Achieve Your Financial Dreams Through Real Estate: Let’s Build Your Wealth Plan Together

In today’s fast-paced world, building wealth and achieving financial freedom can seem like a daunting task. But what if I told you there’s a tried-and-true path to financial stability that is both accessible and rewarding? Real estate has long been one of the most effective ways to create wealth, and as a licensed real estate broker in Washington and Oregon, I’m here to guide you every step of the way.

Real Estate as a Wealth-Building Tool

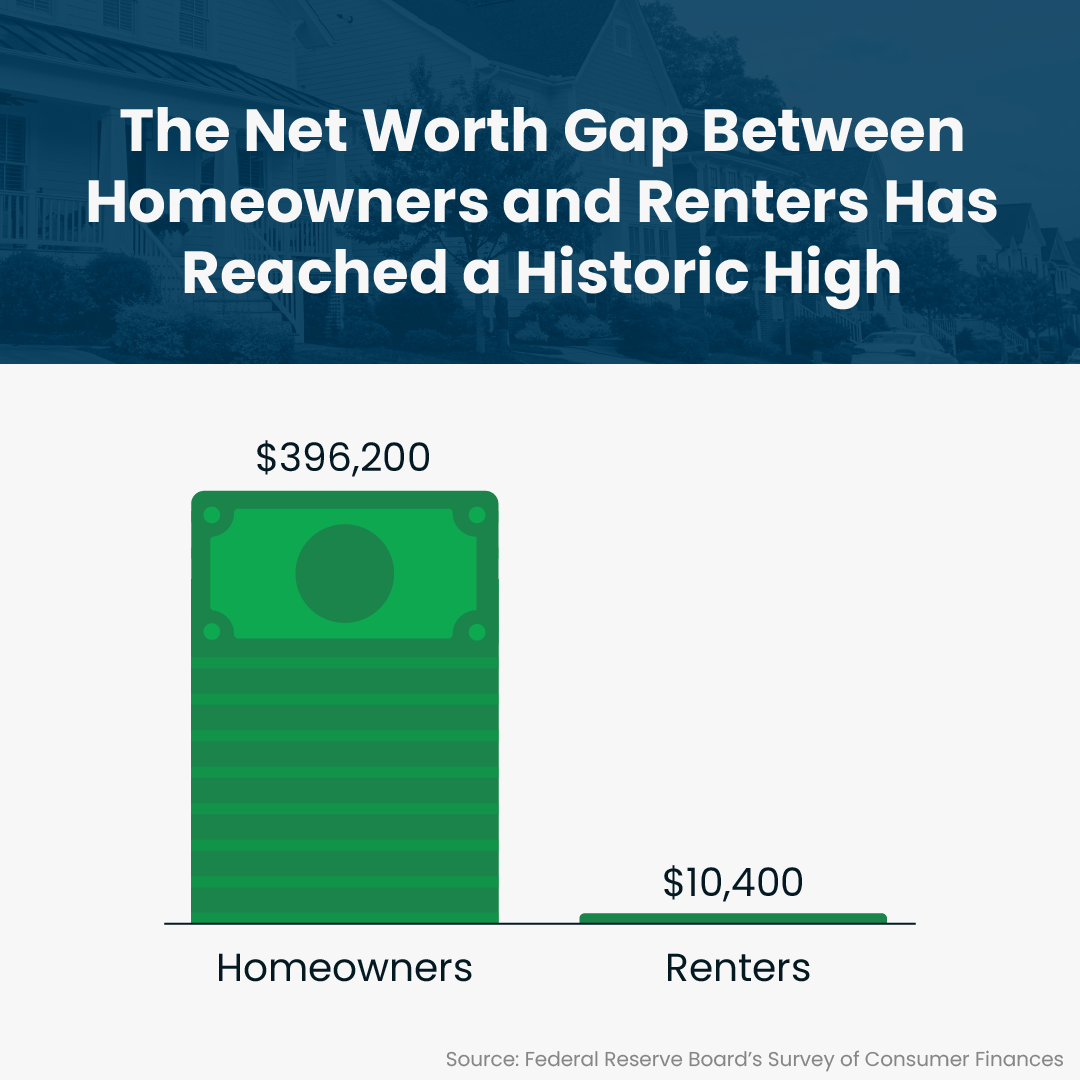

Real estate isn’t just about buying or selling a property; it’s about investing in your future. The power of real estate lies in its versatility and potential for growth. Whether it’s through owning your first home, investing in rental properties, or purchasing a vacation or retirement property, real estate offers pathways to generate passive income, build equity, and secure financial freedom.

Many of my clients come to me with one goal: to increase their wealth while minimizing risk. My approach is simple yet impactful: I focus on personalized strategies that align with your unique financial dreams. A well-designed real estate investment strategy can be a powerful addition to your wealth-building plan, whether you're just starting out or are a seasoned investor.

