, investor confidence in a rate-cutting cycle "could help push borrowing costs lower in the back half of 2025, offering some relief to housing affordability." This is particularly relevant for buyers in our region, where affordability has been a significant challenge.

The bottom line is that while we're unlikely to see rates drop sharply overnight, a potential trend of lower rates in the coming months could make a meaningful difference for your budget. This could be the window of opportunity you've been waiting for to get into the market or make a move.

Your Next Step: Talk Strategy

In a market that's constantly changing, understanding what's ahead is crucial. Small changes in rates can have a big impact on your monthly payment and overall affordability.

If you've been watching the market, waiting for the right moment, now is the time to talk strategy. Let's connect to discuss how a potential trend of lower rates could affect your home-buying or selling goals. We're here to help you make the best decision for your unique situation.

Call Susan & Ken Rosengren at 360.609.0226 to start planning your next move today!

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts