Mortgage Rates Are Making a Move: What It Means for You in the Vancouver & Portland Metro Area

If you've been waiting for a sign to get back into the housing market, this could be it! After what felt like an eternity of stability, mortgage rates just saw their biggest one-day drop in over a year. This is a game-changer for buyers and sellers in the Vancouver, WA and Portland, OR metro areas.

What Sparked the Drop?

According to Mortgage News Daily, this significant drop was a direct reaction to recent economic reports. The August jobs report came in weaker than expected for the second consecutive month, sending a signal that the economy might be slowing. Historically, a slowing economy often leads to a decrease in mortgage rates, and that's exactly what we saw last week. For those of us in the Pacific Northwest, where the market has been particularly competitive, this news is especially welcome.

Why This Matters for Buyers in Our Community

Why This Matters for Buyers in Our Community

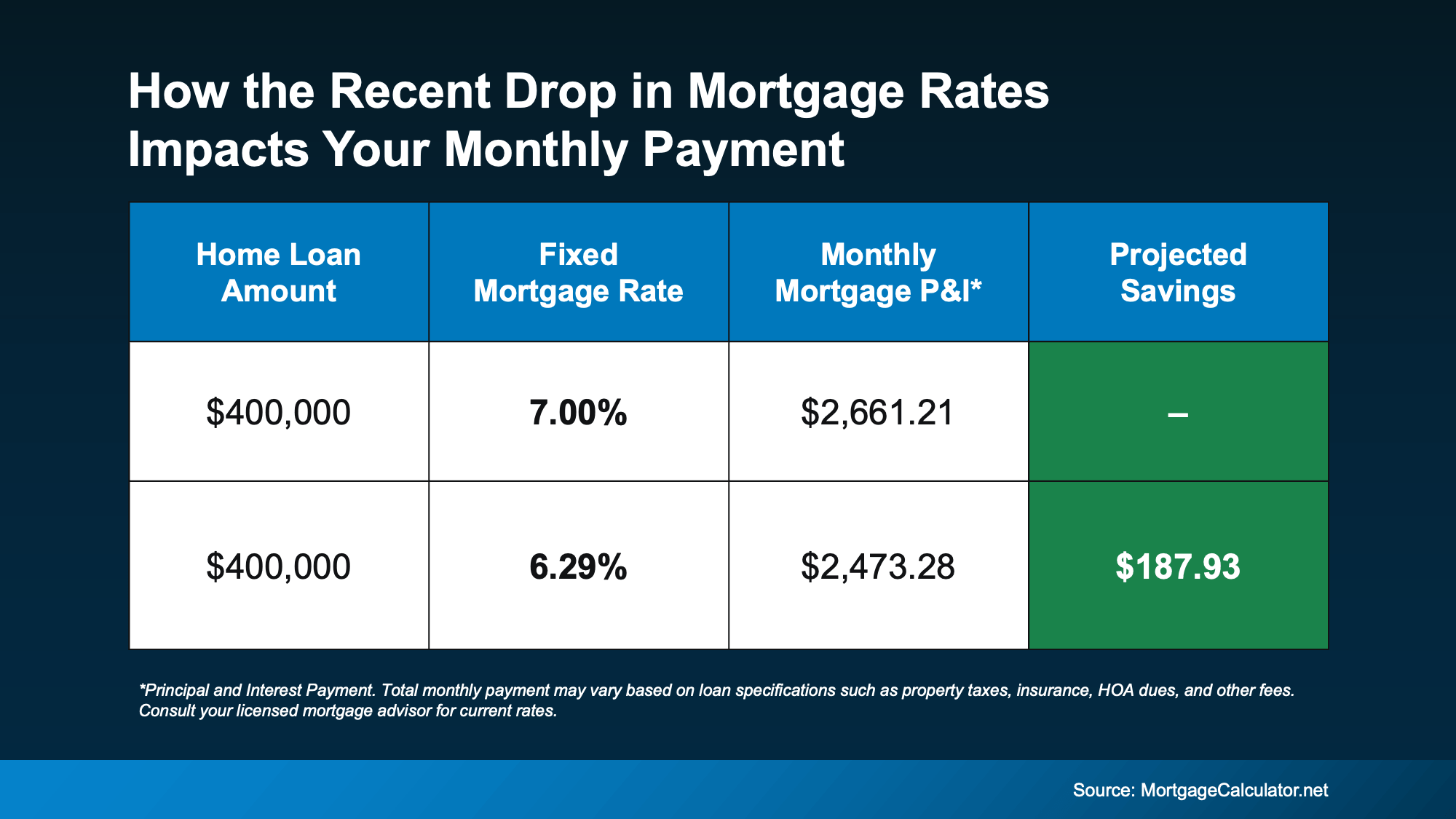

This isn't just a headline—it's an opportunity. A change in mortgage rates can have a huge impact on your budget and purchasing power. To put it in perspective, let's look at the numbers.

Imagine a home you were looking at in May when rates were around 7%. Your monthly principal and interest payment would have been significantly higher than it is today. With rates dropping into the low to mid-6% range, your monthly payment could be hundreds of dollars less, saving you thousands of dollars over the course of a year. That's a huge difference, making homes that felt out of reach just a few months ago now a real possibility.

What's Next for Rates in Vancouver and Portland?

No one has a crystal ball, and we can't say for sure how long this trend will last. Rates could continue to fall, or they could inch back up. This is why it's more important than ever to have a local real estate expert and a trusted lender on your side. We keep a close eye on local economic indicators, job market updates, and other factors that influence rates here in the Pacific Northwest.

As Diana Olick, Senior Real Estate and Climate Correspondent at CNBC, says, "Rates are finally breaking out of the high 6% range, where they’ve been stuck for months." This shift provides a great reason to feel optimistic about your home-buying journey.

The Bottom Line

This is the shift that many of our local buyers have been waiting for. A decrease in mortgage rates can significantly improve your purchasing power and make your dream home more affordable.

Want to see how today's rates could impact your future monthly payment? Let's connect! We're here to help you navigate the Vancouver and Portland real estate market and find the perfect home.

Call Susan & Ken Rosengren at 360.609.0226 to get started today!

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts