Unlocking Financial Security: The Power of Homeownership

Unlocking Financial Security: The Power of Homeownership

Homeownership isn't just about having a place to call your own; it's a powerful financial strategy that can pave the way to long-term wealth and stability. Discover how owning a home can transform your financial future through equity building, tax benefits, and more.

Homeownership offers several significant advantages that can contribute to long-term financial stability and growth. Let's explore how owning a home can be a powerful financial strategy:

1. Equity Building

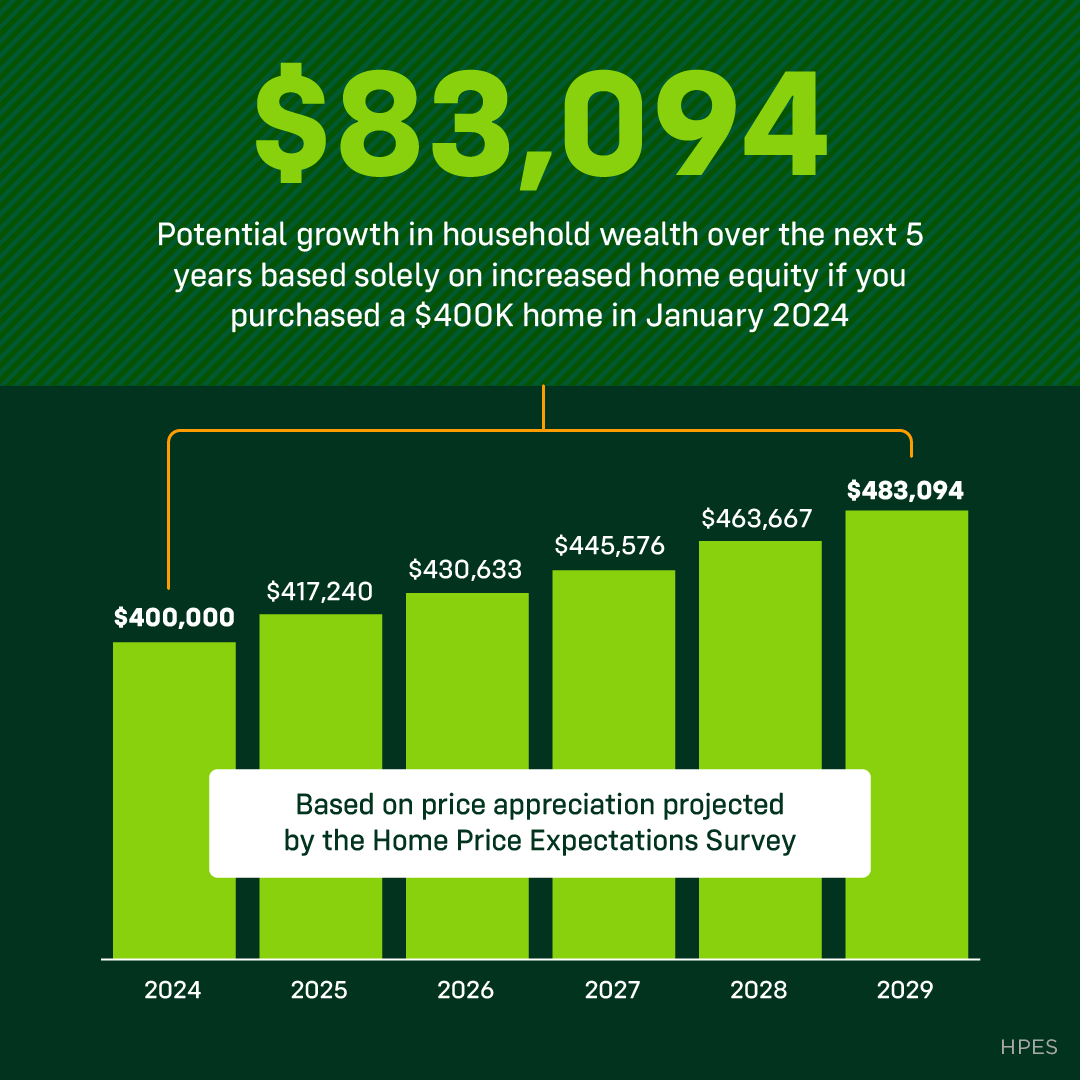

One of the primary financial benefits of homeownership is the opportunity to build equity. As you make mortgage payments, you gradually increase your ownership stake in the property. This process builds equity, a form of wealth that can grow substantially over time. Additionally, real estate generally appreciates in value, meaning that your home is likely to increase in worth, further boosting your equity and overall net worth.

