How the 2024 Presidential Election Is Shaping the Real Estate Market

How the 2024 Presidential Election Is Shaping the Real Estate Market

The U.S. presidential election brings about discussions on taxes, economic policy, and regulatory changes, all of which can have ripple effects across industries. This year’s election is already influencing the real estate market, with impacts felt by buyers, sellers, and investors alike. Here’s a closer look at how the 2024 election is affecting real estate and what it means for you.

1. Buyer Hesitation and Market Slowdown

With the election on the horizon, many potential homebuyers are holding off on big decisions. Uncertainty around future economic policies has led buyers to take a “wait-and-see” approach, resulting in a slowdown in home sales. For example, in July 2024, nearly 60,000 homebuyers canceled their contracts, marking the highest rate of cancellations tracked by Redfin since 2017. This trend reflects how hesitant buyers can become during election cycles, especially when mortgage rates and the cost of living are in flux.

For sellers, this means understanding that demand may be softer than in previous months. Homes may sit on the market longer, especially if the buyer pool shrinks due to concerns over affordability and economic changes tied to the election.

2. Potential Mortgage Rate Fluctuations

Mortgage rates are another area of concern that could be swayed by the election outcome. Interest rates are closely tied to economic policies, especially those that affect inflation and federal debt. Certain proposals from candidates could lead to higher inflation expectations, prompting financial markets to anticipate increased mortgage rates. For example, higher government spending could lead to inflation concerns, which typically push interest rates higher to counteract rising costs.

If mortgage rates climb, buyers may find themselves priced out of certain properties, affecting their purchasing power. On the other hand, if rates stabilize or decrease, more buyers could re-enter the market with increased affordability. This uncertainty around rates makes it challenging for buyers and sellers alike to plan financially.

3. Policy Proposals and Their Potential Impact on Housing Supply and Affordability

Housing affordability has been a hot topic in the 2024 election, with both major candidates addressing housing in their platforms. Here’s a breakdown of the major proposals and how they could impact the market:

-

Kamala Harris: Plans to expand housing supply by constructing 3 million new homes by the end of her term. Additionally, she has proposed a $40 billion federal innovation fund to incentivize local housing projects, expand the low-income housing tax credit, and offer up to $25,000 in down-payment assistance for first-time buyers. If implemented, these policies could ease housing shortages and make homeownership more accessible.

-

Donald Trump: His housing plan focuses on cutting regulatory barriers to construction and designating more federal land for housing development. However, his proposal to increase tariffs on certain goods could make construction materials more expensive, potentially driving up building costs. Lower regulations could expedite construction processes, potentially leading to more supply but possibly at higher prices.

For buyers and sellers, these policies could significantly impact housing affordability and inventory. A boost in homebuilding would help alleviate supply pressures, while down-payment assistance programs could open doors for first-time buyers. Conversely, increased construction costs could continue driving prices upward in certain markets.

4. Investor Behavior and Market Dynamics

Investors in the real estate market are also feeling the effects of the election. The current climate has made some investors hesitant, opting to pause or adjust their strategies until the political landscape becomes clearer. This cautious approach affects housing inventory and pricing, as investors often influence market dynamics, especially in high-demand urban areas.

In the commercial real estate sector, investors are advocating for the continuation of tax relief measures introduced by former President Trump. With rising financing costs and vacancy rates, maintaining these tax benefits is crucial for investors looking to sustain profits in an increasingly challenging market. Until the election outcome is clear, some investors may adopt a “wait-and-see” approach, which could reduce market activity and impact pricing.

5. Regional Variations in Market Impact

The election’s impact on real estate isn’t uniform across the country. Regional factors like local economic fundamentals and demand trends mean that some areas will be more affected by the election than others. Major metropolitan markets like New York, Los Angeles, and Las Vegas are showing resilience and continued growth, with annual price gains outpacing other regions.

