Don't Rent YOUR Future- Own it

🏡 Renting vs. Buying: What’s the Real Cost Over 2 Years?

If you're on the fence about buying a home versus continuing to rent, you're not alone. With rising home prices and changing interest rates, many people wonder: Is it really worth buying right now? Let's break it down.

We’re going to compare what happens financially when you rent a $500,000 home for 2 years versus buying that same home. The numbers may surprise you.

🔴 Renting for 2 Years

Let’s say you’re paying $3,000/month in rent (which is standard in many parts of the Pacific Northwest right now). Over two years, that adds up to:

-

💸 $3,000 × 24 months = $72,000

-

📉 $0 equity — that’s money you’ll never see again.

-

🚫 No tax benefits — your landlord might be cashing in, but you aren’t.

-

📈 Rent increases likely after the first year.

That’s $72,000 paid… with nothing to show for it.

🟢 Buying a $500,000 Home for 2 Years

Let’s run the numbers for buying the same $500,000 home, with a 3% down payment ($15,000) — and remember, down payment assistance could make that number $0.

-

Loan amount: $485,000

-

Interest rate: 6.5%

-

Monthly P&I (principal + interest): ~$3,065

-

All-in monthly costs (incl. taxes, insurance, PMI): ~$3,500

-

Total payments over 2 years: ~$84,000

Yes — it’s slightly more than renting up front. But here’s what you gain:

-

💰 Principal Paid Down in 2 Years: ~$16,500

-

📈 Home Appreciation (4%/yr): ~$40,800

-

✅ Tax Benefits (Mortgage Interest Deduction): ~$4,500–$6,000

That’s a net gain of $60,000+ in equity, appreciation, and tax savings.

💡 Why This Matters

When you rent, you’re paying someone else’s mortgage — and helping them build wealth. When you own, your money works for you.

Even with a higher monthly cost, the return on ownership makes it clear: in just two years, you could gain over $60,000 in value.

And here’s the bonus: as a homeowner, your payments are fixed, your home could increase in value even more than 4% annually, and you’re building something that’s truly yours.

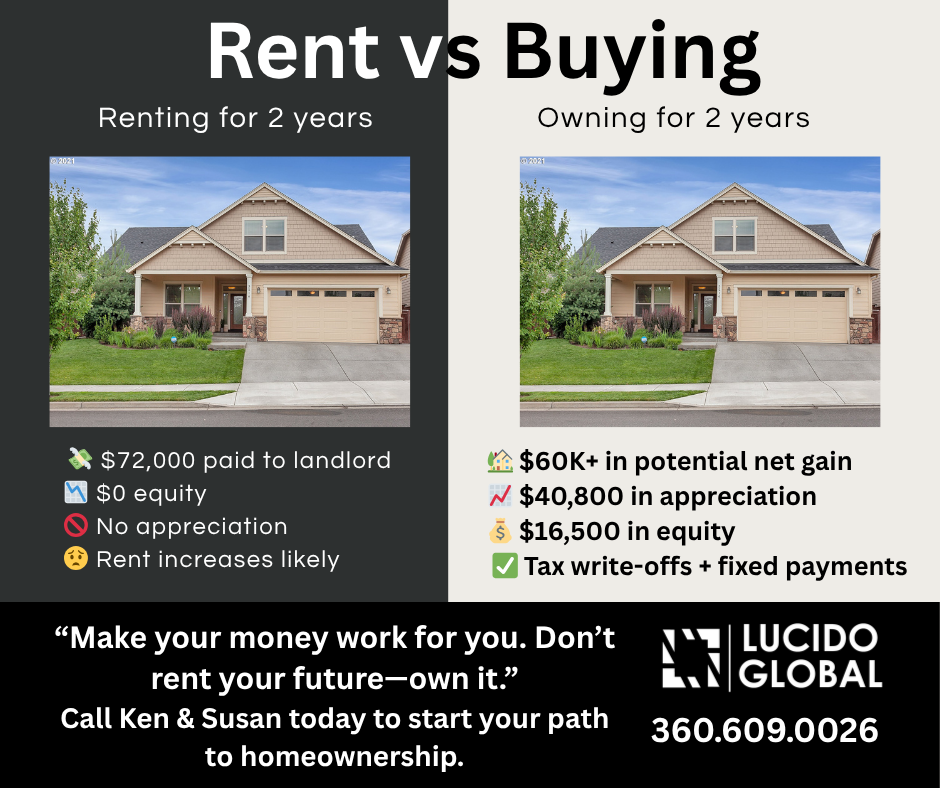

📊 Visual Recap: Renting vs. Buying

Consider this infographic-style breakdown:

➖ Renting (24 Months)

-

💸 $72,000 paid to landlord

-

📉 $0 equity

-

🚫 No appreciation

-

😟 Rent likely to rise

➕ Owning (24 Months)

-

🏡 $60K+ potential net gain

-

📈 $40,800 appreciation

-

💰 $16,500 in equity

-

✅ Tax benefits + stable payments

Ready to Explore Homeownership?

Buying a home isn’t just about shelter — it’s a step toward building wealth. If you're ready to stop renting and start building your future, let’s talk. Whether you're a first-time buyer, need down payment help, or just have questions, we’re here to help you run the numbers and make the right move.

📞 Call Ken & Susan today to get started 360.609.0226

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts