The Lock-In Effect Is Breaking: Why PNW Homeowners Are Giving Up Their Low Mortgage Rate

If you own a home in the Portland-Vancouver Metro with a mortgage rate starting with a '3' or a '4', you've likely thought this: "I want to move, but I refuse to give up my fantastic rate."

That feeling is understandable. Your low rate is one of your greatest financial victories. However, as a top 20% real estate expert, I am seeing a definitive shift: a great rate will not make up for a home that no longer works for your life.

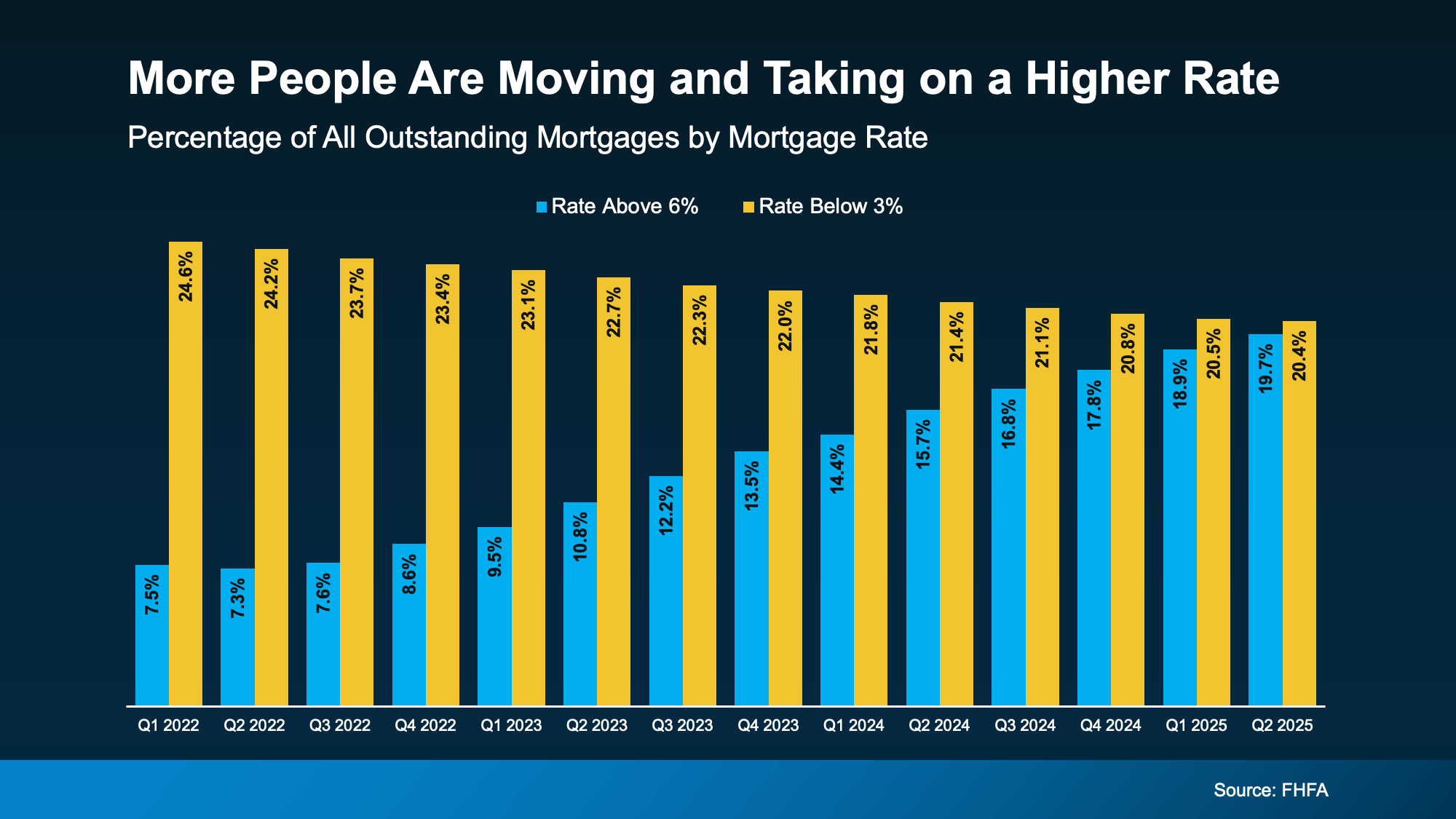

The expert-coined "lock-in effect" (the reluctance to move and take on a higher rate) is finally starting to ease. Data from the Federal Housing Finance Agency (FHFA) shows the share of homeowners with the lowest rates is slowly declining—meaning more people are choosing to move and prioritize their lives.

