The 3 Housing Market Questions You’ll Hear at Every PNW Holiday Party (and the Expert Answers)

Whether you're at a company party in downtown Portland, a family gathering in Beaverton, or catching up with friends in Vancouver, the Portland-Vancouver housing market is always a top conversation starter.

As your top 20% local expert, I’m here to give you the clear, data-driven answers to the three questions on everyone’s mind this season, so you can feel confident about your next move.

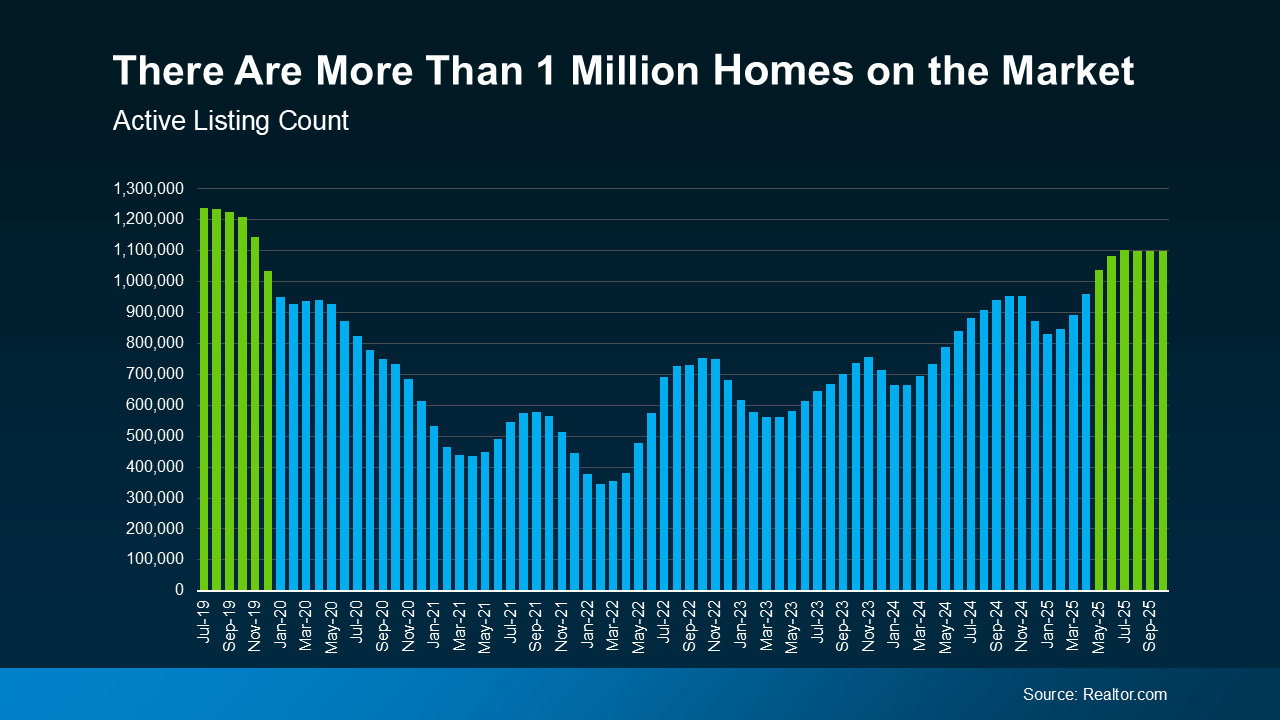

1. “Will I even be able to find a home in the Portland Metro if I want to move?”

The Expert Answer: Yes, and you have more options now than you've had in years.

For years, the shelves felt bare. Now, the number of homes for sale across the Portland and Vancouver metro area has been steadily rising and remains healthier than the ultra-tight markets of 2021–2023.

-

More Breathing Room for Buyers: You are no longer competing for the same handful of listings the minute they hit the market. This gives you more time to breathe, compare properties, and make a confident, unhurried decision.

-

Sellers Have Options, Too: This increased inventory means sellers finally have more places to move to next, which helps loosen the "lock-in" effect that was stifling the market.

If you hit pause on your home search last year, it is definitely time to look again—especially in growing areas like Clark County, where new construction is providing much-needed supply.

2. “Will I ever be able to afford a house in this market?”

2. “Will I ever be able to afford a house in this market?”

The Expert Answer: Affordability is finally improving, and the opportunity is opening up.

It has been a tough few years for affordability, but the combination of moderating prices and easing rates is making a real difference in your budget right now:

-

Easing Mortgage Rates: Mortgage rates have eased from their 2024 peak (when they were near 7.0% or higher). This drop translates to hundreds of dollars in savings on the monthly payment for the median-priced home in the Portland-Vancouver area compared to just a few months ago.

-

Price Moderation: While the average sale price in the metro area is generally flat or slightly down year-over-year (around 1-2% softening), this is enough to give well-prepared buyers leverage and a chance to negotiate.

Buying still requires a strategy, but the financial metrics are trending in the right direction, making homeownership a more realistic goal for many who were previously priced out.

