How Buying or Selling a Home Helps Your Local Economy

How Buying or Selling a Home Helps Your Local Economy

Whether you’re buying or selling a house, here’s something to think about that most people don’t. Your decision doesn’t just impact your life and your family’s, it sparks a ripple effect that has a positive impact on your entire community.

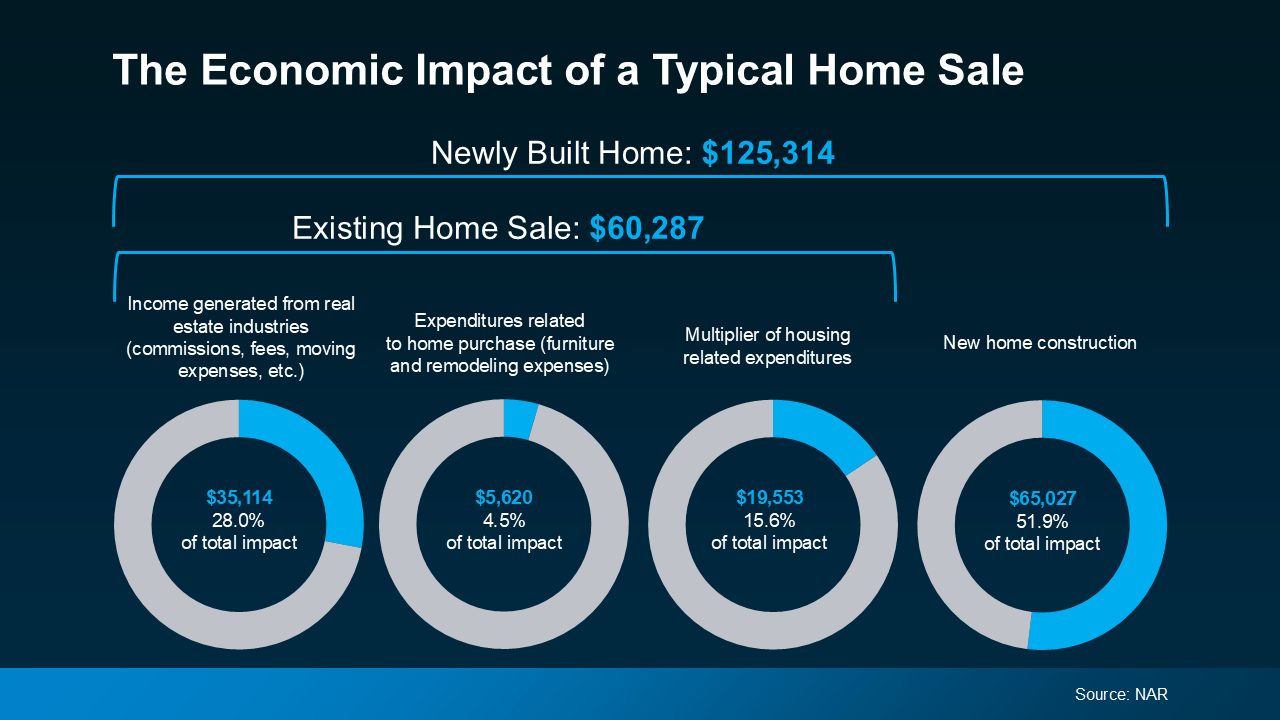

Every year, the National Association of Realtors (NAR) puts out a report that breaks down the financial impact that comes from people buying and selling homes.

The data shows that if you buy an existing (previously lived-in) home, you're giving the local economy a boost of just over $60K. And if you buy a newly built home, that number goes up to over $125K (see visual below):

That’s because of all the people needed to build, fix up, and sell homes. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), explains how the housing industry adds jobs to a community:

That’s because of all the people needed to build, fix up, and sell homes. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), explains how the housing industry adds jobs to a community:

“. . . housing is a significant job creator. In fact, for every single-family home built, enough economic activity is generated to sustain three full-time jobs for a year . . .”

When you think about it, it makes sense. Behind every home sale is a network of people involved, including contractors, city officials, real estate agents, lawyers, specialists, and more. Everyone has a job to do to help make sure your deal goes through.

Put simply, when you buy or sell a home, you’re helping out your neighbors. So, your decision to move doesn’t just meet your needs; it supports their families, strengthens your town, and shapes the future of your community.

Imagine walking through the front door of your next home, knowing your decision helped a local contractor keep their crew working or a small business thrive. Remember that feeling as you make your decision this year.

Bottom Line

Moving isn’t just a personal milestone – it's an investment in your community, too. If you’re ready to make a move, let’s connect. You’ll make a difference for more people than you know.

What’s most important to you as you prepare to buy or sell your house this year?

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts