Should a Buyer Wait for Interest Rates to Drop from 6.5% to 5.5%?

Categories

- All Blogs (462)

- For Sale By Owner (15)

- Local Events (6)

- Affordability (31)

- Agent Value (86)

- Buying Tips (192)

- Closing Costs (1)

- Community Support (1)

- Debt-Free Living, (1)

- Design (8)

- Downsize (5)

- Economy (23)

- Equity (23)

- Financial Planning (32)

- First-Time Home Buyer (137)

- For Sale by Owner (2)

- Forecasts (14)

- Foreclosures (4)

- Foster Care Resrources (1)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (237)

- Home Inspections (1)

- Home Prices (63)

- Home Selling (170)

- Inventory (34)

- Local (24)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (35)

- Mortgage (50)

- Move-Up (2)

- New Construction (7)

- Newsletter (9)

- Open House (1)

- Portland OR (1)

- Portland OR Affordability (2)

- Portland OR Homes (2)

- Portland OR Real Estate (3)

- Portland-Vancouver Home Value (1)

- Portland-Vancouver Inventory (1)

- Real Estate Investing (7)

- Rent vs Buy (8)

- Restaurant Reviews (5)

- Seasonal (11)

- selling tips (125)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (1)

- Vancouver WA Affordability (2)

- Vancouver WA Real Estate (4)

- Vancouver WA Selling Tips (1)

- Wealth Building (12)

Recent Posts

Raising 100 Hands for Foster Care: A New Local Effort to Support SW Washington Foster Families

Mortgage Rate Forecast: Why Lower Rates Are Coming to Vancouver WA and Portland OR

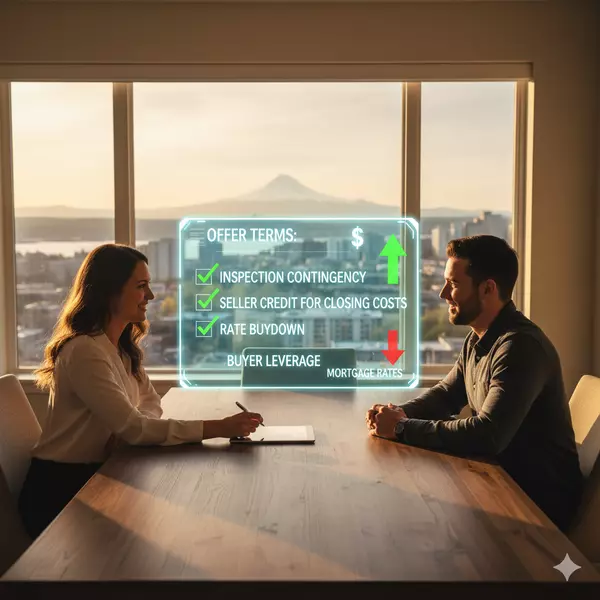

Buyer Power is Back! How to Negotiate Your Best Deal in Portland OR & Vancouver WA

The Best Time to Buy is Now: Your October Advantage in Vancouver WA & Portland OR

What Vancouver & Portland Buyers Need Most (And How Our Local Market is Adjusting)

Mortgage Rates in Portland & Vancouver: Why "Marry the House, Date the Rate" is Your 2025 Strategy

Unpacking Buyer Closing Costs in Vancouver WA & Portland OR

Closing Costs Unpacked: The Critical Differences for Buyers in Portland (OR) vs. Vancouver (WA)

Downsizing Without Debt: How Portland & Vancouver Homeowners Are Buying Their Next House in Cash

3 Reasons Affordability Is Showing Signs of Improvement for Portland & Vancouver Buyers This Fall