However, areas heavily influenced by federal policies and regulations could experience significant changes depending on the election results. For instance, regions with industries impacted by candidate policies on tariffs, taxes, or federal funding may see noticeable shifts in local market conditions, affecting housing demand and pricing trends. Sellers in these areas should monitor these trends closely, as buyer behavior and demand may change post-election.

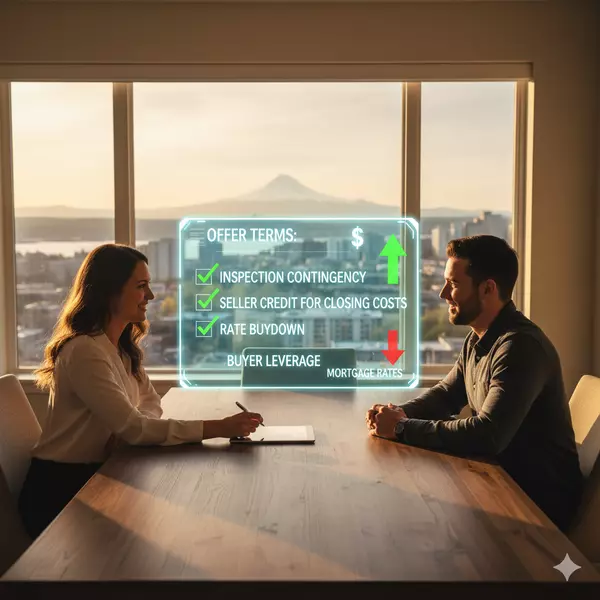

What This Means for Buyers and Sellers

For Buyers: If you’re considering purchasing a home, now may be a good time to evaluate interest rates and weigh potential price changes. With interest rates likely to fluctuate, waiting until after the election could lead to either a more favorable buying environment or higher costs, depending on the policies that prevail. Buyers should also keep an eye on any new first-time buyer incentives that may emerge if housing becomes a central part of the winning candidate’s economic strategy.

For Sellers: For sellers, this election cycle means understanding that buyer hesitation and investor caution may impact market demand. If rates are likely to rise, selling sooner could help avoid potential decreases in buyer affordability. However, if housing becomes a primary focus post-election, an increase in demand could benefit sellers. Working with a real estate agent who understands the timing of these factors will be essential in crafting a selling strategy that maximizes value.

Conclusion

The 2024 presidential election is undeniably influencing the real estate market, from buyer behavior and mortgage rates to regional demand variations and investor strategies. By staying informed and working closely with a knowledgeable real estate professional, buyers and sellers can navigate this period with confidence. Although uncertainty is part of any election year, understanding the key factors at play allows you to make well-informed decisions that align with your financial goals.

Categories

- All Blogs (462)

- For Sale By Owner (15)

- Local Events (6)

- Affordability (31)

- Agent Value (86)

- Buying Tips (192)

- Closing Costs (1)

- Community Support (1)

- Debt-Free Living, (1)

- Design (8)

- Downsize (5)

- Economy (23)

- Equity (23)

- Financial Planning (32)

- First-Time Home Buyer (137)

- For Sale by Owner (2)

- Forecasts (14)

- Foreclosures (4)

- Foster Care Resrources (1)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (237)

- Home Inspections (1)

- Home Prices (63)

- Home Selling (170)

- Inventory (34)

- Local (24)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (35)

- Mortgage (50)

- Move-Up (2)

- New Construction (7)

- Newsletter (9)

- Open House (1)

- Portland OR (1)

- Portland OR Affordability (2)

- Portland OR Homes (2)

- Portland OR Real Estate (3)

- Portland-Vancouver Home Value (1)

- Portland-Vancouver Inventory (1)

- Real Estate Investing (7)

- Rent vs Buy (8)

- Restaurant Reviews (5)

- Seasonal (11)

- selling tips (125)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (1)

- Vancouver WA Affordability (2)

- Vancouver WA Real Estate (4)

- Vancouver WA Selling Tips (1)

- Wealth Building (12)

Recent Posts