Pathways to Financial Freedom

Let’s talk about the different ways real estate can fit into your personal wealth-building plan:

-

Homeownership as a Foundation: Purchasing a primary residence builds equity over time, giving you a stable asset that typically appreciates. With the right market conditions, your home can become a cornerstone of your financial plan.

-

Investing in Rental Properties: Rental income can create a steady stream of passive income and long-term wealth. Whether it’s a single-family home, a multi-unit property, or even a commercial space, rentals can be a fantastic way to diversify your income and offset your expenses.

-

Vacation and Retirement Properties: If you’re looking at securing a property that can generate rental income today and serve as a retirement home tomorrow, there are smart, strategic ways to make this dream a reality.

-

Building Equity Through Fix-and-Flips: For those interested in a more hands-on approach, the fix-and-flip model allows you to actively grow your capital. This strategy can yield high returns when executed with the right knowledge and support.

A Personalized Wealth-Building Plan

Everyone’s financial situation is unique, which is why there’s no one-size-fits-all plan when it comes to real estate investment. During our consultation, I’ll take the time to understand your financial goals, your risk tolerance, and your timeline. Then, I’ll guide you through the real estate options that can best help you meet your specific needs.

Together, we’ll build a Wealth-Building Plan tailored to you. Here’s what you can expect from this consultation:

-

A Holistic Financial Review: We’ll assess where you are now and discuss where you want to be in the next five, ten, or twenty years.

-

Real Estate Strategy Development: Based on your goals, I’ll outline practical real estate investment strategies, from primary residence options to investment properties and more.

-

Local Market Insights: As someone deeply familiar with the Washington and Oregon markets, I’ll provide you with the most current data on market trends, property values, and investment hotspots.

-

Long-Term Wealth Goals: I’ll walk you through how we can leverage real estate to help build not just immediate value but also lasting wealth.

Client Success Stories: Real Results from Real Estate Investments

Over the years, I’ve had the privilege of helping clients across Washington and Oregon reach their financial dreams through real estate. I’ve seen families buy their first home, then use the equity to purchase an investment property. I’ve worked with clients to create a retirement portfolio with income-generating vacation rentals. These are just a few examples of how real estate, combined with personalized guidance, can lead to financial security and peace of mind.

One recent example involves a client who initially purchased a single-family home, then decided to move into a larger property and rent out the first home. With rental income now helping to cover their mortgage, they’re building equity faster than they’d imagined and are well on their way to owning multiple income-generating properties.

Ready to Start Your Wealth-Building Journey?

If you’re ready to start building wealth through real estate, I invite you to schedule a consultation with me. Let’s create a comprehensive Wealth-Building Plan that aligns with your financial dreams. I’ll be there to provide advice, insights, and a roadmap tailored to your goals—whether that’s buying your first home, expanding your property portfolio, or creating a retirement haven that also generates income.

Real estate has the power to change lives, and I’m here to help make it happen for you. Don’t wait to take control of your financial future—reach out to me today and let’s start building the life you envision!

Categories

- All Blogs (485)

- For Sale By Owner (15)

- Local Events (6)

- Affordability (33)

- Agent Value (89)

- Buying Tips (201)

- Clark County Housing (4)

- Closing Costs (1)

- Community Support (1)

- Debt-Free Living, (1)

- Design (8)

- Downsize (7)

- Economy (24)

- Equity (24)

- Financial Planning (33)

- First-Time Home Buyer (144)

- For Sale by Owner (3)

- Forecasts (15)

- Foreclosures (4)

- Foster Care Resrources (1)

- Fun Tips (5)

- Giving Back (1)

- Home Buying (250)

- Home Inspections (1)

- Home Prep & Staging (2)

- Home Prices (68)

- Home Selling (182)

- Home Value (2)

- Inventory (36)

- Listing Strategy (1)

- Local (25)

- Local Non-Profits (1)

- Luxury / Vacation (1)

- Market Update (37)

- Mortgage (54)

- Move-Up (4)

- New Construction (9)

- Newsletter (9)

- Open House (1)

- Portland OR (6)

- Portland OR Affordability (3)

- Portland OR Home Buying (3)

- Portland OR Homes (8)

- Portland OR Real Estate (21)

- Portland OR Seller Tips (2)

- Portland-Vancouver Home Value (3)

- Portland-Vancouver Inventory (3)

- Real Estate Investing (7)

- Rent vs Buy (8)

- Restaurant Reviews (5)

- Seasonal (11)

- selling tips (129)

- Technology (1)

- Teens & Young Adults (11)

- Trends (15)

- Vancouver WA (6)

- Vancouver WA Affordability (3)

- Vancouver WA Home Buying (5)

- Vancouver WA Real Estate (27)

- Vancouver WA Selling Tips (5)

- Wealth Building (12)

Recent Posts