Homeownership: The Heart of the American Dream

Homeownership: The Heart of the American Dream

Everyone’s vision for the future is personal and unique. But for many, common goals include success, freedom, and prosperity — values closely tied to having your own home and the iconic feeling of achieving the American Dream.

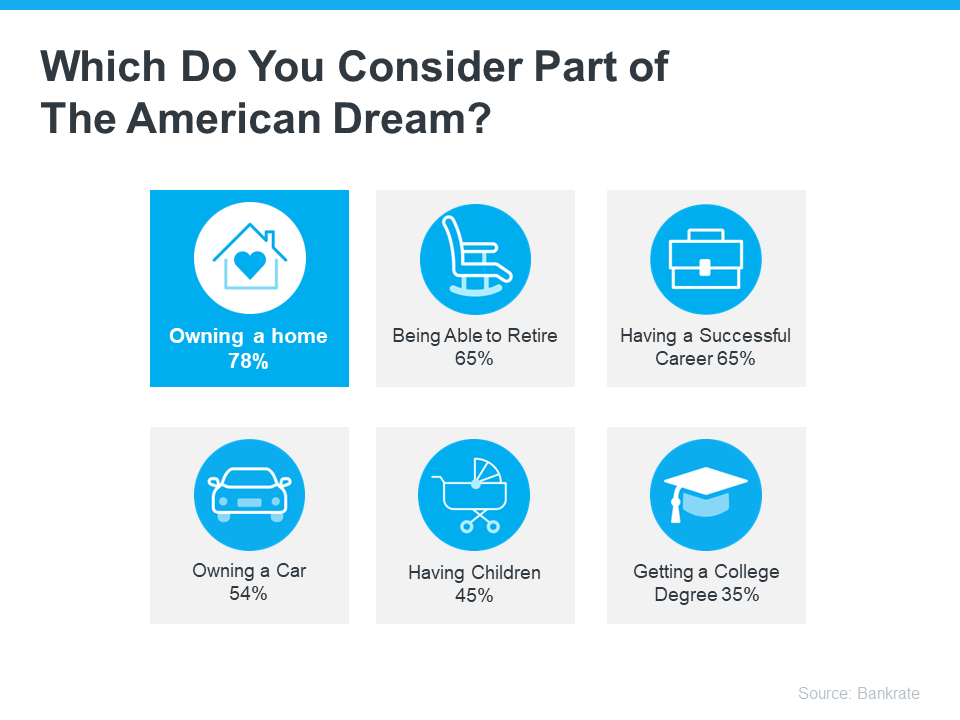

A recent survey by Bankrate reveals exactly that: homeownership is still a part of the American Dream. The results show, at 78%, that owning a home tops the list, surpassing other significant milestones such as retirement, having a successful career, and more (see below):

So, why is buying a home important to so many today? One reason is the financial and physical security it provides. Many people see homeownership as a way to reduce stress because owning a home with a fixed-rate mortgage stabilizes what is likely their largest monthly expense.

Another factor is the potential for building wealth. That’s because, over time, homeowners gain equity as they pay down their mortgage and as home prices appreciate, leading to longer-term financial stability.

But what about the responsibilities that come with owning and maintaining a home? According to a survey by Entrata, only 23% of renters feel homeownership is too much work, indicating the majority are open to the commitments and obligations that come with being a homeowner.

What Does This Mean for You?

While buying a home today might seem daunting due to higher mortgage rates and rising home prices, the long-term benefits can make it worthwhile. If you’re considering homeownership, remember that it's more than just a financial investment — it's a step toward securing your future.

Bottom Line

Owning a home is a significant and powerful decision that represents a big part of the American Dream. If you’re ready to take this step, let’s connect so you have someone who can guide you through the process and help you make your homeownership goals a reality.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Categories

- All Blogs (499)

- For Sale By Owner (15)

- Local Events (7)

- 1031 Exchange PNW (1)

- Affordability (34)

- Agent Value (90)

- Buying Tips (202)

- Clark County Housing (4)

- Closing Costs (1)

- Community Support (2)

- Debt-Free Living, (1)

- Design (8)

- Downsize (8)

- Downsizing Vancouver WA (1)

- Economy (25)

- Equity (25)

- Expired Listings (1)

- Featured (1)

- Financial Planning (33)

- First-Time Home Buyer (149)

- For Investors (1)

- For Sale by Owner (4)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (1)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (255)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (186)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (1)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (39)

- Mortgage (57)

- Move-Up (4)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (9)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (4)

- Portland OR Home Buying (4)

- Portland OR Homes (9)

- Portland OR Real Estate (23)

- Portland OR Seller Tips (2)

- Portland Real Estate FAQs (1)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (5)

- Portland-Vancouver Inventory (4)

- Price It Right Portland (2)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (9)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (131)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (5)

- Vancouver WA Home Buying (8)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (32)

- Vancouver WA Selling Tips (5)

- Wealth Building (13)

Recent Posts