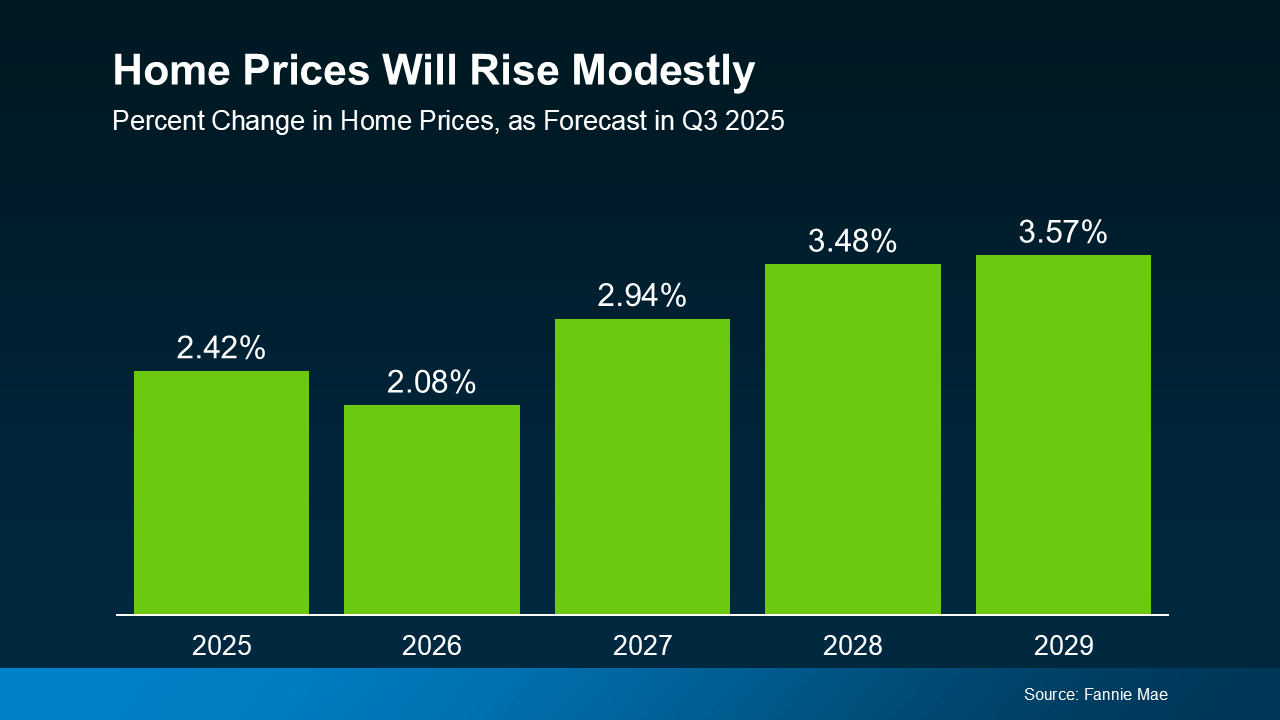

3. “Should I wait for prices to crash before I buy?”

The Expert Answer: No, the data points toward stability and moderate growth, not a crash.

It is understandable to worry about a crash, but the current data strongly indicates we are in a period of stabilization, not collapse.

-

No Oversupply: While inventory is up, it is still well below the 6 months of supply necessary for a price crash on a national or local scale.

-

Financial Stability: Unlike 2008, homeowners today have significant equity and are in a much stronger financial position. Sellers are choosing to take their homes off the market rather than liquidate at a massive loss.

-

2026 Price Forecast: Experts surveyed by major institutions project that home prices will continue to rise, just at a more sustainable, moderate pace (forecasts suggest 1-3% growth for the PNW in 2026). Waiting for a major price drop means you are gambling against the long-term trend of wealth building through homeownership.

The Strategic Takeaway: History shows that people who spend time in the market tend to build the most long-term wealth, not the people who try to time the market perfectly.

🏁 Bottom Line

Don't let loud headlines and confusing conversations derail your housing goals. The Portland-Vancouver market is shifting from volatility to stability, creating a calmer, more predictable environment for both buyers and sellers.

If you want to understand what these trends mean for your personal goals in Portland, OR, or Vancouver, WA, let’s connect and walk through the data together.

#BuyerConfidence #SellerStrategy #AskTheExpert #HomePriceForecast #PortlandRealEstate #VancouverWAHomes #PNWRealtor #ExpertAnswers #Top20Percent #HousingMarket #RealEstateData #MarketUpdate #Affordability #Inventory

Categories

- All Blogs (499)

- For Sale By Owner (15)

- Local Events (7)

- 1031 Exchange PNW (1)

- Affordability (34)

- Agent Value (90)

- Buying Tips (202)

- Clark County Housing (4)

- Closing Costs (1)

- Community Support (2)

- Debt-Free Living, (1)

- Design (8)

- Downsize (8)

- Downsizing Vancouver WA (1)

- Economy (25)

- Equity (25)

- Expired Listings (1)

- Featured (1)

- Financial Planning (33)

- First-Time Home Buyer (149)

- For Investors (1)

- For Sale by Owner (4)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (1)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (255)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (186)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (1)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (39)

- Mortgage (57)

- Move-Up (4)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (9)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (4)

- Portland OR Home Buying (4)

- Portland OR Homes (9)

- Portland OR Real Estate (23)

- Portland OR Seller Tips (2)

- Portland Real Estate FAQs (1)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (5)

- Portland-Vancouver Inventory (4)

- Price It Right Portland (2)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (9)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (131)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (5)

- Vancouver WA Home Buying (8)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (32)

- Vancouver WA Selling Tips (5)

- Wealth Building (13)

Recent Posts