Setting Financial Goals: A Roadmap for Teens and Young Adults

Setting Financial Goals: A Roadmap for Teens and Young Adults

One of the most powerful steps you can take toward building wealth is setting clear financial goals. Without a roadmap, it’s easy to get lost in the hustle of daily life, spending money without intention or direction. If I had learned the importance of setting financial goals earlier in life, it could have helped me avoid costly mistakes and stay focused on my bigger dreams.

Unfortunately, financial goal-setting is another critical skill that isn’t taught in school. Let’s dive into why it’s so important, how to do it, and how it can transform your financial future.

Why Financial Goals Matter

Financial goals provide clarity and motivation. They give you a purpose for saving and help you measure your progress. Without goals, it’s easy to fall into the trap of spending impulsively or thinking, “I’ll start saving later.”

Whether it’s buying your first car, saving for college, or building an emergency fund, having a specific goal helps you prioritize your money and make smarter decisions.

How to Set Financial Goals

-

Start with Your Dreams

Think about what you want to achieve in the short term (1 year), medium term (2–5 years), and long term (10+ years). Examples could include:- Buying a new laptop.

- Building a $1,000 emergency fund.

- Saving for a down payment on a house someday.

-

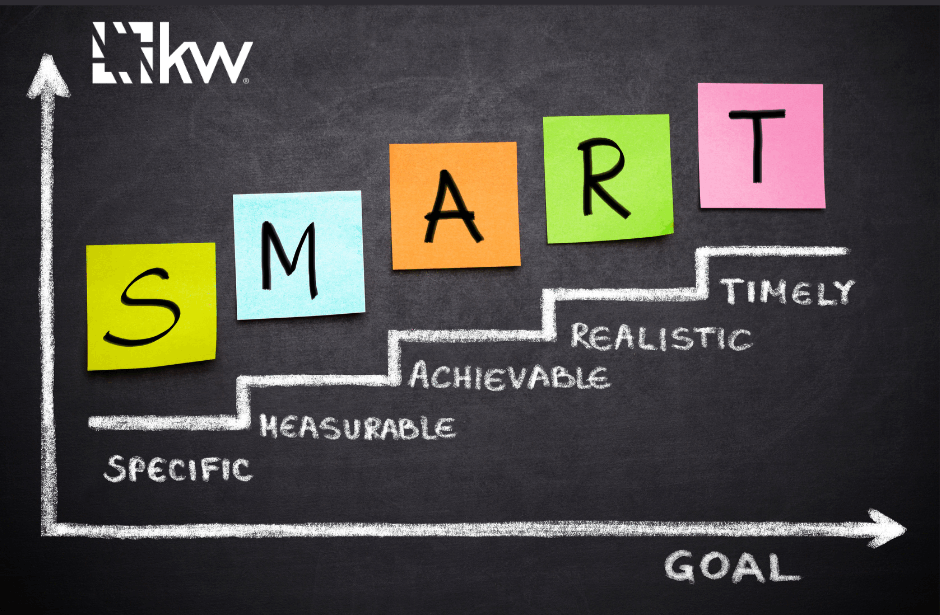

Make Your Goals SMART

SMART goals are:- Specific: Clearly define what you want to achieve.

- Measurable: Attach a number or metric to your goal.

- Achievable: Ensure it’s realistic based on your income and expenses.

- Relevant: Make sure it aligns with your values and priorities.

- Time-bound: Set a deadline to stay focused.

For example, instead of saying, “I want to save money,” say, “I want to save $500 in six months by putting aside $20 a week.”

-

Break Goals Into Actionable Steps

Once you have your goals, create a plan to achieve them. For example:- Cut back on non-essential spending, like eating out or subscriptions.

- Set up a savings account specifically for your goal.

- Automate transfers to that account every payday.

-

Track Your Progress

Regularly check how close you are to reaching your goal. This will keep you motivated and allow you to adjust if needed. Apps like Mint or even a simple spreadsheet can help you track your savings and spending. -

Celebrate Milestones

Reaching financial goals is rewarding! Celebrate your progress, even if it’s small. Positive reinforcement makes the process more enjoyable and encourages you to keep going.

Common Financial Goals for Teens and Young Adults

If you’re not sure where to start, here are some popular goals for young people:

- Build an emergency fund with at least three months of expenses.

- Save for a big purchase, like a car, a computer, or a dream trip.

- Set aside money for college or pay off student loans.

- Start investing for long-term goals, like retirement.

Why Schools Should Teach Goal-Setting

Financial goal-setting isn’t just about numbers—it’s about building discipline, confidence, and a sense of purpose. These are life skills that go beyond money, yet they’re rarely taught in classrooms. Imagine how much more empowered young people would feel if they graduated with the knowledge and tools to set and achieve financial goals.

Instead, many young adults enter the workforce or college without a plan, learning about money the hard way—through trial and error. Teaching financial goal-setting in schools could change lives by equipping students with the skills to take control of their futures.

Take Action Today

Setting financial goals doesn’t have to be complicated, and you don’t need to wait until you have a full-time job to start. Whether you’re saving a little from your part-time job, birthday money, or allowances, the key is to start now.

Take a few minutes today to write down one short-term, one medium-term, and one long-term financial goal. Break them into actionable steps, and start tracking your progress.

Financial freedom begins with a plan. If you need help setting your goals or creating a strategy, reach out—I’d love to help you get started! Together, we can make those goals a reality.

Categories

- All Blogs (484)

- For Sale By Owner (15)

- Local Events (6)

- Affordability (33)

- Agent Value (89)

- Buying Tips (200)

- Clark County Housing (4)

- Closing Costs (1)

- Community Support (1)

- Debt-Free Living, (1)

- Design (8)

- Downsize (7)

- Economy (24)

- Equity (24)

- Financial Planning (33)

- First-Time Home Buyer (144)

- For Sale by Owner (3)

- Forecasts (15)

- Foreclosures (4)

- Foster Care Resrources (1)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (249)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (181)

- Home Value (2)

- Inventory (36)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (37)

- Mortgage (54)

- Move-Up (4)

- New Construction (8)

- Newsletter (9)

- Open House (1)

- Portland OR (6)

- Portland OR Affordability (3)

- Portland OR Home Buying (3)

- Portland OR Homes (8)

- Portland OR Real Estate (20)

- Portland OR Seller Tips (2)

- Portland-Vancouver Home Value (3)

- Portland-Vancouver Inventory (3)

- Real Estate Investing (7)

- Rent vs Buy (8)

- Restaurant Reviews (5)

- Seasonal (11)

- selling tips (129)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (6)

- Vancouver WA Affordability (3)

- Vancouver WA Home Buying (5)

- Vancouver WA Real Estate (26)

- Vancouver WA Selling Tips (5)

- Wealth Building (12)

Recent Posts