💔 Why The Rate Loss Is Worth It Now

More homeowners are deciding to move because their life priorities are starting to decisively outweigh the financial benefit of clinging to a low mortgage rate. As Chen Zhao, Head of Economic Research at Redfin, puts it: "Life doesn't stand still... those needs are starting to outweigh the financial benefit."

In the PNW, these shifts are driving inventory back onto the market:

The "5 Ds" Driving Moves in Oregon & Washington

-

Diapers (Upsizing): You’ve outgrown your starter home in inner Portland and urgently need space for a new baby, a playroom, or a dedicated remote workspace. The stress of inadequate space is often too high to ignore.

-

Downsizing: The kids have moved out, and you are tired of the constant maintenance, utilities, and taxes on a large home. You are ready to simplify and capture the massive home equity you've built. This equity provides the cash you need to retire comfortably.

-

Divorce/Death: Major life events often require a new place to call home, either for new beginnings or to be closer to critical family support systems.

-

Diplomas (Job/Career): A new high-paying job in the tech corridor (Hillsboro) or a career opportunity that necessitates a move across the river for the Washington no income tax advantage. The long-term income gain easily outweighs the temporary cost of a higher rate.

-

Dullness (Lifestyle Change): You're ready for a change in scenery—perhaps moving from the dense city to a suburban enclave like Ridgefield or closer to nature near the Columbia Gorge.

⚖️ The Real Question: Lifestyle Equity vs. Financial Equity

⚖️ The Real Question: Lifestyle Equity vs. Financial Equity

Yes, you will likely take on a higher rate initially. But here is the winning financial strategy many of my sellers are adopting:

-

Capture Maximum Equity: Your current home has massive equity. Sell it now to capture that wealth.

-

Move to the Home That Fits: Get into the house that meets your lifestyle needs (the bigger yard, the dedicated office, the smaller space).

-

Refinance When Rates Drop: Since rates have already come down from their peak and are forecast to ease slightly more in 2026, you can simply refinance into a lower rate later.

The Question to Ask Yourself: How much longer are you willing to stay somewhere that no longer fits your life, just to hold onto a rate that you will likely be able to change in a few years anyway?

🏁 Bottom Line

Life doesn’t wait for the perfect rate. By moving now, you capture your hard-earned equity and solve your lifestyle problem. You can always refinance the rate later, but you can't get back the time spent living in a home that doesn't fit.

If you are ready to see what is possible in the Portland or Vancouver market and want a strategy to mitigate the rate change, let’s talk.

#PortlandRealEstate #VancouverWAHomes #PNWRealtor #AskTheExpert #Top20Percent #MortgageRates #RefinanceStrategy #RealEstateFinance #EquityGrowth #LockInEffect #WhySellersMove #LifestyleEquity #LifeDoesntWait #DownsizingGoals

Categories

- All Blogs (499)

- For Sale By Owner (15)

- Local Events (7)

- 1031 Exchange PNW (1)

- Affordability (34)

- Agent Value (90)

- Buying Tips (202)

- Clark County Housing (4)

- Closing Costs (1)

- Community Support (2)

- Debt-Free Living, (1)

- Design (8)

- Downsize (8)

- Downsizing Vancouver WA (1)

- Economy (25)

- Equity (25)

- Expired Listings (1)

- Featured (1)

- Financial Planning (33)

- First-Time Home Buyer (149)

- For Investors (1)

- For Sale by Owner (4)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (1)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (255)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (186)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (1)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (39)

- Mortgage (57)

- Move-Up (4)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (9)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (4)

- Portland OR Home Buying (4)

- Portland OR Homes (9)

- Portland OR Real Estate (23)

- Portland OR Seller Tips (2)

- Portland Real Estate FAQs (1)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (5)

- Portland-Vancouver Inventory (4)

- Price It Right Portland (2)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (9)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (131)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (5)

- Vancouver WA Home Buying (8)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (32)

- Vancouver WA Selling Tips (5)

- Wealth Building (13)

Recent Posts