2. Forced Savings

When you pay rent, you are effectively contributing to your landlord's equity, without building any for yourself. However, mortgage payments work differently. Each payment you make helps you own a larger share of your home, acting as a form of forced savings. This not only helps in accumulating wealth but also ensures that your money is going towards an asset that can increase in value.

3. Tax Benefits

Homeownership comes with several tax advantages. The mortgage interest deduction allows homeowners to deduct interest paid on their mortgage from their taxable income, which can lead to significant tax savings. Property taxes are also often deductible, reducing the overall cost of homeownership and making it a financially smart decision.

4. Stable Housing Costs

A fixed-rate mortgage ensures that your monthly payments remain consistent over the life of the loan. This stability protects you from the unpredictability of rising rents and inflation. Knowing your housing costs allows for better budgeting and financial planning, providing peace of mind and financial security.

5. Leveraging Home Equity

Home equity can be a valuable financial resource. Homeowners can borrow against their equity for major expenses such as home improvements, education, or emergencies. Home Equity Loans and Home Equity Lines of Credit (HELOC) offer flexible borrowing options, allowing you to use your home’s equity as needed.

6. Retirement Planning

Homeownership can play a crucial role in retirement planning. As you approach retirement, you have the option to downsize, selling your home and moving to a smaller, less expensive property. The proceeds from the sale can significantly boost your retirement savings. Additionally, for homeowners aged 62 or older, a reverse mortgage can provide a steady income stream by converting part of your home equity into cash.

7. Generational Wealth

Owning a home can help create generational wealth. You can pass your home down to your heirs, providing them with a valuable asset that can continue to appreciate or be used for their financial needs. This inheritance can offer financial security and a stable living environment for your family, contributing to their overall well-being.

8. Diversification of Assets

Diversifying your investment portfolio is essential for reducing financial risk. Homeownership adds real estate to your asset mix, balancing out your investments and potentially offering more stability. This diversification can protect your wealth against market fluctuations.

9. Community and Social Benefits

Homeowners often have a stronger connection to their community, which can lead to better local services and a more supportive social network. Stability in neighborhoods can also improve the overall quality of life, making homeownership beneficial not just financially, but socially as well.

By leveraging these benefits, homeownership can be a powerful tool for enhancing financial stability, growth, and security over the long term. Investing in a home is not just about having a place to live; it's about securing your financial future and building wealth that can be passed down through generations.

Categories

- All Blogs (514)

- For Sale By Owner (15)

- Local Events (8)

- 100 Hands for Foster Care (1)

- 1031 Exchange PNW (1)

- Affordability (36)

- Agent Value (92)

- Buying Tips (205)

- Clark County Housing (6)

- Closing Costs (1)

- Community Support (3)

- Debt-Free Living, (1)

- Design (8)

- Downsize (9)

- Downsizing Vancouver WA (3)

- Economy (25)

- Equity (26)

- Expired Listings (1)

- Featured (1)

- Financial Planning (34)

- First-Time Home Buyer (153)

- For Investors (1)

- For Sale by Owner (5)

- Forecasts (16)

- Foreclosures (4)

- Foster Care Resrources (2)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (260)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (189)

- Home Staging PNW (1)

- Home Value (2)

- Housing Market Confidence (2)

- Independent Living PNW (1)

- Inventory (38)

- Lifestyle Move PNW (2)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (43)

- Mortgage (57)

- Move-Up (5)

- Moving for Job Relocation (1)

- Negotiation Strategy (1)

- New Construction (10)

- Newsletter (10)

- Open House (1)

- Portland Downsizing (2)

- Portland OR (7)

- Portland OR Affordability (6)

- Portland OR Home Buying (10)

- Portland OR Homes (9)

- Portland OR Real Estate (26)

- Portland OR Seller Tips (8)

- Portland Real Estate FAQs (3)

- Portland Recession Risk (1)

- Portland-Vancouver Home Value (6)

- Portland-Vancouver Inventory (6)

- Price It Right Portland (3)

- Real Estate Investing (7)

- Real Estate Tax Strategy (1)

- Rent vs Buy (10)

- Restaurant Reviews (5)

- Retirement Planning (2)

- Seasonal (11)

- Selling Rental Property (2)

- selling tips (132)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (7)

- Vancouver WA Affordability (8)

- Vancouver WA Home Buying (14)

- Vancouver WA Home Value (2)

- Vancouver WA Real Estate (35)

- Vancouver WA Selling Tips (11)

- Wealth Building (13)

Recent Posts